SoFi Retail Traders Get Excited As Stock Stays On Course To Hit Fresh Peak

The company’s stock has nearly doubled this year (+92%), helping its market capitalization swell to over $35 billion.

SoFi Technologies, Inc. (SOFI) stock is on track to hit a fresh high on Monday, potentially topping the $30 psychological barrier for the first time.

San Francisco, California-based SoFi is a fintech company that has evolved from being a student loan financing company to a full-service digital platform, offering loans, banking, investing, and technology. The company’s stock has nearly doubled this year (+92%), helping its market capitalization swell to over $35 billion. Ever since the market-cap has met the criteria for addition to the S&P 500 Index, traders have begun hoping that it would be added to the broader U.S. stock market gauge.

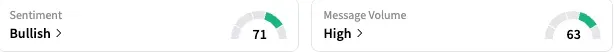

SoFi became the top-trending equity ticker on Stocktwits early Monday, with the retail sentiment toward the stock remaining ‘bullish’ (71/100) and the message volume staying ‘high.’

A bullish user drew a parallel between retail trading platform Robinhood Markets (HOOD) and SoFi, predicting that SoFi stock would reach $100 by the end of the year.

Another user guessed the stock could hit $35 on Monday, which implies an over 18% jump from the last close.

Another retail trader highlighted the company’s exposure to crypto and student loans, as well as its buyback. “Shorts in a very bad position,” they posted.

Short interest in SoFi stock is relatively elevated at 8.50%, although less than the 13.8% seen in July, according to Koyfin.

SoFi made headlines this month by announcing a multi-year partnership with Buffalo Bills quarterback Josh Allen, who will appear in a campaign set to launch at the start of the NFL season. The company also rolled out an agentic artificial intelligence (AI) exchange-traded fund (ETF).

The next major catalyst is likely to be the company’s third-quarter earnings, tentatively due in late October. The Koyfin-compiled consensus calls for revenue of $880.21 million, up about 28% year-over-year from $689.45 million last year, and earnings per share (EPS) of $0.08 versus the year-ago’s $0.05.

Last week, Mizuho lifted the price target for SoFi stock to $31 from $26, and maintained an ‘Outperform’ rating, attributing the optimism to its view that the company is the best positioned among bank processors, consumer lenders, and exchanges to benefit from the recent rate cut by the Federal Reserve.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Get the daily crypto email you’ll actually love to read. It’s value-packed, data-driven, and seasoned with wit.