Bhutan Transfers $107M Bitcoin, With $1.1B BTC Left

The Royal Government of Bhutan transferred more than $100 million worth of Bitcoin this week, raising concerns about potential sell pressure in the market just as the US Federal Reserve delivered its first interest rate cut of 2025.

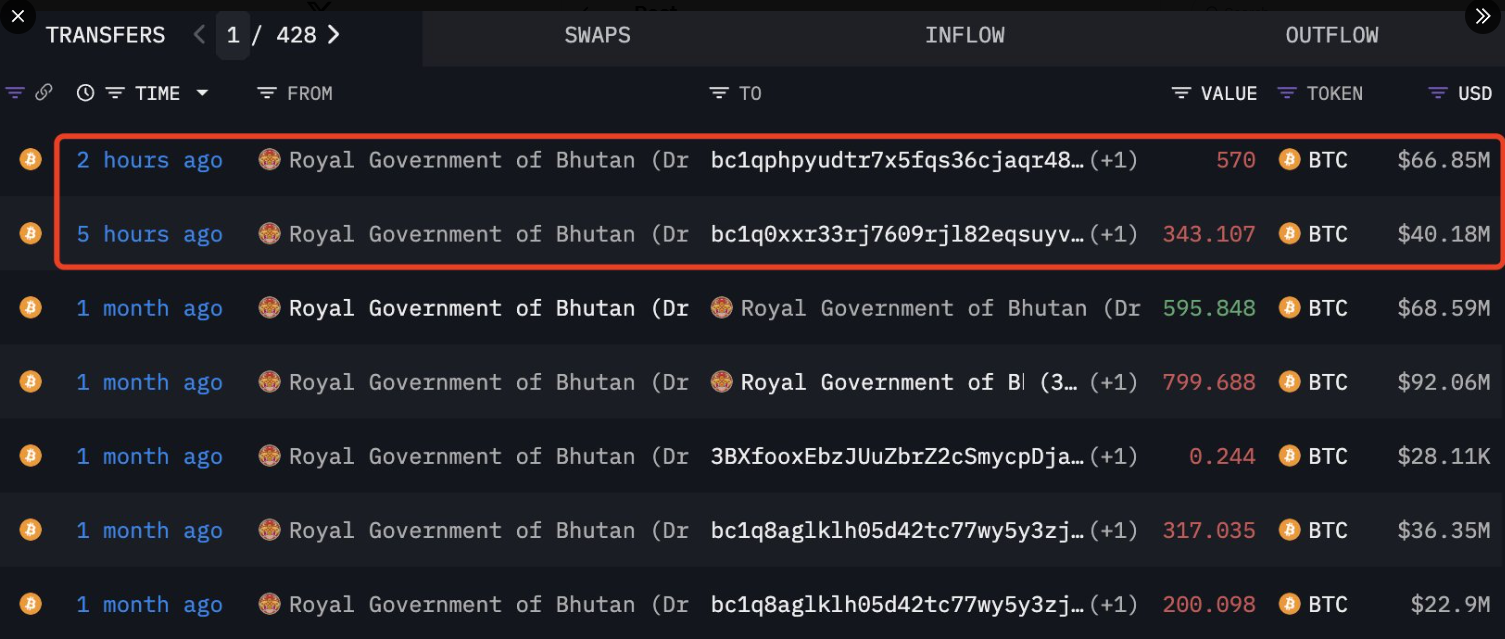

The Bhutan government-labelled wallet moved 913 Bitcoin (BTC) worth around $107 million into two newly-created cryptocurrency wallets on Thursday.

The wallet still holds a total of 9,652 Bitcoin worth over $1.1 billion, according to blockchain data platform Lookonchain.

The transfers may indicate Bhutan is preparing to sell a portion of its holdings. If the government liquidated its entire stash, it could add more than $1 billion of supply to the market.

Related: Standard Chartered venture arm to raise $250M for digital asset fund: Report

It was the first activity in a month from the wallet, which previously moved $92 million worth of Bitcoin on Aug. 18, according to Arkham data.

Bhutan has embraced cryptocurrency under its current monarch, King Jigme Khesar Namgyel Wangchuck, including initiatives such as hydro-powered Bitcoin mining and a crypto reserve.

In September 2024, Arkham identified the first Bitcoin address of Bhutan’s investment arm, Druk Holding and Investments, which held approximately $780 million in total crypto holdings, showcasing the benefits of cryptocurrency adoption for developing economies.

Related: ‘Diamond hand’ investor turns $1K into $1M as BNB tops $1,000

Whales stir as Fed cuts rates

The Bhutan transfers come as other large holders move coins ahead of potential volatility.

On Wednesday, an unknown whale woke up after 12 years of dormancy to transfer $116 million worth of Bitcoin, which he initially acquired for just $847 per token, worth around $847,000 at the time.

The transfer occurred shortly before Wednesday’s highly anticipated Federal Open Market Committee (FOMC) meeting, which delivered the first US interest rate cut of the year.

While Bitcoin initially topped $117,000 on the interest rate cut announcement, the “median FOMC projection of just 50 bps in total cuts this year tempers the optimism,” introducing short-term volatility risks, Ryan Lee, chief analyst at Bitget exchange, told Cointelegraph, adding:

“Historically, crypto has dipped 5–8% percent following rate cuts before resuming its upward path, suggesting a potential “sell the news” phase in the days ahead.”

“In the near term, Ethereum and Solana may outperform on ETF-driven inflows and network catalysts, while Bitcoin consolidates before targeting $123,000 to $150,000 if subsequent cuts materialize,” the analyst added.

https://www.youtube.com/watch?v=-CpJxNaN8s4

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder