Perimeter Solutions Inc (NYSE:PRM) Meets Mark Minervini’s High-Growth Momentum Criteria

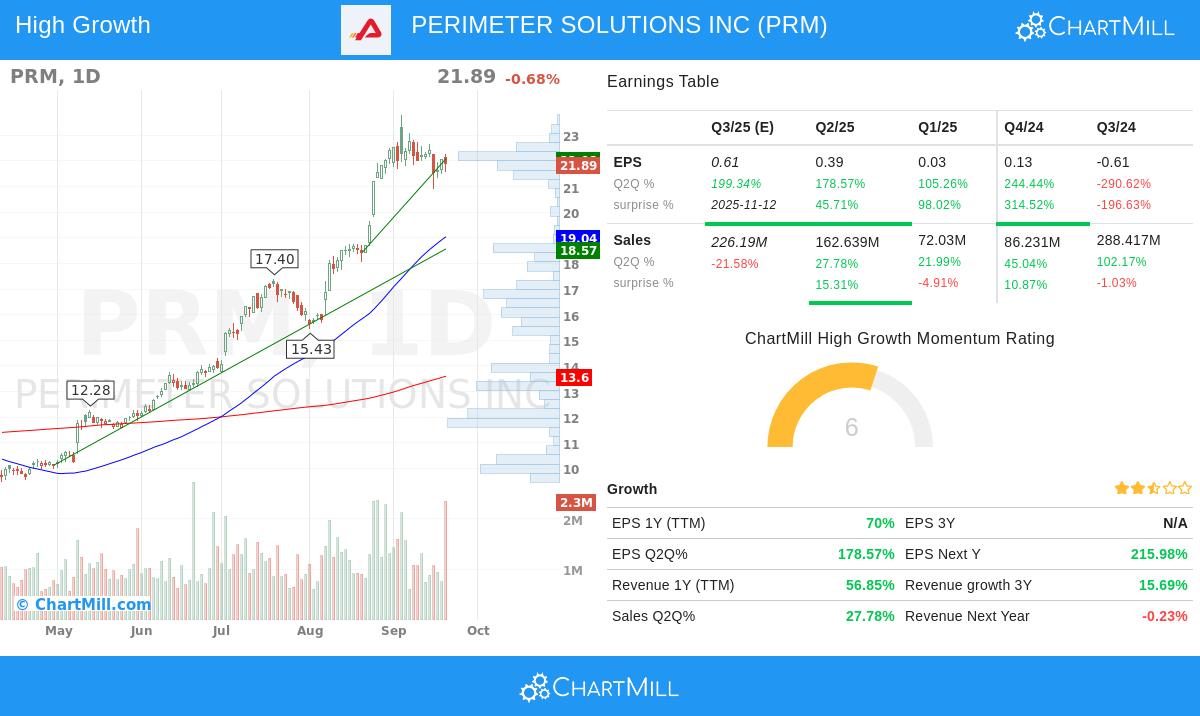

Perimeter Solutions Inc (NYSE:PRM) has recently appeared on a specific stock screen made to find companies that fit Mark Minervini’s high-growth momentum strategy. This method uses strict technical rules from Minervini’s Trend Template with a look at solid fundamental growth, trying to find stocks showing both strong price trends and underlying business improvement. The strategy tries to find leaders early in their growth periods by making sure they are technically healthy and fundamentally sound.

Meeting the Minervini Trend Template

A central idea of the Minervini method is finding stocks in a confirmed Stage 2 advance, shown by a strong and continuing uptrend. The Trend Template uses a group of moving average and price-level tests to look for such strength. Perimeter Solutions currently meets these technical conditions, placing it as a candidate for more study.

The stock’s price action compared to important moving averages is notable:

- The current price is trading above its rising 50-day, 150-day, and 200-day simple moving averages.

- The 50-day moving average is located above both the 150-day and 200-day averages, showing aligned positive momentum across short and medium-term timeframes.

- The 150-day moving average is also above the 200-day average, confirming the stock’s long-term positive structure.

Also, the stock’s position compared to its 52-week range meets Minervini’s rules for momentum. The current price is well above the 30% level from its 52-week low and is trading within 25% of its 52-week high, suggesting it has the strength common of market leaders. This technical condition is supported by a ChartMill Technical Rating of 10 out of 10, showing very good performance across short and long-term timeframes. The stock also has a high relative strength ranking of 93.72, meaning it is doing better than most of the market, a key trait Minervini focuses on for finding true leaders.

Fundamentals Driving High Growth Momentum

While the technical view identifies the trend, the fundamental analysis confirms the cause behind it. The “High Growth Momentum” part of the screen looks at companies showing major improvement in earnings and sales, which often draws institutional interest and pushes further price gains. Perimeter Solutions shows several of these high-growth features.

The company has displayed notable improvement in its financial performance:

- Earnings Improvement: Quarterly EPS growth has been very large, with the most recent quarter showing a 178.57% increase year-over-year. The earlier quarters also showed solid growth of 105.26% and 244.44%, indicating a strong and improving trend.

- Sales Growth: Revenue growth is also notable, with trailing twelve-month (TTM) revenue up 56.85%. Recent quarterly sales growth numbers of 27.78%, 21.99%, and 45.04% show consistent top-line increase.

- Positive Surprises: The company has exceeded EPS estimates in three of the last four quarters, with an average beat of 65.41%. This record of beating expectations can be a catalyst, making analysts update their future estimates higher, which then draws more investors.

These fundamental measures are important because, as Minervini states, “Big Earnings Attract Big Attention.” A company showing such clear improvement is likely to be found by institutional investors, providing the support for a continuing price increase.

Technical Setup and Risk Considerations

Beyond meeting the Trend Template, the stock currently shows a positive technical setup. ChartMill gives it a Setup Rating of 8, indicating the price is pausing in a useful pattern after its recent increase. The analysis notes the creation of a bull flag pattern, which often comes before a continuation of the earlier uptrend. Key support is found in the area between $21.56 and $21.88, giving a sensible level for a stop-loss order to handle risk.

This mix of a strong technical rating and a good-quality setup is exactly what the strategy looks for. It suggests the stock is not only in a powerful trend but is also giving a possible entry point with a clear risk level.

High-Level Technical Summary

The detailed technical report for Perimeter Solutions supports the positive thesis. It confirms both short-term and long-term trends are good and points out the stock’s major better performance compared to both the wider market and its industry peers. The report also finds clear support and resistance levels, which are useful for planning trade entry and exit points.

Discovering Similar Opportunities

For investors curious about using this same strict method to find other possible high-growth leaders, the screening process that found Perimeter Solutions can be a useful tool. This particular “High Growth Momentum + Trend Template” screen is made to systematically filter the market for stocks that meet these combined technical and fundamental rules.

You can view the current results of this screen and find other qualifying stocks by following this link: High Growth Momentum + Trend Template Screen.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice. The analysis is based on publicly available data and a specific investment strategy. All investment decisions carry risk, and individuals should conduct their own research and consult with a qualified financial advisor before making any investment decisions.