Micron Technology Inc (NASDAQ:MU) Meets Key Peter Lynch Investment Criteria

For investors looking for companies with sustainable growth paths at acceptable prices, the Peter Lynch investment strategy provides a structured method. This method concentrates on finding businesses with solid foundations that are available at prices not aligned with their future possibilities. Lynch’s system highlights companies with steady earnings increases, sound financial statements, and acceptable prices compared to their growth speeds – exactly the traits growth at a reasonable price (GARP) investors look for.

Meeting the Lynch Criteria

Micron Technology Inc (NASDAQ:MU) appears as an interesting option when measured against important Peter Lynch screening factors. The memory and storage solutions company shows a number of traits that match Lynch’s idea of investing in easy-to-understand businesses with maintainable growth patterns.

The company’s financial numbers show why it meets the Lynch screen:

- Earnings Growth: 23.98% average EPS growth over the last five years fits into Lynch’s chosen 15-30% maintainable growth bracket

- Valuation: PEG ratio of 0.79 suggests the stock could be priced low compared to its growth path

- Financial Health: Debt-to-equity ratio of 0.26 and current ratio of 2.52 show careful financial handling

- Profitability: Return on equity of 15.76% is higher than Lynch’s 15% minimum requirement

These numbers are very important within the Lynch method because they together create an image of a company increasing at a maintainable speed without taking on too much financial risk. The PEG ratio under 1 is especially important as Lynch saw this as a main sign of growth opportunities available at low prices.

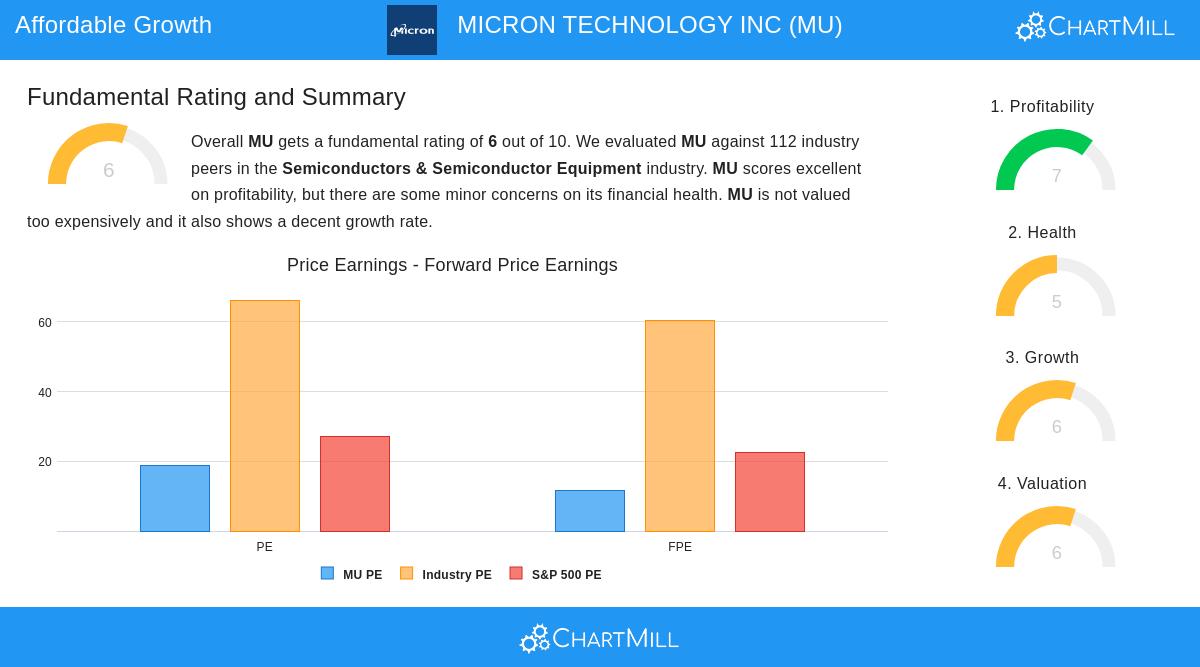

Fundamental Assessment

Micron’s full fundamental review shows a varied but mostly good picture. The company performs well on profitability measures, doing better than most semiconductor industry competitors on return metrics. Its valuation seems acceptable compared to both industry averages and wider market indexes, although there are some questions about financial health signs.

The fundamental report states that while Micron is among the top of its industry in terms of profitability, there are small worries about financial health. The company displays good margin improvement patterns and notable past growth, however future growth projections seem more measured. This even-handed review indicates a company that has shown operational skill but deals with the usual up-and-down challenges of the semiconductor industry.

View the complete fundamental analysis report for detailed metrics

Industry Position and Business Model

Micron’s business model focuses on supplying essential memory and storage solutions across different areas including data centers, mobile devices, automotive, and consumer markets. The company’s spread across these areas offers some protection against downturns in particular markets. Its place in dynamic random-access memory (DRAM), NAND, and NOR memory solutions puts it at the center of technological progress, especially in artificial intelligence and compute-heavy applications that need more and more advanced memory solutions.

The semiconductor industry’s natural ups and downs means that companies like Micron need to keep financial control during slow periods to take advantage of later improvements. Micron’s low debt levels and good cash position indicate the company is prepared to handle industry cycles while still investing in future technologies.

Investment Considerations

For GARP investors, Micron offers an interesting example of weighing growth possibility against industry cycles. The company’s good past growth rates and acceptable valuation multiples suggest the market might not completely recognize its long-term potential. Still, investors should stay aware of the semiconductor industry’s instability and watch how Micron handles future demand cycles.

The company’s concentration on memory and storage solutions for developing technologies places it to gain from long-term trends in data use, artificial intelligence, and connected devices. These built-in growth drivers could provide support that helps balance out occasional industry slowdowns.

Discover more companies meeting Peter Lynch criteria through our specialized stock screener

Disclaimer: This article presents information for educational purposes only and should not be construed as investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions.