Consensys CEO Says SWIFT Is Building on Linea

SWIFT — the Society for Worldwide Interbank Financial Telecommunication — will be building its recently announced blockchain payment settlement platform on Ethereum layer 2 Linea, Consensys CEO Joe Lubin has confirmed.

On Monday, SWIFT revealed that it tapped Consensys and over 30 TradFi institutions to build infrastructure for a 24/7 real-time crypto payments system — but didn’t confirm which chain it would build on despite widespread speculation that it would be Linea.

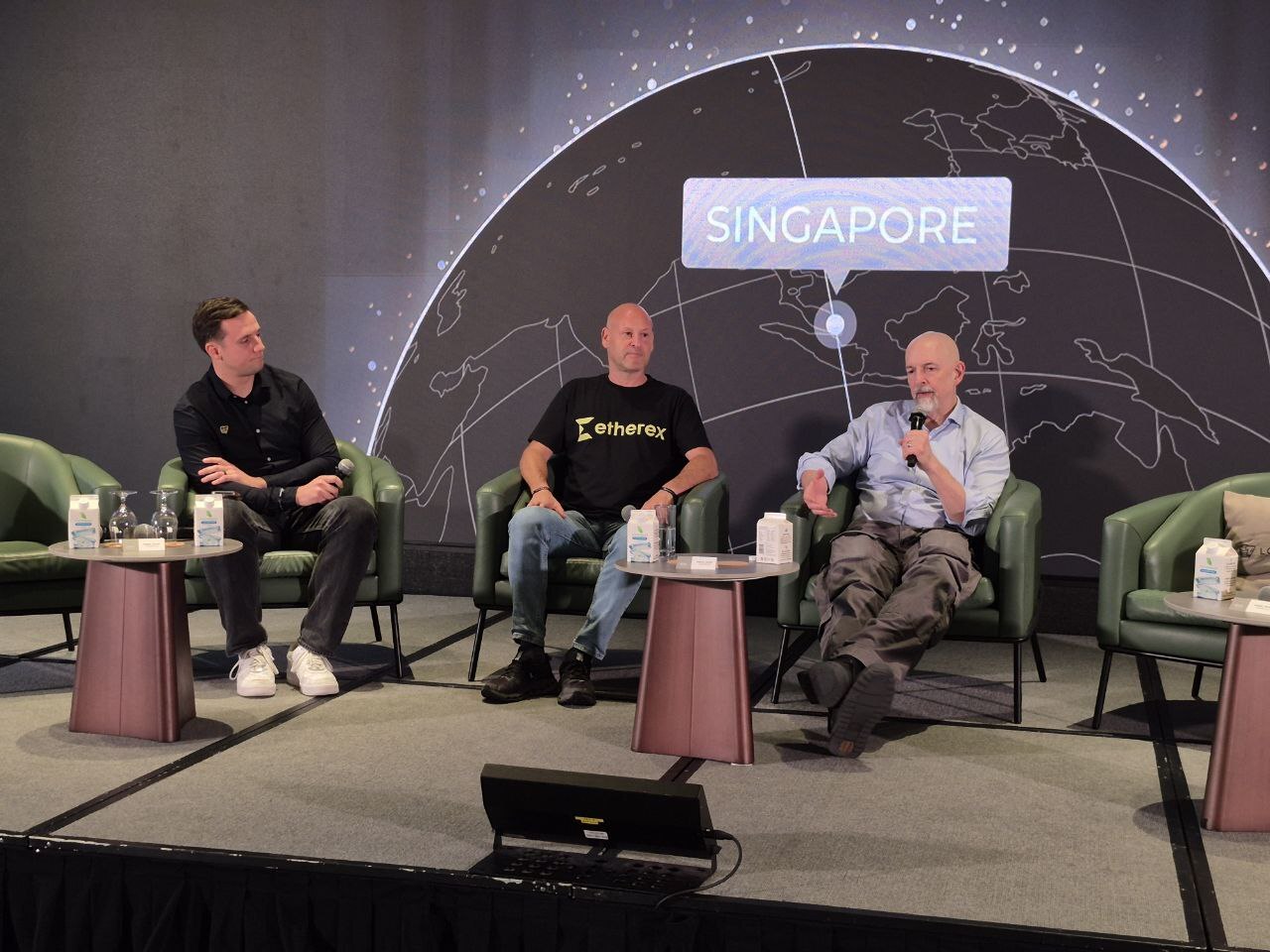

But Lubin confirmed Linea’s selection in a fireside chat with Cointelegraph’s Gareth Jenkinson at the TOKEN2049 conference in Singapore on Thursday.

Lubin said that during SWIFT’s announcement to the banking sector, SWIFT CEO Javier Pérez-Tasso didn’t mention Linea by name. Lubin said SWIFT had to “soft roll out” the “big news,” which was taken rather positively.

“I believe the sentiment was, ‘thank you for doing this.’ It’s about time to bring the two streams, DeFi and TradFi, together,” said Lubin.

Developed by Consensys, Linea is a scaling-focused layer 2 that leverages zk-EVM rollup technology to process around 1.5 transactions a second at one-fifteenth the cost of fees on Ethereum.

It has $2.27 billion worth of total value locked — the fourth largest among Ethereum layer 2s, trailing only Arbitrum One, Base Chain and OP Mainnet, L2BEAT data shows.

SWIFT’s entry into the blockchain payments space could be massive, as it handles around $150 trillion worth of global payments through traditional banking rails each year.

Some of the biggest banks are involved

Bank of America, Citi, JPMorgan Chase, and Toronto-Dominion Bank are among the TradFi firms set to participate in trials of SWIFT’s new blockchain payments rail on Linea.

It could pose a serious competitor to Ripple’s XRP Ledger, one of the few prominent blockchain-based payment systems tailored for banks.

SWIFT’s move to build a blockchain payments rail has been anticipated for some time, benefiting from the blockchain’s near-instant, 24/7 settlement without intermediaries, while reducing costs, errors, and delays.

Linea could enable a “user-generated civilization,” says Lubin

Lubin highlighted the broader potential of Linea beyond payments, describing it as a platform where “content can be created in a user-generated fashion.”

Related: ‘Stablecoin duopoly ending’ as USDT, USDC dominance falls to 84%

“We will have user-generated civilization and user-generated content on Linea and other places,” Lubin said, explaining that by leveraging Ethereum’s trustless settlement layer, Linea allows communities to build infrastructure, rules, and apps from the bottom up — opposite to the top-down approach seen in traditional government and banking hierarchies.

Decentralized autonomous organizations are already trying to run entities without centralized leadership, often implementing smart contracts and decentralized voting systems to manage treasuries and make decisions. However, few DAOs have achieved success at scale so far.

Magazine: Can Robinhood or Kraken’s tokenized stocks ever be truly decentralized?