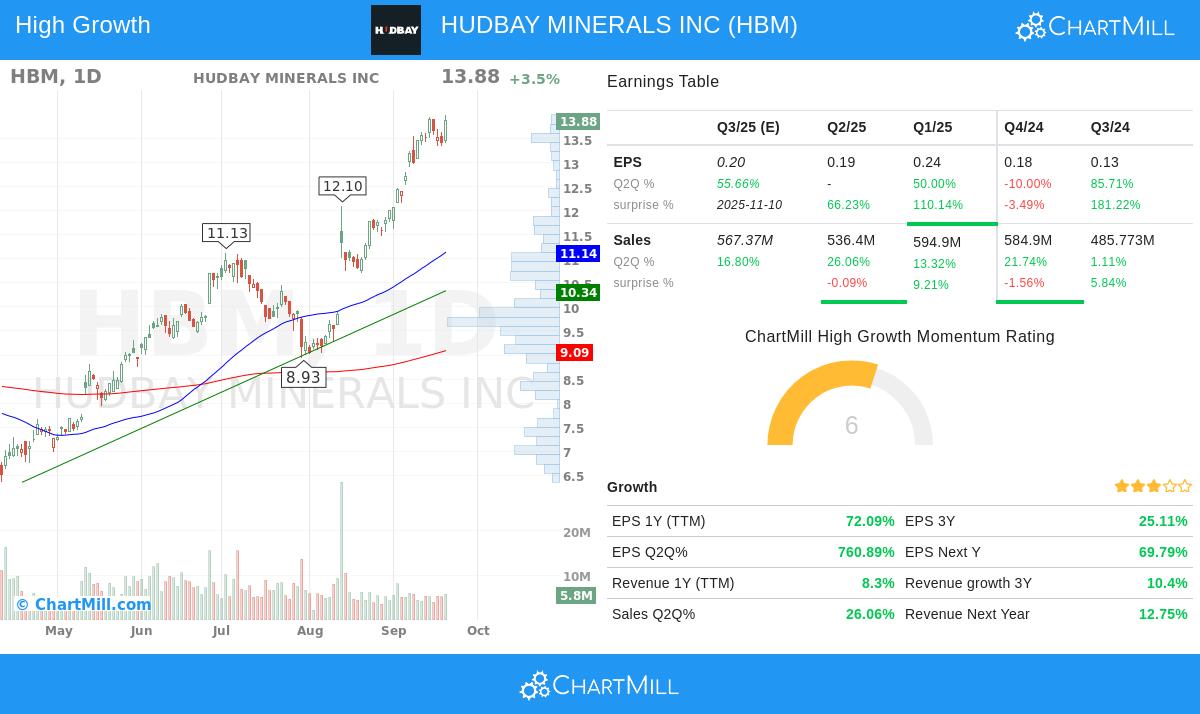

Hudbay Minerals Inc (NYSE:HBM) Combines Strong Trend Template with High Growth Momentum

Hudbay Minerals Inc (NYSE:HBM) has recently appeared on a specific screen made to find stocks that fit a disciplined growth and momentum investing method. This method joins Mark Minervini’s strict Trend Template, which finds stocks in strong uptrends, with a High Growth Momentum (HGM) filter to confirm basic fundamental improvement. The aim is to locate companies showing both good price momentum and solid earnings growth, a pairing that has in the past been a sign of top market performers.

Meeting the Minervini Trend Template

A main idea of Mark Minervini’s strategy is to invest with the current trend, concentrating on stocks that are already in a confirmed Stage 2 advance. Hudbay Minerals shows a clear match with the Trend Template’s technical requirements, which is made to filter for such strength.

- Price Above Key Moving Averages: The stock is trading well above its rising 50-day, 150-day, and 200-day simple moving averages. This shows continued buying pressure across short, medium, and long-term timeframes.

- Moving Average Alignment: The 50-day SMA ($11.14) is above both the 150-day SMA ($9.24) and the 200-day SMA ($9.09), while the 150-day SMA is also above the 200-day SMA. This order is a typical indication of a sound, improving uptrend.

- Proximity to Highs: With a current price of $13.88 sitting just below its 52-week high of $13.99, HBM is within the important “within 25% of its high” parameter. Stocks close to new highs frequently have little overhead resistance and have strong momentum.

- Significant Rally from Lows: The stock is currently 133% above its 52-week low of $5.95, greatly exceeding the template’s need of being 30% above the low, indicating a strong recovery and trend change.

- Superior Relative Strength: HBM has a ChartMill Relative Strength rating of 92.61, meaning it has done better than over 92% of all stocks in the market over the past year. Minervini stresses that real market leaders regularly show high relative strength.

This technical view indicates HBM is in a leading uptrend, making it a possibility for more study based on Minervini’s ideas.

Fundamentals for High Growth Momentum

The second part of this screening method is finding companies with improving business fundamentals. The High Growth Momentum rating for HBM is backed by large improvements in profitability and positive analyst changes.

- Earnings Per Share (EPS) Surge: The most recent quarterly EPS grew by a very large 760% compared to the same quarter last year. Even on a trailing twelve-month (TTM) basis, EPS growth is at 72%. This type of large earnings growth is a main force behind high momentum, as “big earnings attract big attention” from institutional investors.

- Dramatic Improvement in Profit Margins: The company’s profit margin in the last reported quarter was 21.94%, a major increase from 16.88% the prior quarter and only 3.79% in the last full fiscal year. Getting better margins indicate pricing ability and operational effectiveness, important factors for continued growth.

- Strong Analyst Confidence: Analysts have greatly increased their earnings estimates for the next fiscal year, with upward changes of over 45% in the last three months. Such positive changes often come before continued good price action as expectations are set higher.

- Positive Revenue Trajectory: While earnings growth is the main feature, revenue growth is also good, with the last quarter showing a 26% year-over-year increase and next quarter estimates indicating nearly 17% growth.

These fundamental measurements show that the stock’s price increase is supported by real and large improvements in the company’s earnings ability, a vital part for high-growth investors.

Technical Health and Setup Summary

The provided technical analysis report gives a complete view of HBM’s chart health. The stock gets a perfect technical rating of 10 out of 10, reflecting its strong trend across all timeframes. The report says that both long-term and short-term trends are positive and that the stock is currently forming a bull flag pattern, which can sometimes be a continuation signal inside a larger uptrend.

The setup rating of 7 indicates the stock is in a consolidation phase after its recent advance, possibly giving a clear entry point. Key support levels are found between $13.40 and $13.51, giving a logical area for a stop-loss order to handle risk. For a detailed look at the technical picture, including support and resistance levels, you can check the full technical analysis report for HBM.

Discovering Similar Opportunities

Hudbay Minerals Inc is the kind of company that can be found by methodically using a mix of technical and fundamental growth filters. Investors looking for other possibilities that meet similar strict requirements for strong trends and high growth momentum can examine the screen that found HBM.

Click here to view the current results of the ‘High Growth Momentum + Trend Template’ screen.

Disclaimer: This article is for informational and educational purposes only and should not be construed as investment advice. The analysis is based on data provided and does not constitute a recommendation to buy or sell any security. Investors should conduct their own research and consider their individual financial situation before making any investment decisions.