DATs become corporate crypto’s standard while Stablecoins take over payments in 2025.

The Digital Asset Treasury (DAT) strategy has moved from an experiment to a consensus playbook for public companies seeking balance-sheet exposure. Digital Asset Treasuries are listed companies that accumulate tokens as treasury assets, using the stock market’s financing power to steadily increase onchain holdings.

In its half-year report, HTX research breaks down how the DAT strategy has become the industry standard, how perpetual aggregators ballooned, how stablecoins remain a dominant narrative, and more.

DATs 101: How the “mNAV flywheel” became corporate crypto’s benchmark

The approvals of spot BTC and ETH ETFs and the shift to fair-value accounting for crypto have made it simpler for public companies to disclose and manage token exposure. This visibility, paired with equity market financing, catalyzed digital asset treasuries (DATs).

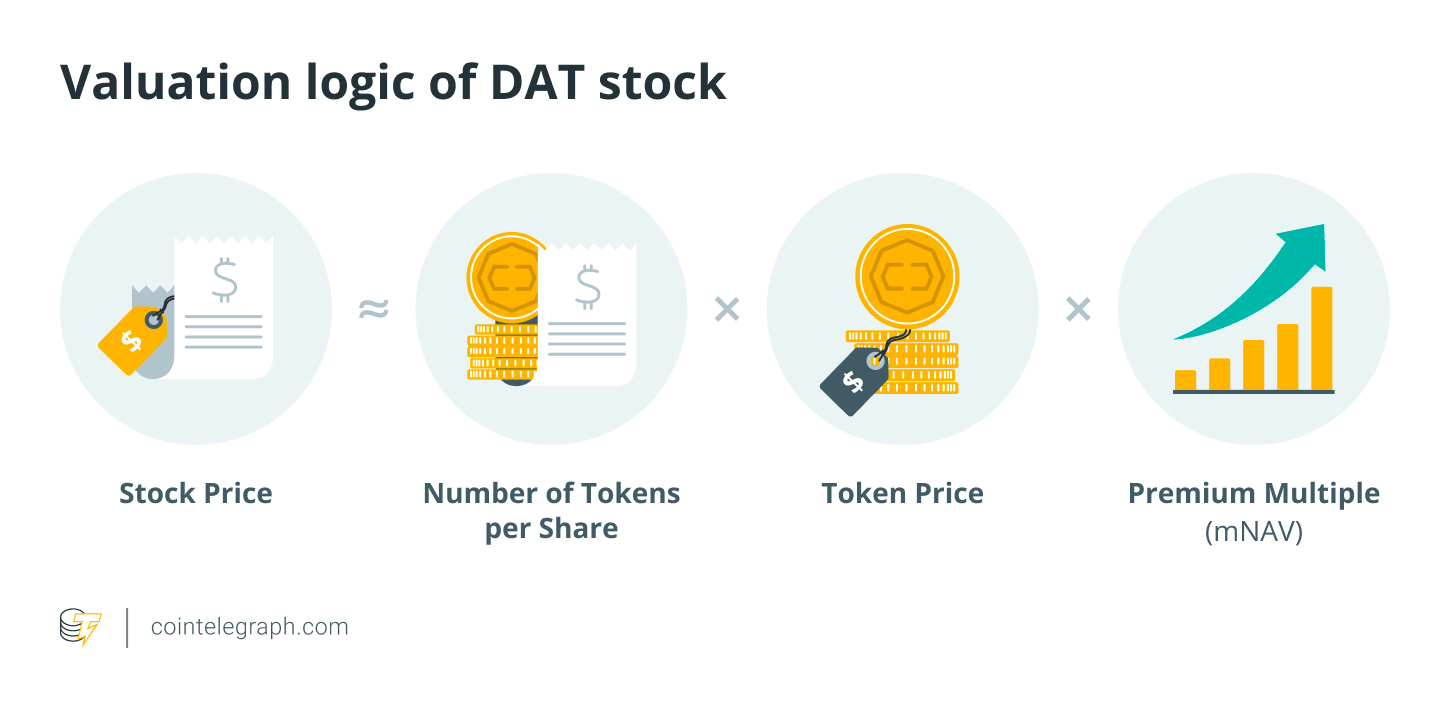

Digital Asset Treasuries follow a comprehensive strategy with their valuation logic following Net Asset Value (NAV), tokens-per-share × token price, is the base metric. The market-to-NAV ratio (mNAV = stock price ÷ NAV) measures the premium investors pay over the pure asset value.

A 1.0–1.5 mNAV typically reflects token value plus growth expectations; persistent readings >2.0 imply enthusiasm that can be fragile. When mNAV

Finally, the Strategy DAT model enhances its uniqueness among strong players, showing that the company not only focuses on accumulating Bitcoin but also prioritizes optimizing its financing structure. By contrast, mid-tier and weaker treasury companies still need to rely on convertibles, PIPE, and credit facilities, with higher leverage levels, making them vulnerable when markets cool down.

Notably, Strategy’s stock performance has been able to maintain a high-premium for a long period of time while the markets followed an alternative pace. This difference explains why Strategy’s stock performance has outpaced Bitcoin itself, allowing it to remain ahead in the fiercely competitive crypto treasury market.

Stablecoin rail wars: from tech to channel control, with TRON defending the moat

Stablecoins settle fast, interoperate across chains, and now underpin payroll, remittances, and B2B flows. Recent research highlights why fully reserved designs, 24/7 settlement, and programmable cash-like features are drawing corporations and fintechs into dollar-token rails. Policy has pulled in the same direction.

With the GENIUS Act signed in July 2025 and the Stable Act passed in April 2025, the US now has a federal framework for payment stablecoins (full-reserve backing, audits, AML controls) signaling a policy green light for banks, card networks, and fintechs to integrate dollar tokens into cross-border and settlement flows. Stablecoins are graduating from trading instruments to plumbing for global payments.

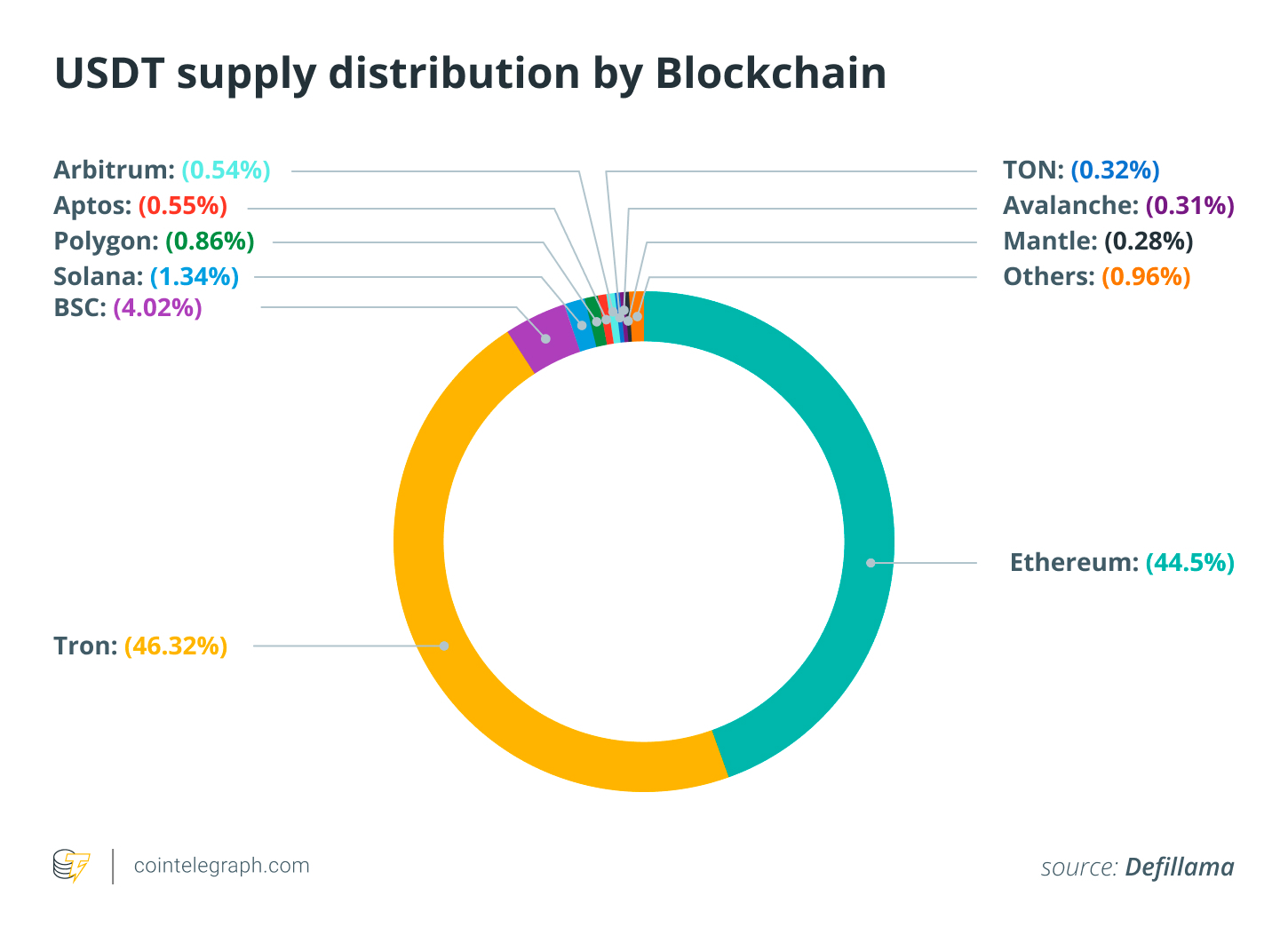

However, the competitive frontier for stablecoin infrastructure is no longer throughput or lowest nominal fees; it’s channel control. Multiple independent data sets show TRON hosting $80B+ in USDT supply and processing far more USDT transfers (count and value) than Ethereum through H1 2025.

CryptoQuant’s H1 review tallies ~2.3–2.4M USDT transfers per day on TRON and average daily USDT transfer value near $23–25B, magnitudes above rival chains. Monthly network activity also set multi-year highs, with 273M transactions in May and 28.7M active addresses in June. According to these metrics, TRON remains the dominant rail.

DeFi feedback loops on TRON reinforce its primary position in payments. The SunSwap DEX volumes topped $3B monthly throughout 2025 (peaking near $3.8B in May), while lending demand on JustLend climbed, pushing stablecoin velocity and onchain funding rates that keep USDT circulating on TRON.

TRON has competitive advantages in the field for the following reasons:

-

Low migration costs: EVM-compatible tooling and early ERC-20 lineage made USDT migration trivial for developers and DApps, thus capturing the majority of the stablecoin payments market.

-

Deep exchange defaults: Major platforms, such as Binance and KuCoin, have increasingly prioritised TRON for deposits/withdrawals, creating path-dependent flows.

-

Emerging-market fit: Remittances and payroll in LATAM, Africa, and SEA favor TRON’s low, predictable costs.

-

Near-zero transfer costs for institutions: DPoS with bandwidth/energy staking subsidizes high-volume flows.

-

Moat of stickiness formation—OTC desks and corridors are “locked in” by liquidity habits, not code.

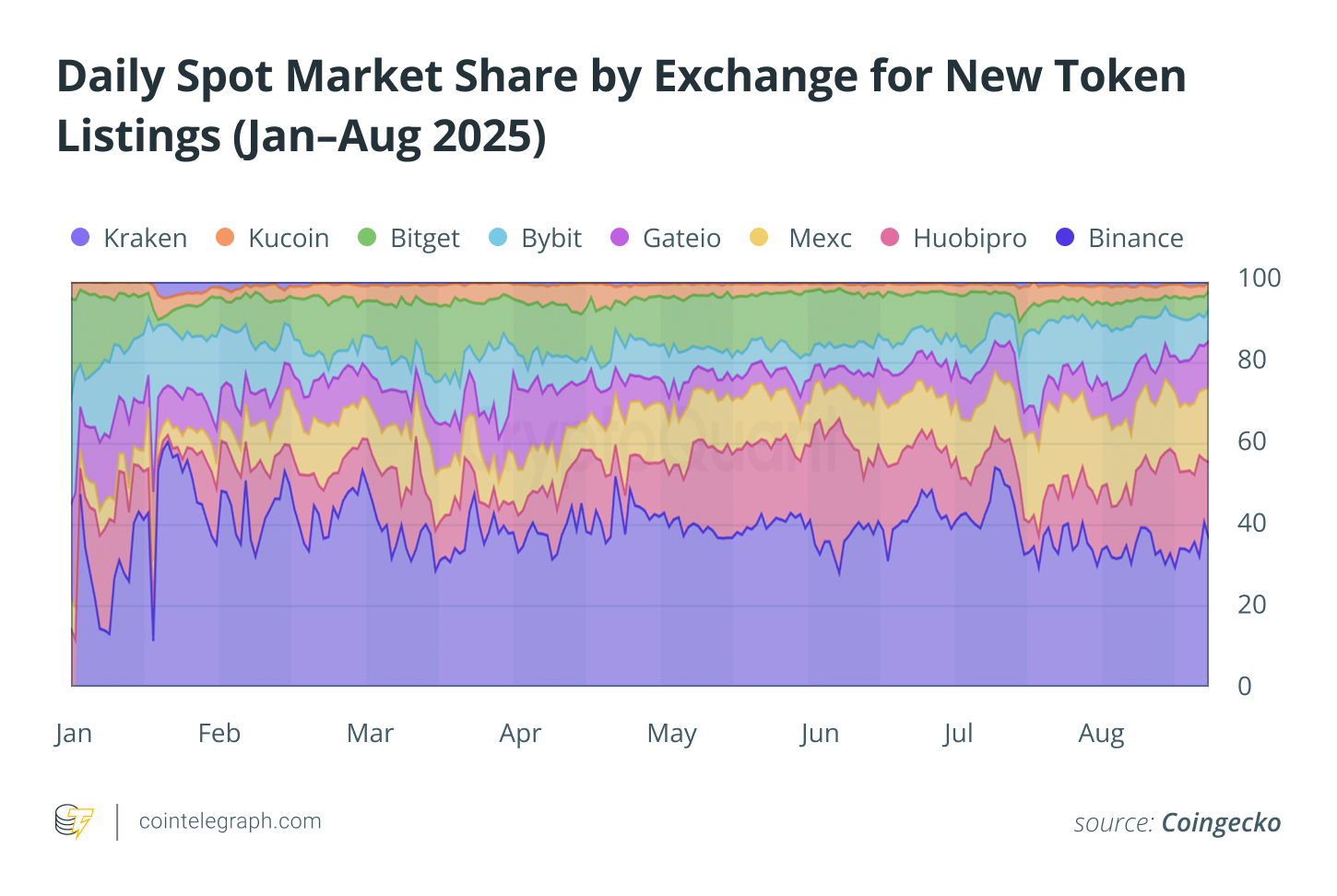

Beyond payments, exchange competition has reshuffled in the face of this stablecoin expansion. HTX’s new “Verified Station”, launched in Aug. 2025, curates OTC merchants with “zero-freeze” histories. It pairs this with a 0-freeze, 100% reimbursement policy of up to 10,000 USDT for stablecoin off-ramps. According to CryptoQuant, as of mid-Aug 2025, HTX’s YTD spot trading volume for new listings reached $38B, ranking first among “second-tier” exchanges and accounting for 22% of daily new-coin trading. Binance led with $133B, followed by Bybit ($35B) and MEXC ($34B).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Cointelegraph does not endorse the content of this article nor any product mentioned herein. Readers should do their own research before taking any action related to any product or company mentioned and carry full responsibility for their decisions.