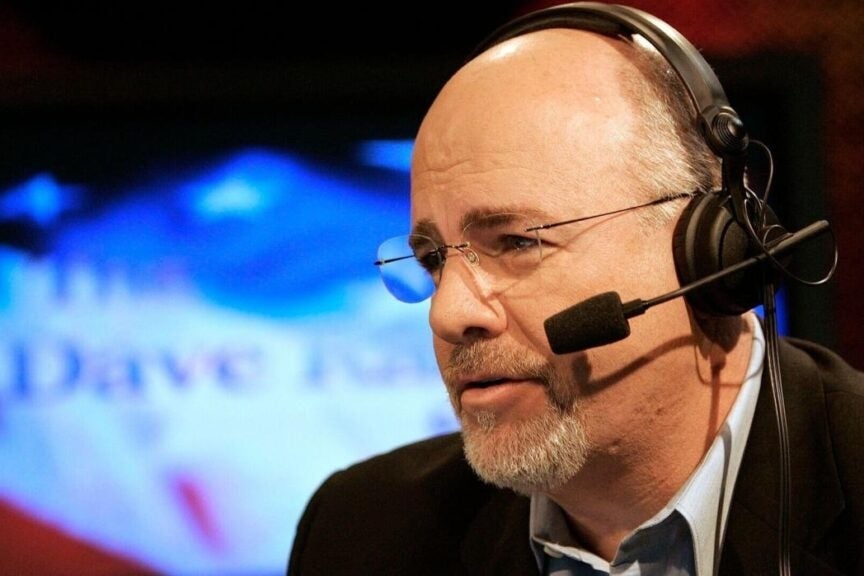

Dave Ramsey’s Portfolio Outperformed by S&P 500, Three-Fund Portfolio Across All Time Frames Over Past 10 Years, Podcaster Says – Vanguard S&P 500 ETF (ARCA:VOO)

Personal finance expert Dave Ramsey is known for teaching people how to get rid of debt and typically recommends investing in growth and income funds with a long-term focus.

In June, Brian Preston and Bo Hanson on “The Money Guy Show” YouTube channel compared with hypothetical portfolio based on Ramsey’s investing approach with the Vanguard S&P 500 ETF (NYSE:VOO) and the well-known three-fund portfolio, which combines US stocks, international equities and bonds.

Don’t Miss:

“If you listen to Dave Ramsey, if you’ve listened to any of his investing advice, he comes up with this idea. He says your portfolio should be split equally between four different categories: growth and income, growth, aggressive growth, and international,” Preston said.

The podcast hosts chose the following funds to include in the Dave Ramsey portfolio:

- Columbia Large Cap Index Fund Class A (NASDAQ:NEIAX) for growth and income

- JPMorgan Mid Cap Growth Fund Class R3 (NASDAQ:JMGPX) for growth

- American Funds EUPAC R4 (NASDAQ:REREX) for international

- Franklin Small Cap Growth Fund Class A (NASDAQ:FSGRX) for aggressive growth

Trending: Kevin O’Leary Loves ‘Wonderful Recurring Cash Flows’ — These Small Industrial Assets Deliver Just That

The Ramsey portfolio returned about 8% over the past 10 years, versus 12% for VOO and 9% for the three-fund portfolio, according to the research results shared on the show. Over the past five years, Ramsey’s portfolio posted a return of 10%, down from VOO’s gains of 15% and 12% from the three-fund portfolio. The S&P 500 fund outperformed the Ramsey portfolio by a wider margin of 7 percentage points over the past year, and by 4 percentage points over the past three years.

“You can see that VOO for life, which is the S&P 500, has dominated,” Preston said. “Really, I mean, you look at the one year, the three year, the five year and 10 year, not a period there that the S&P 500 didn’t dominate. So that’s one of those things that historically, if you’ve been in the S&P, you’ve been greatly rewarded.”

See Also: Microsoft’s Climate Innovation Fund Just Backed This Farmland Manager — Accredited Investors Can Join the Same Fund

Preston said Ramsey’s portfolio would have “crushed” it in 2005, 2006 and 2007 amid strong growth in emerging and developing markets. However, major large-cap stocks in the U.S. generally outperformed other asset classes for many years afterward, leading to the S&P 500’s overall outperformance. He also called Ramsey’s portfolio approach “wild” because of its excessive focus on growth.

“Sometimes when I look at Dave’s portfolio, and I don’t know if they’ve considered updating it, but it does look like it is an exercise in growth and income,” Preston said. “Growth just means it’s probably going to be on the aggressive side of the large-cap holdings. Aggressive growth is probably going to be small-cap or something like that. And then international, I mean, just by its nature, international has a lot of growth components to it. So, this thing seems like it is wild. It’s wild.”

Read Next: If You’re Age 35, 50, or 60: Here’s How Much You Should Have Saved Vs. Invested By Now

Image: Shutterstock