YELP Inc (NYSE:YELP) Emerges as a Standout Value Investment Opportunity

Yelp Inc (NYSE:YELP) has become a noteworthy option for investors using a value-focused method. The stock was found using a filter that highlights solid fundamental valuation while keeping acceptable results in profitability, financial condition, and growth measures. This system fits with established value investment rules, where investors look for companies priced lower than their inherent worth but with enough operational soundness to imply the market could later acknowledge this difference.

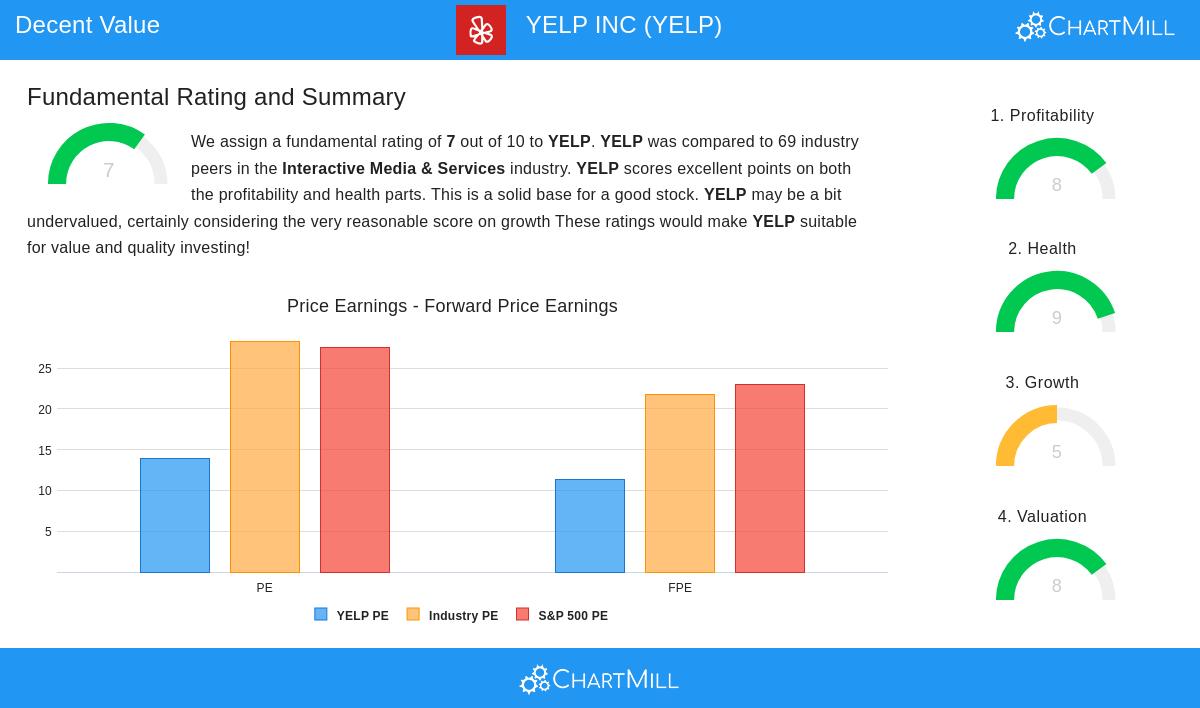

Valuation Assessment

Yelp’s valuation measures show a notably positive view for value-focused investors. The company’s present valuation score of 8/10 shows a number of noteworthy elements that point to possible underappreciation compared to both industry counterparts and wider market benchmarks.

• Price-to-Earnings ratio of 13.87 looks good against the industry average of 28.32 and the S&P 500’s 27.54

• Forward P/E ratio of 11.39 shows ongoing sensible valuation outlooks

• Enterprise Value to EBITDA and Price/Free Cash Flow ratios are lower priced than about 90% of industry rivals

• PEG ratio that includes growth outlooks hints at more valuation attractiveness

These valuation traits are especially important in value investing, as they supply the necessary safety buffer that Benjamin Graham stressed. When companies show sound fundamental operations while being priced at lower multiples, they offer the typical value investment situation where market price may not completely show business caliber.

Financial Health Analysis

Yelp shows very good financial soundness with a health score of 9/10, giving investors assurance about the company’s steadiness and risk level. The balance sheet displays several notable positive points that lower investment risk.

• No debt puts the company in a good position compared to rivals with debt

• Current ratio of 3.27 and quick ratio of 3.27 show very good short-term cash availability

• Altman-Z score of 5.95 points to very low failure risk and does better than 83% of industry peers

• Steady decrease in share count via buybacks improves value per share

For value investors, financial condition acts as a key protective feature. Companies with sound balance sheets can handle economic declines and market changes more successfully, lowering the chance of lasting loss of capital while anticipating the market to see the basic value.

Profitability Metrics

The company’s profitability score of 8/10 shows reliably good operational results across several areas. Yelp produces notable gains on both capital and sales, showing effective business activities.

• Return on Invested Capital of 19.82% is in the best 12% of the industry

• Profit margin of 10.28% and operating margin of 13.49% are higher than three-fourths of competitors

• Gross margin of 90.63% shows considerable price setting ability and operational effectiveness

• Recent margin widening hints at better operational scale

Profitability is vital in value investing because it confirms the lasting nature of the business plan. Companies creating good returns on capital can put money back into growth, give capital back to shareholders, or do both, all while keeping the operational soundness that supports inherent value estimates.

Growth Considerations

While Yelp’s growth score of 5/10 is the most average of its fundamental results, the company still shows important increases in main areas. The growth outline mixes past strength with more measured future outlooks.

• Earnings per share increase of 19.47% over the last year and 24.97% per year over several years

• Revenue increase of 5.37% each year, though slowing from past rates

• Expected EPS increase of 18.17% each year based on forward projections

• Revenue growth estimates of 3.74% each year pointing to steady but slower widening

For value investors, average growth can be better than fast but uncertain widening. Maintainable growth rates support sensible valuation guesses and lower the chance of letdown that frequently comes with too hopeful projections. Yelp’s mix of past growth and practical forward estimates gives a firm base for value evaluation.

The fundamental features shown by Yelp match well with value investment standards, especially when reviewed through the detailed fundamental analysis report. The company’s good valuation measures point to possible underappreciation, while its very good financial condition and profitability give assurance about business quality. The average growth outline offers sensible outlooks without needing flawless performance.

Investors looking for comparable options can review more choices using the Decent Value Stocks screening tool, which finds companies showing this mix of valuation attractiveness and fundamental soundness.

Disclaimer: This analysis is based on fundamental data and does not constitute investment advice. Investors should conduct their own research and consider their individual financial circumstances before making investment decisions. Past performance does not guarantee future results, and all investments carry risk including potential loss of principal.