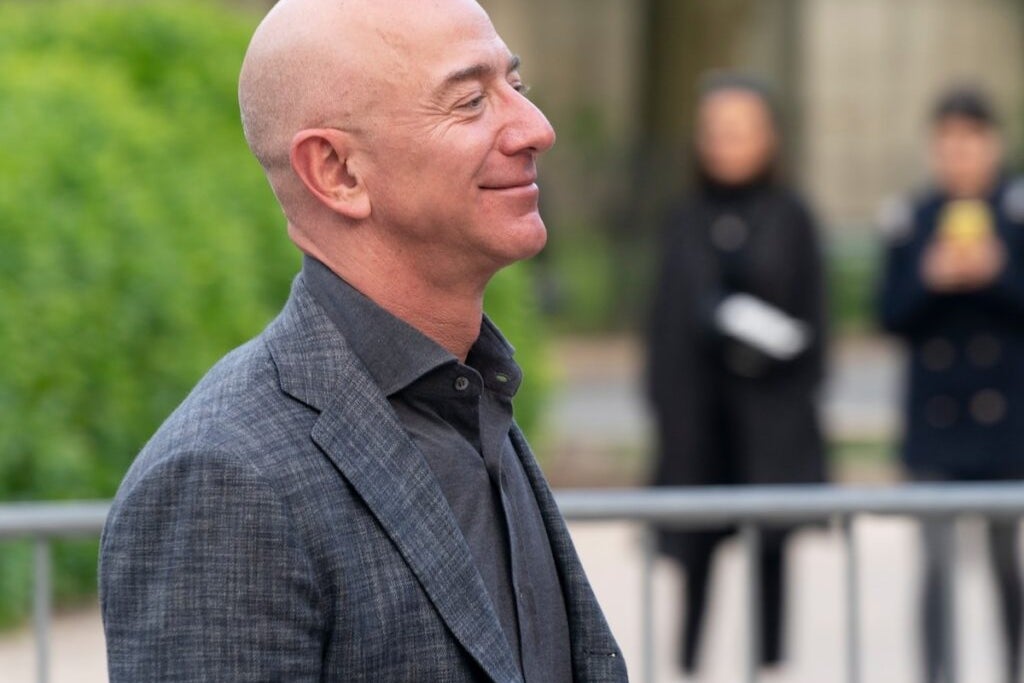

Jeff Bezos Predicts Gigawatt-Scale Orbital Data Centers In 10–20 Years, Compares AI Boom To Early 2000s Dot-Com Era – Ferrari (NYSE:RACE), Amazon.com (NASDAQ:AMZN)

Amazon.com Inc. (NASDAQ:AMZN) founder Jeff Bezos said on Friday that within the next 10 to 20 years, massive data centers could be built in space, taking advantage of uninterrupted solar energy as a key edge over those on Earth.

Check out the current price of AMZN stock here.

Speaking at Italian Tech Week in Turin, Bezos said that data centers in orbit could eventually outperform those on Earth because they would have a constant power supply. “We have solar power there, 24/7. There are no clouds and no rain, no weather,” he told Ferrari and Stellantis Chairman John Elkann, Reuters reported.

Cost Competitiveness Expected Within Decades

The billionaire entrepreneur predicted that data centers in space could match the costs of those on the ground. “We will be able to beat the cost of terrestrial data centers in space in the next couple of decades,” he said.

Bezos said that the giant training clusters would be better built in space, noting the continuous electricity and water demands of data centers on Earth.

Data centers now consume 5% of U.S. power and are projected to double, driving interest in space-based alternatives.

Challenges Include Maintenance, Launch Risks

According to reports, space-based data centers would face several operational challenges, including difficult maintenance, complex upgrade logistics, high rocket launch costs, and the risk of launch failures.

AI Boom Compared To Dot-Com Era

The tech visionary likened the rise of AI to the internet boom of the early 2000s, encouraging optimism while also recognizing the risk of bubbles.

He further said it is important to separate the potential bubbles and their possible bursts from the underlying reality.

Stock Performance

The American multinational technology company a has gained 17.7% over the past year, trading between $161.43 and $242.52, with a market capitalization of $2.34 trillion, an average daily volume of 41.65 million shares, and a price to earnings ratio of 33.5.

Benzinga Edge Stock Rankings indicate that AMZN is experiencing short-term consolidation. Track the performance of other players in this segment.

Read Next:

Photo courtesy: Lev Radin on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.