Novartis AG-Sponsored ADR (NYSE:NVS): A Strong Dividend Stock with High Profitability and Sound Financial Health

For investors looking for dependable income, dividend investing is a proven way to accumulate assets. One organized way to find good dividend stocks is to filter for companies with good dividend traits while also having sound financial condition and earnings. This measured method helps prevent the typical mistake of pursuing very high yields that could indicate business weaknesses. By concentrating on stocks with high dividend scores and good profitability and health scores, investors can find companies able to maintain and possibly increase their dividend distributions over the long term.

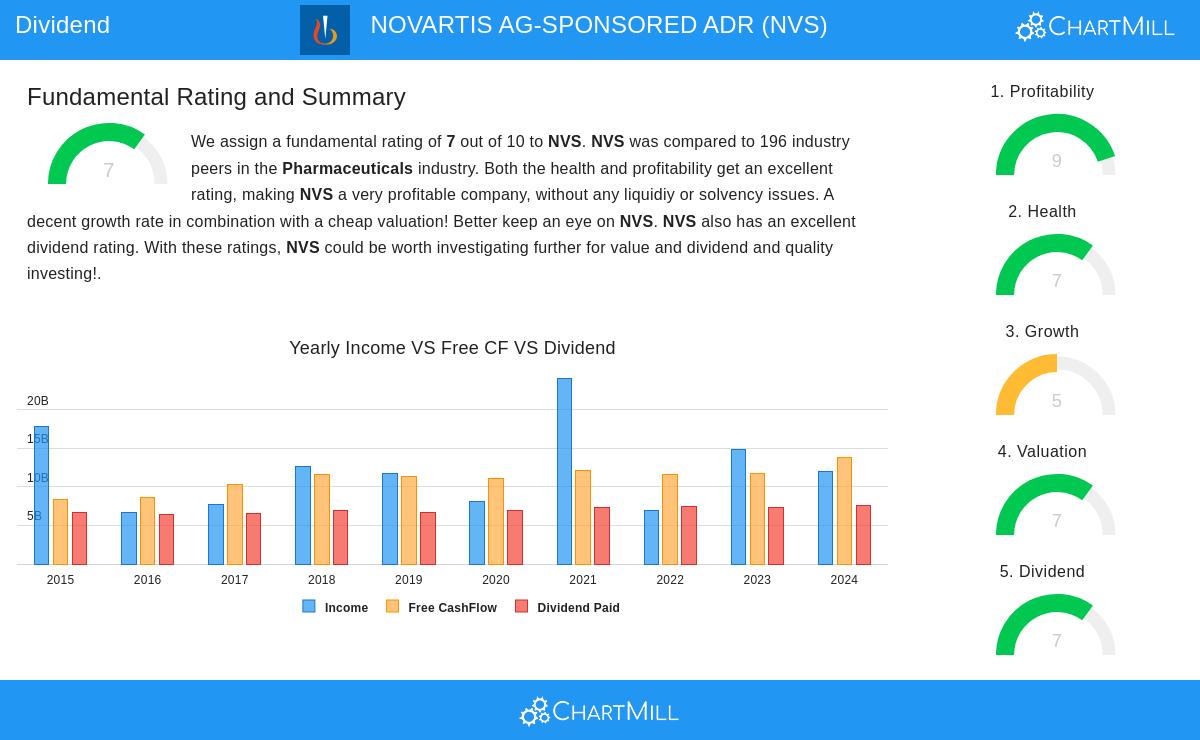

Novartis AG-Sponsored ADR (NYSE:NVS) appears as a noteworthy candidate using this filtering method, displaying traits that match well with systematic dividend investing rules.

Dividend Strength and Sustainability

Novartis has a noteworthy dividend profile that mixes a good yield with lasting traits:

- Current Yield and Positioning: The company provides a 3.58% dividend yield, which is higher than the S&P 500 average of 2.41% and places well within the pharmaceuticals industry where it is better than 93.88% of similar companies

- Dividend Growth History: Having a history of at least ten years of steady dividend payments and no cuts in the last five years, Novartis shows dependable dividend management

- Sustainable Payout Ratio: The company keeps a payout ratio of 57.26% of income, which finds a middle ground between rewarding shareholders and keeping enough profits for business investment

- Growth Alignment: Earnings growth is currently faster than dividend growth, creating a buffer for future dividend raises without pressuring the company’s finances

The mix of these elements helps Novartis attain a ChartMill Dividend Rating of 7, signaling good dividend traits that match the filtering method’s focus on lasting income creation.

Profitability Foundations

Good profitability forms the base for consistent dividend payments, and Novartis performs well here with a ChartMill Profitability Rating of 9. The company’s notable return measures show effective use of capital:

- Return on Assets of 13.08% is better than 93.88% of industry peers

- Return on Equity of 32.52% is higher than 95.41% of pharmaceutical companies

- Return on Invested Capital of 22.91% is above 96.94% of industry rivals

These impressive profitability measures are supported by good margins, including a 24.90% profit margin and 33.45% operating margin, both placing in the top group of the pharmaceuticals industry. This good profitability gives sufficient coverage for dividend payments and backs the company’s capacity to maintain distributions through different economic periods.

Financial Health Evaluation

Novartis keeps a sound financial condition with a ChartMill Health Rating of 7, indicating a balance sheet able to support continuing operations and dividend obligations. The company shows strength in solvency measures despite some liquidity points:

- An Altman-Z score of 3.89 signals low bankruptcy risk and financial steadiness

- Debt to Free Cash Flow ratio of 1.93 implies the company could pay off all debt in less than two years using existing cash flow creation

- The company has been lowering shares outstanding over both one-year and five-year timeframes, possibly improving per-share measures

While current and quick ratios suggest possible short-term liquidity points, the company’s good solvency position and notable profitability give perspective that these measures may reflect industry-specific working capital patterns instead of basic financial pressure.

Valuation Background

From a valuation viewpoint, Novartis seems fairly valued compared to both industry peers and wider market indexes:

- Price-to-Earnings ratio of 13.97 compares well to industry averages and the S&P 500’s 27.54

- Forward P/E of 12.94 shows continued earnings growth expectations

- Enterprise Value to EBITDA and Price to Free Cash Flow ratios both indicate the stock is valued at a lower level than most industry rivals

The mix of fair valuation, good profitability, and lasting dividend traits presents a noteworthy case for dividend-oriented investors looking for involvement in the pharmaceuticals sector.

For investors wanting to find similar options, the Best Dividend Stocks screen gives more candidates that meet these systematic standards for dividend investing. The full fundamental analysis report for Novartis provides more detailed information on the company’s financial measures and rating parts.

Disclaimer: This analysis is based on fundamental data and ratings provided by ChartMill and is intended for informational purposes only. It does not constitute investment advice, nor does it recommend buying or selling any security. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance does not guarantee future results, and dividend payments are subject to company discretion and market conditions.