BTC Eyes $115K Rally But CME Gap Risk Lingers

Key takeaways:

-

Bitcoin rallied 4.5% in 48 hours, reclaiming $114,000.

-

A reset in BTC’s open interest points to healthier upside after long de-leveraging.

-

A CME gap near $111,300 remains a short-term risk to bullish momentum.

Bitcoin (BTC) price rallied 4.5% in less than 48 hours, retesting $114,000 on Monday. The recovery followed last week’s sharp correction between Monday and Saturday, where data indicated the pullback was less about aggressive shorting and more about longs de-leveraging to set up a cleaner base for future upside.

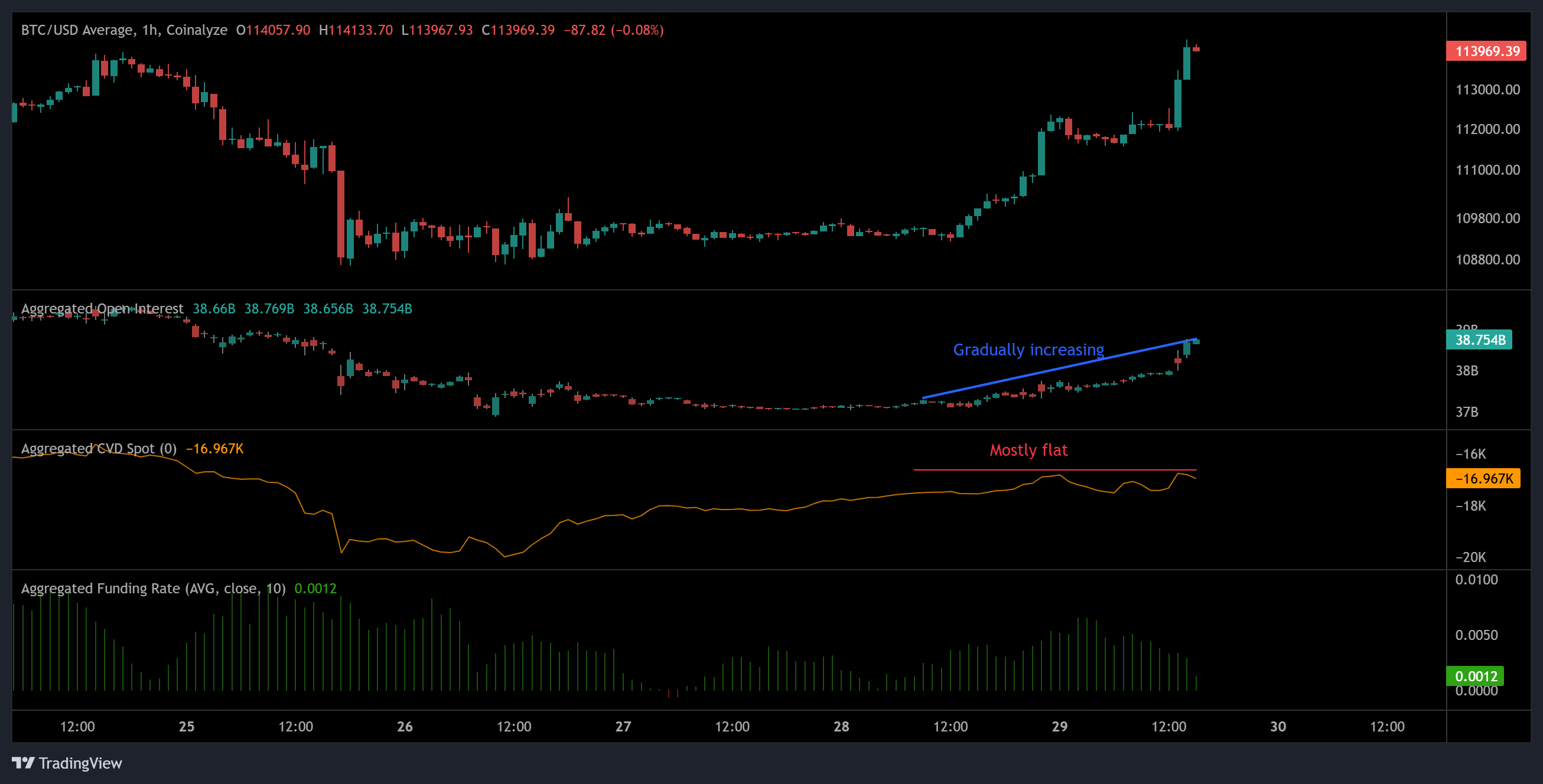

Between Sept. 21 and Sept. 27, Bitcoin slipped to $109,500 from $115,600, a 5.3% decline alongside a 6.2% drop in futures open interest (OI) to $39.9 billion from $42.6 billion. The 30-day correlation between price and OI tightened to +0.46, signaling longs were trimming exposure rather than shorts forcing the move. Such resets often clear excess leverage, paving the way for healthier rallies.

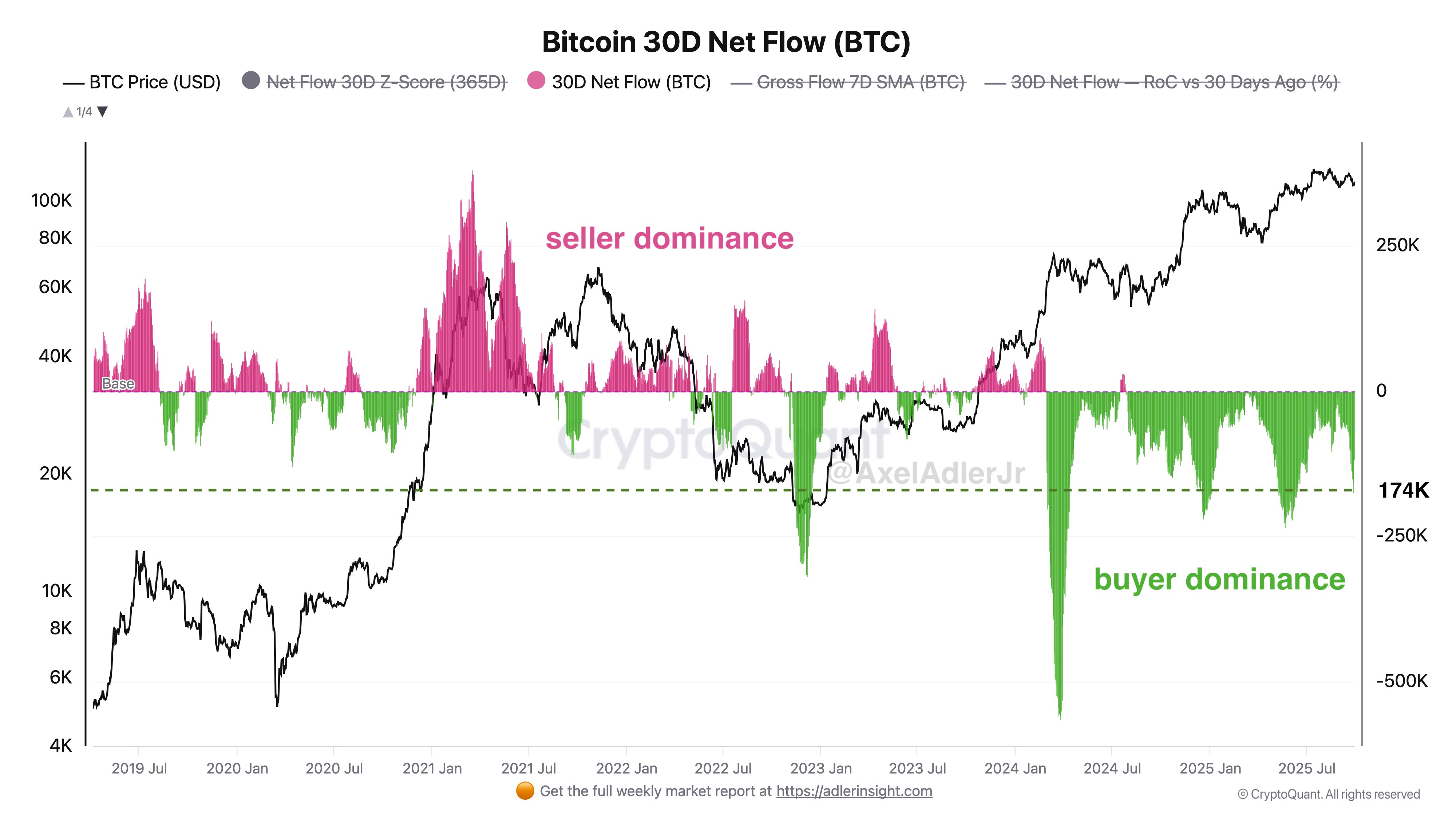

Spot market dynamics are also turning favorable. Buyers continued to dominate centralized exchanges, with net 30-day flows in negative territory at around 170,000 BTC, meaning more coins are leaving exchanges than entering. This pattern is often seen as a sign of accumulation and reduced sell-side pressure.

Meanwhile, Crypto market researcher Dom pointed out that the immediate target could be above $115,000. The analyst said,

“The liquidation divergence has played out pretty well. Spot books remain thin up until ~$115K on Binance. Thin books = easier to move price. Still need the bulls to stay aggressive to get there.”

Funding rates have cooled into a neutral range, removing the risk of cascading long squeezes and instead supporting a gradual rebuild of leverage. However, there is a lack of cohesion between the aggregated spot cumulative volume delta (CVD) and OI.

Spot CVD has remained largely flat during Monday’s rally, and OI is gradually increasing. The price action could welcome late spot bids if the price stabilizes above $113,000, setting the stage for the much-anticipated “Uptober” rally.

Related: $300K Bitcoin target ‘becoming increasingly likely,’ analyst says

CME gap risk remains in play near $111,300

Despite Bitcoin’s breakout above $114,000, derivatives traders could be watching a CME gap that remains unfilled between $111,300 and $110,900. CME gaps occur when Bitcoin futures on the Chicago Mercantile Exchange close for the weekend and reopen at a different price level, leaving a visible void on charts. Historically, BTC has shown a strong tendency to revisit these levels, with every gap since June being fully closed.

This suggested a short-term pullback toward the $111,000 zone cannot be ruled out before the recovery rally extends higher. The CME gap also coincides with a fair value gap, and a drop to $111,000 would also sweep the internal liquidity block between $112,300 and $111,400.

Thus, a short-term dip near these levels remains in play over the next few days. An immediate bullish invalidation would be a strong daily close above $115,000, which may reduce the probability of a drop to $111,000.

While historical trends emphasize that CME gap fills are not guaranteed, its recent 100% closure rate makes it an important technical factor for traders assessing near-term risks within Bitcoin’s broader bullish Q4 outlook.

Related: BTC price due for $108K ping pong: 5 things to know in Bitcoin this week

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.