CorVel Corp (NASDAQ:CRVL) Embodies the Caviar Cruise Investment Strategy

The Caviar Cruise investment strategy represents a systematic method for finding good companies suitable for long-term ownership. This framework, drawn from the work of Belgian author Luc Kroeze, centers on businesses that show steady revenue and profit improvement, high returns on capital put to work, acceptable debt, and good cash flow generation. Investors using this method look for companies with lasting competitive strengths and viable business structures capable of producing compounding results over many years.

CorVel Corp (NASDAQ:CRVL) appears as a noteworthy candidate using this screening method. The Irvine, California-based business offers risk management and insurance services, with a focus on workers’ compensation, general liability, and hospital bill auditing. Their combined claims management programs and individual services meet the needs of employers, third-party administrators, and government agencies aiming to control medical expenses while upholding care standards.

Financial Performance Metrics

CorVel displays the kind of financial traits that these investors look for. The company’s past results indicate solid operational management and fiscal responsibility:

- EBIT growth of 14.76% CAGR over five years is well above the 5% minimum target

- Return on Invested Capital excluding cash, goodwill, and intangibles is a notable 82.75%

- Debt-to-Free Cash Flow ratio of 0.0 shows no debt

- Profit Quality averaging 99.01% over five years reflects very good cash flow generation

The EBIT growth above 5% shows the company’s capacity to increase its core operational earnings, a main point for investors who value sustainable profit generation. The strong performance compared to the minimum target implies CorVel has pricing strength or operational effectiveness that turns revenue improvement into even quicker profit growth.

Capital Efficiency and Financial Health

CorVel’s very high ROICexgc of 82.75% is much better than the 15% minimum, signaling outstanding effectiveness in using capital. This measure is especially significant for these investors because it shows how well management uses invested capital to produce returns. The total lack of debt offers financial room and lowers risk, while the nearly perfect profit quality score of 99.01% means that accounting profits regularly become actual cash flow.

The company’s position with no debt means it could, in theory, pay off all liabilities at once with existing cash flow, giving it notable stability in economic declines. This financial caution matches investment principles that value business endurance and risk control.

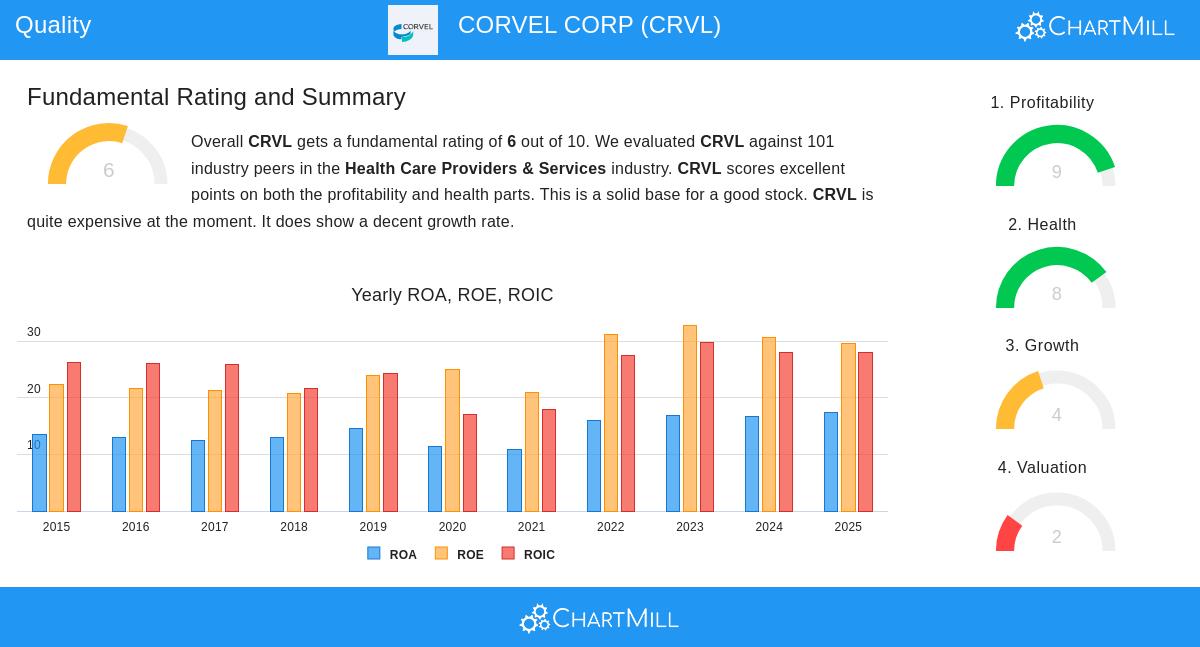

Fundamental Assessment Overview

Based on the detailed fundamental analysis, CorVel gets an overall rating of 6 out of 10, with especially good scores in profitability (9/10) and financial health (8/10). The company is strong in return measures, with Return on Assets of 16.88%, Return on Equity of 29.43%, and Return on Invested Capital of 28.10%, all placing in the top tiers of its Health Care Providers & Services industry. Margins indicate steady gain, with Profit Margin at 10.98% and Operating Margin at 13.94%, both near the top of the industry.

The main point of caution in the analysis involves valuation, with the stock having a Price/Earnings ratio of 38.25, higher than the S&P 500 average. Still, the report recognizes that CorVel’s exceptional profitability might support a higher valuation for investors concentrating on quality attributes.

Quality Investing Considerations

Beyond the numbers, CorVel works in an industry area that usually shows stability through economic changes. The company’s services meet necessary requirements for employers and insurers handling healthcare costs, forming repeat revenue sources. Their national presence and specific knowledge in claims management offer competitive benefits that support pricing strength and customer loyalty.

The business structure seems reasonably easy to grasp, focusing on cost management and care quality tracking within set insurance systems. While judging management skill needs non-quantitative assessment, the steady financial performance and capital effectiveness numbers imply capable leadership and strategic operation.

For investors wanting to look at more companies fitting the Caviar Cruise requirements, the complete screening results offer a wider list of possible quality investments.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance does not guarantee future results.