Synchrony Financial (NYSE:SYF) Shows High Technical and Setup Ratings for Potential Breakout

Technical analysis often uses identifying stocks that not only show strong basic momentum but also offer clear, actionable entry points. One method for finding such opportunities uses screening for securities with high technical ratings—which point to good trend health—combined with high setup quality scores, indicating consolidation patterns that might come before breakouts. This method helps investors concentrate on names that are both technically good and set for possible short-term moves.

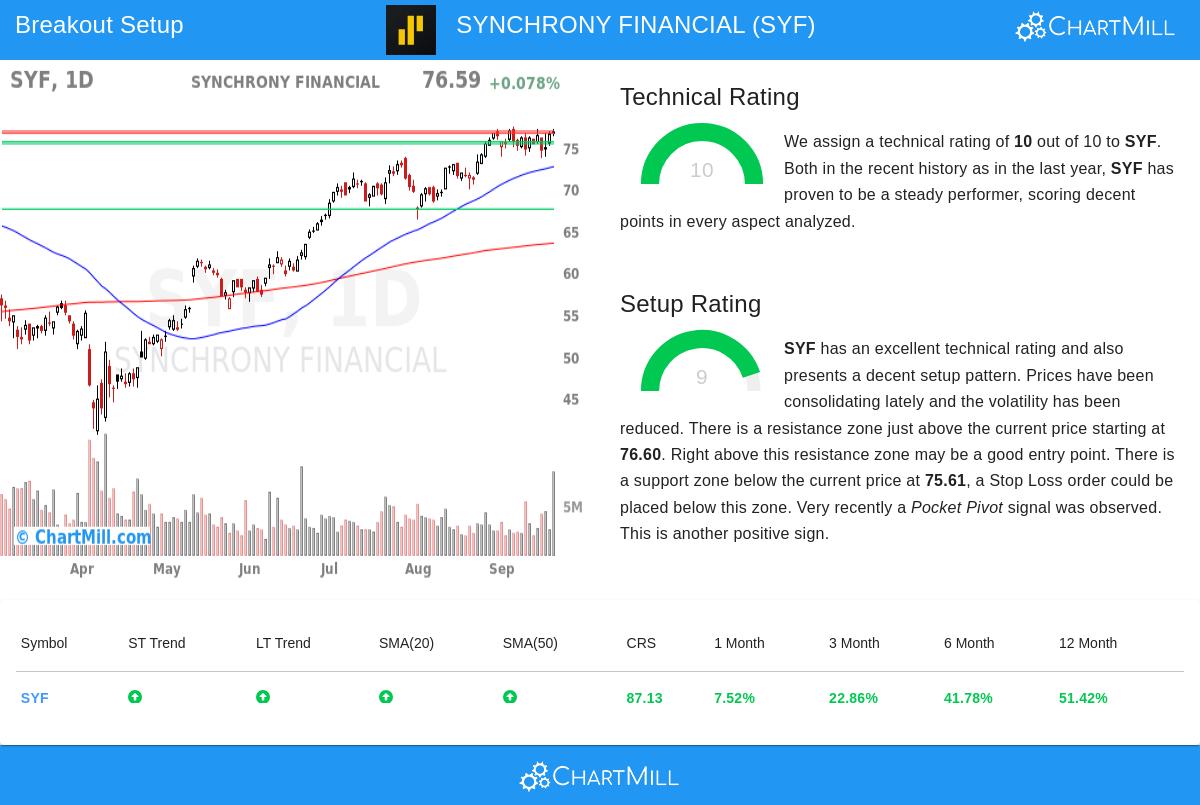

Synchrony Financial (NYSE:SYF) recently appeared in such a screen, showing a strong combination of technical strength and setup quality. The stock’s present profile suggests it could be interesting to traders searching for breakout candidates inside a strong uptrend.

Technical Strength

A high technical rating is important because it shows lasting bullish momentum across various timeframes and confirms that a stock is doing better than the wider market. Synchrony Financial gets a top-level technical rating of 10, highlighting outstanding trend health. Main factors adding to this score are:

- Both long-term and short-term trends are positive, with the stock trading well above its main moving averages (20-day, 50-day, 100-day, and 200-day).

- The stock shows strong relative strength, doing better than 87% of all stocks over the last year.

- It is trading near its 52-week high, showing continued buyer interest and momentum matching the present positive trend in the S&P 500.

These traits show that SYF is not just in an uptrend but is one of the market’s leaders—an important quality for breakout strategies, since breakouts are most dependable when they happen in stocks with confirmed strength.

Setup Quality

While technical strength finds which stocks are appealing, setup quality helps decide when to enter. A high setup score implies the stock is consolidating within a narrow range, lowering volatility and giving a clear support level from which a breakout might happen. Synchrony Financial has a setup rating of 9, pointing to a good-quality consolidation pattern. Important parts include:

- The stock is making a bull flag pattern, a bullish continuation signal where prices rest slightly after a strong rise.

- It is trading near short-term moving averages, which helps keep entry points reasonable and stops close.

- A recent pocket pivot signal—where price rises on higher volume—hints at accumulation by bigger players.

This mix of tight consolidation and basic strength raises the chance that a breakout above resistance might lead to more gains.

Trade Structure and Levels

For technical traders, SYF gives a clear level-based setup. Resistance is seen near $76.60, and a break above this area could act as a trigger for entry. Support is around $75.35, giving a sensible level for a stop-loss order. The nearness of these levels keeps risk clear—about 1.99% from entry to stop—which is good for position sizing.

It is important to note that while the pattern is encouraging, traders should stay mindful of earnings reports or sector-specific news that might affect price action. The present technical and setup ratings come from past data and pattern recognition—not future promises.

View More Breakout Opportunities

Synchrony Financial is only one instance of the kind of opportunity that can be found using a mixed technical and setup-based screen. For readers curious about finding more stocks showing similar breakout traits, the Technical Breakout Setups screen is refreshed daily and may provide other candidates.

,

Disclaimer: This article is for informational purposes only and does not constitute investment advice. The analysis is based on technical metrics and historical performance, which are not guarantees of future results. Investors should conduct their own research and consider their risk tolerance before making any trading decisions.