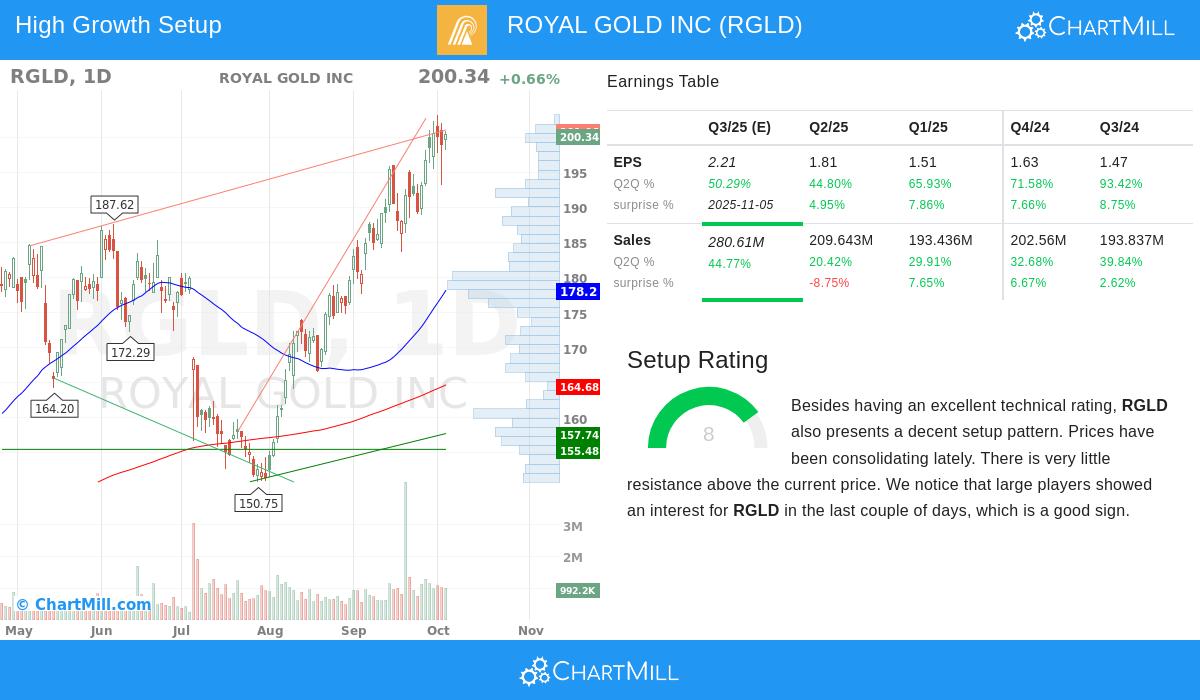

ROYAL GOLD INC (NASDAQ:RGLD) Combines Strong Earnings Growth with Bullish Technical Setup

A methodical way to find good investment chances joins basic growth speed with technical breakout formations. This process filters for businesses showing solid earnings speed, good estimate changes, and growing profit margins, important traits wanted by high growth speed investors. At the same time, these investments need to show sound technical condition and base patterns that indicate possible breakout chances. This two-part plan tries to catch stocks possessing both basic speed and good technical placement.

Basic Growth Speed

ROYAL GOLD INC (NASDAQ:RGLD) shows interesting basic traits that match high growth speed investment ideas. The company’s earnings results display notable speed across several periods, a key part of growth speed methods that look for businesses with bettering company operations.

The earnings growth path shows clear speed:

- Quarterly EPS growth rates: 93.4% (Q-3), 71.6% (Q-2), 65.9% (Q-1), and 44.8% (latest quarter)

- Full-year EPS growth sped up from -5.8% two years back to 48.2% in the latest fiscal year

- TTM EPS growth is at 65.9%, showing continued speed

Profit margin growth further backs the growth story, with quarterly margins getting better steadily from 49.7% three quarters ago to 63.1% in the latest quarter. This margin growth is especially important in growth investing as it shows better operational effectiveness along with sales growth. The company has shown steady earnings estimate beats, going above analyst predictions in all of the last four quarters by an average of 7.3%. Analyst view stays good with next-year EPS estimates changed upward by 8.3% over the last three months, showing increasing belief in the company’s future.

Technical Condition and Pattern Quality

The technical view for Royal Gold matches its basic strength, with the stock getting a perfect Technical Rating of 10 from ChartMill. This very good rating shows better performance across both short and long-term periods, doing better than 84% of all stocks in the market over the last year. The technical condition is shown by several good factors that make a positive setting for continued upward movement.

Important technical features include:

- Both short-term and long-term directions are positive across all periods

- The stock trades close to its 52-week high of $203.18, showing clear speed

- All main moving averages (20, 50, 100, and 200-day) are going up and placed below the present price

- Relative strength rank of 84.76 shows market leadership

The Setup Rating of 8 shows the stock is making a good base pattern inside its larger upward direction. Prices have been trading in the $183.58 to $203.18 area over the last month, with the present price near the top of this area. This base gives a possible start for the next move higher. The technical study finds clear support levels at $188.01, $155.48-$158.35, and $152.31, giving clear risk management points for traders. Detailed technical analysis shows more details about the stock’s technical build and possible trading levels.

Investment Meaning

The mix of solid basic growth speed and technical breakout possibility makes Royal Gold a noteworthy choice for investors using growth speed plans. The company’s speeding earnings growth, growing profit margins, and good estimate changes meet the main needs of high growth speed investing. At the same time, the technical view indicates the stock is placed for possible continuation of its upward direction after a time of basing.

The present pattern shows a situation where basic strength is matched by technical placement, lowering the chance of buying into stretched speed without correct base action. The stock’s results within the metals and mining field are especially important given that 60% of field members are doing worse than Royal Gold, showing company-specific strength instead of just field support.

For investors looking for similar chances that join growth speed with technical breakout patterns, additional screening results can find other investments meeting these rules. The screening process keeps watching the market for businesses showing both basic growth speed and good technical formations.

Disclaimer: This study is for information only and does not make up investment advice, suggestion, or request to buy or sell any investments. Investors should do their own study and talk with money advisors before making investment choices. Past results do not promise future outcomes.