Ryanair Holdings PLC-SP ADR (NASDAQ:RYAAY): A Prime Candidate for the ‘Decent Value’ Investor

The search for undervalued companies with sound basic fundamentals is a cornerstone of value investing. This strategy involves identifying stocks trading below their intrinsic value, but with the important condition that the business itself is healthy and profitable. A “Decent Value” screen refines this approach by filtering for companies that not only appear inexpensive on standard valuation measures but also show solid financial health, profitability, and growth potential. This helps investors avoid so-called “value traps”, stocks that are inexpensive for a reason, often due to fundamental business deterioration. One company that recently passed such a screen is RYANAIR HOLDINGS PLC-SP ADR (NASDAQ:RYAAY).

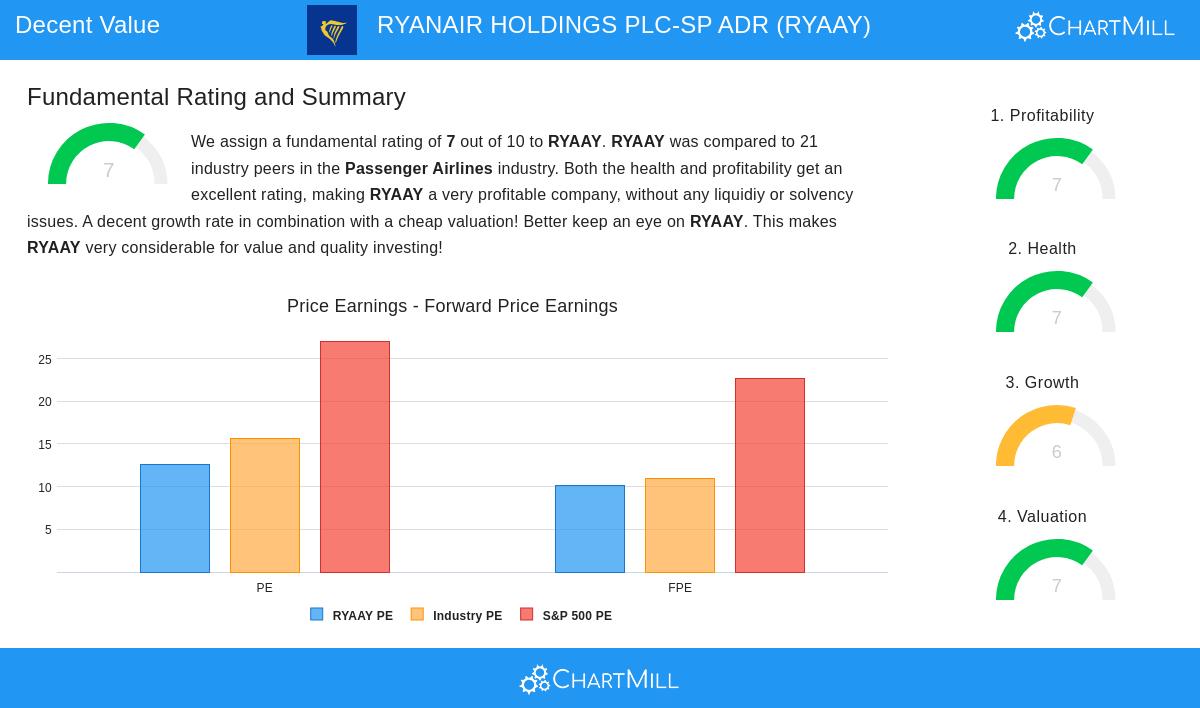

Valuation Metrics

A primary attraction for value investors is a stock’s price relative to its earnings and cash flow. Ryanair’s current valuation measures suggest it is trading at a discount compared to both the broader market and many of its industry peers. For value investors, a low valuation is the initial screening point, as it indicates a potential margin of safety.

- Price-to-Earnings (P/E) Ratio: Ryanair’s P/E ratio of 12.59 is significantly lower than the S&P 500 average of 27.06. Furthermore, it is valued more cheaply than approximately two-thirds of the companies in the passenger airline industry.

- Forward P/E Ratio: Looking ahead, the company’s Forward P/E ratio of 10.10 also points to a reasonable valuation, being in line with the industry average but well below the S&P 500.

- Price-to-Free-Cash-Flow: Based on this measure, 66.67% of its industry peers are more expensive, indicating the market may be undervaluing Ryanair’s cash-generating ability.

Financial Health

An inexpensive stock is only a good investment if the company is financially stable. Value investors prioritize companies with strong balance sheets to weather economic downturns and avoid bankruptcy risk. Ryanair’s financial health rating is strong, particularly in the critical area of solvency.

- Low Debt Dependency: The company has a remarkably low Debt-to-Equity ratio of 0.03, performing better than 95% of its industry peers. This minimal reliance on debt financing provides significant financial flexibility.

- Strong Solvency: Ryanair’s Debt-to-Free-Cash-Flow ratio is a very good 1.12, meaning it could theoretically pay off all its debts with just over a year’s worth of free cash flow. This is a best-in-class figure within the industry.

- A Note on Liquidity: It is important to note that the company’s Current and Quick ratios are below 1, which typically signals potential short-term liquidity concerns. However, these figures are actually better than a majority of its competitors, suggesting this may be a characteristic of the airline industry’s operational model rather than a company-specific weakness.

Profitability

For a value investment to realize its potential, the company must be profitable and efficiently using its capital. Ryanair is very good in this area, which is a key differentiator from a struggling company that might simply be inexpensive. Strong profitability supports the thesis that the low valuation is an opportunity.

- High Returns on Capital: The company demonstrates excellent efficiency with a Return on Invested Capital (ROIC) of 22.96%, performing better than 95% of the industry. Its Return on Equity (ROE) of 27.99% is also top-tier.

- Healthy Margins: Ryanair’s Profit Margin of 14.13% and Operating Margin of 14.36% are some of the best in the passenger airline sector. These strong margins indicate pricing power and operational efficiency.

Growth Prospects

While pure value investing can sometimes involve stagnant companies, combining value with decent growth can be a strong catalyst for price appreciation. Ryanair shows a healthy track record of growth, though future expectations are more moderate.

- Past Performance: Over the past years, the company has achieved an impressive average EPS growth of 20.18% and revenue growth of 10.43% annually.

- Future Expectations: Analysts expect EPS growth to continue at a solid 15.20% on average, though revenue growth is projected to be more modest at 5.67%. This indicates that while explosive growth may not be anticipated, the company is still on a positive path.

Ryanair presents a strong case for investors using a “Decent Value” strategy. It trades at a valuation that provides a potential margin of safety, while its exceptional profitability and strong financial health suggest the low price is not a sign of fundamental weakness. The company’s solid growth history and continued positive earnings expectations provide a catalyst for the market to re-rate the stock closer to its intrinsic value. For a detailed breakdown of all fundamental factors, you can review the full fundamental analysis report for RYAAY.

This analysis of Ryanair was identified using a specific screening methodology. If you are interested in discovering other companies that fit a similar profile of good valuation, health, profitability, and growth, you can see more results from the Decent Value stock screen here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The opinions expressed are based on current market conditions and data believed to be reliable, but no assurance can be given that these opinions are accurate. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.