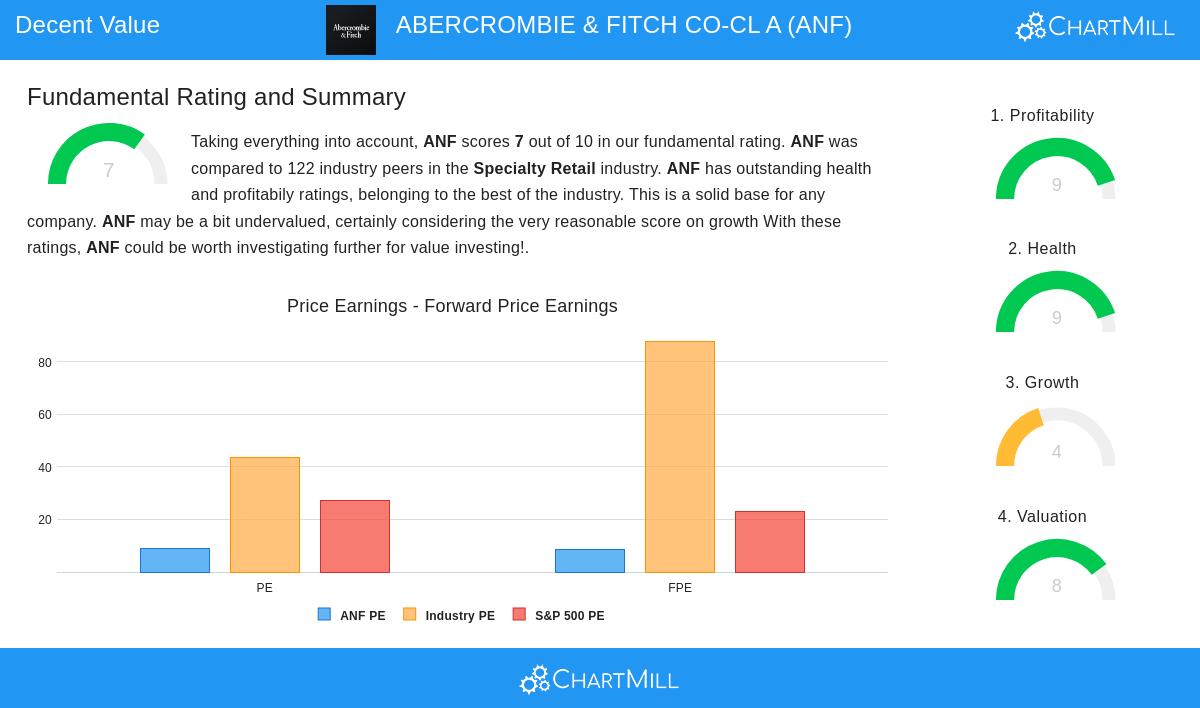

ABERCROMBIE & FITCH CO-CL A (NYSE:ANF): A Deep Value Stock With Strong Fundamentals

In the search for undervalued investment opportunities, many investors turn to a disciplined approach that combines strong fundamental health with attractive pricing. The “Decent Value” screen is one such method, made to identify stocks that show solid profitability and financial stability while trading at valuations that indicate possible upside. This strategy matches core value investing principles, looking for companies where the market price may not completely show the actual business quality, therefore offering a margin of safety for investors.

ABERCROMBIE & FITCH CO-CL A (NYSE:ANF) appears as a candidate that fits this screen, showing a notable mix of valuation appeal and operational strength. The company, a well-known specialty retailer operating under its namesake and Hollister brands, has shown an ability to manage the competitive apparel market while keeping solid financial metrics.

Valuation Metrics

A key part of value investing is finding stocks trading below their intrinsic worth, and ANF’s valuation metrics are especially attractive:

- Price-to-Earnings (P/E) ratio of 9.11, much lower than the industry average of 43.64 and the S&P 500 average of 27.38

- Price-to-Forward Earnings of 8.37, also well below industry and broader market comparables

- Enterprise Value-to-EBITDA and Price-to-Free Cash Flow ratios each rank better than about 90% of industry peers

These numbers indicate the market may be undervaluing ANF relative to both its sector and the company’s own financial performance. For value investors, such discounted multiples provide that important margin of safety, buying at a price that offers protection against overestimation of intrinsic value or unforeseen challenges.

Financial Health

Financial stability is necessary for value investments, as it lowers bankruptcy risk and provides resilience during economic downturns. ANF scores very well here with a Health rating of 9/10:

- Zero outstanding debt, removing interest burden and default risk

- Altman-Z score of 5.37 shows very low bankruptcy risk

- Strong solvency metrics do better than 86% of industry peers

- Share count reduction over past years shows capital discipline

This solid financial position means the company can handle market volatility without risking operations, a key factor for investors who usually hold positions through market cycles.

Profitability Strength

Value investing doesn’t mean accepting poor businesses, it means finding good companies at discounted prices. ANF’s profitability profile is excellent with a 9/10 rating:

- Return on Assets of 17.21% does better than 95% of industry peers

- Return on Equity of 44.80% ranks in the top 6% of the sector

- Profit margin of 10.60% exceeds 91% of competitors

- All major margins (gross, operating, profit) have improved in recent years

These metrics show that despite its discounted valuation, ANF runs a highly efficient business that creates strong returns on capital, exactly the type of profitable company value investors look for when searching for undervalued opportunities.

Growth Considerations

While not a pure growth stock, ANF shows adequate expansion potential with a Growth rating of 4/10:

- Revenue grew 9.34% in the past year, with 6.43% average annual growth over recent years

- EPS has grown at a notable 69.30% average annually over past years

- Future estimates project modest but positive growth in both revenue and earnings

The moderate growth profile is actually better for many value investors, as explosive growth often comes with premium valuations and higher risk. ANF’s steady expansion indicates sustainable business performance rather than speculative hype.

Investment Implications

The combination of these factors, deep value valuation, exceptional financial health, strong profitability, and reasonable growth, makes ANF an interesting candidate for investors using a value strategy. The company seems to be trading at a discount to its intrinsic value while keeping operational excellence, creating the possibility for price appreciation as the market sees this disconnect.

For investors interested in finding similar opportunities, additional stocks identified by the Decent Value screen can be found through this link. The screen keeps finding companies that meet these balanced criteria of value and quality.

Disclaimer: This analysis is based on fundamental data and investment screening methodologies, but it does not constitute investment advice. Investors should conduct their own research and consider their individual financial circumstances before making investment decisions. Past performance does not guarantee future results, and all investments carry risk of loss.