JD.com (NASDAQ:JD) Appears as a Fit for Peter Lynch’s GARP Strategy

The investment philosophy created by Peter Lynch has long been a guide for investors looking to build wealth through a disciplined, long-term method. His strategy centers on finding companies that show sustainable growth, financial health, and reasonable prices, a method often called Growth at a Reasonable Price (GARP). By mixing parts of both growth and value investing, Lynch sought to find businesses that were not only growing but also trading at prices that did not exaggerate their future potential. This system offers a structured way to assess possible investments, and one company that currently appears from a screen built on these ideas is JD.COM INC-ADR (NASDAQ:JD).

Alignment with Lynch’s Growth and Valuation Filters

A central part of the Lynch strategy is to find companies with solid, but not extreme, earnings growth. He thought that very high growth rates were often not maintainable. Also, he believed that investors should not pay too much for that growth, which is where the PEG ratio becomes an important valuation measure. JD.com’s financial numbers demonstrate a clear fit with these ideas.

- Earnings Per Share Growth: The company has reached an EPS growth rate of 26.75% on average over the last five years. This number easily passes Lynch’s minimum requirement of 15%, pointing to solid expansion, while staying under his upper warning limit of 30%, implying the growth could be more maintainable.

- PEG Ratio: Maybe the most notable number is JD.com’s PEG ratio of 0.31. Lynch viewed a PEG ratio under 1.0 as a signal of a company priced low relative to its growth path. A ratio this low suggests the market may be valuing the stock cautiously in spite of its good historical earnings growth.

Financial Health and Profitability

Lynch put great importance on a company’s financial soundness, favoring businesses with good balance sheets that could endure economic declines. He used particular ratios to filter out financially risky companies. JD.com’s profile shows a varied but generally acceptable view here.

- Debt-to-Equity Ratio: The company reports a Debt/Equity ratio of 0.25. This meets Lynch’s stricter preference for a ratio under 0.25, showing a careful capital structure funded mainly by equity instead of debt. This reduces the company’s financial risk and fits well with the strategy’s focus on safety.

- Return on Equity (ROE): With an ROE of 17.02%, JD.com passes Lynch’s 15% requirement. This shows that the company is effectively creating profits from its equity base, a main sign of management skill and good profitability.

- Current Ratio: The Current Ratio of 1.22 meets the basic Lynch filter of being more than 1.0, indicating the company has enough short-term assets to pay for its short-term obligations. Still, it is important to see that this is an area where the company falls behind most of its industry competitors.

Fundamental Analysis Overview

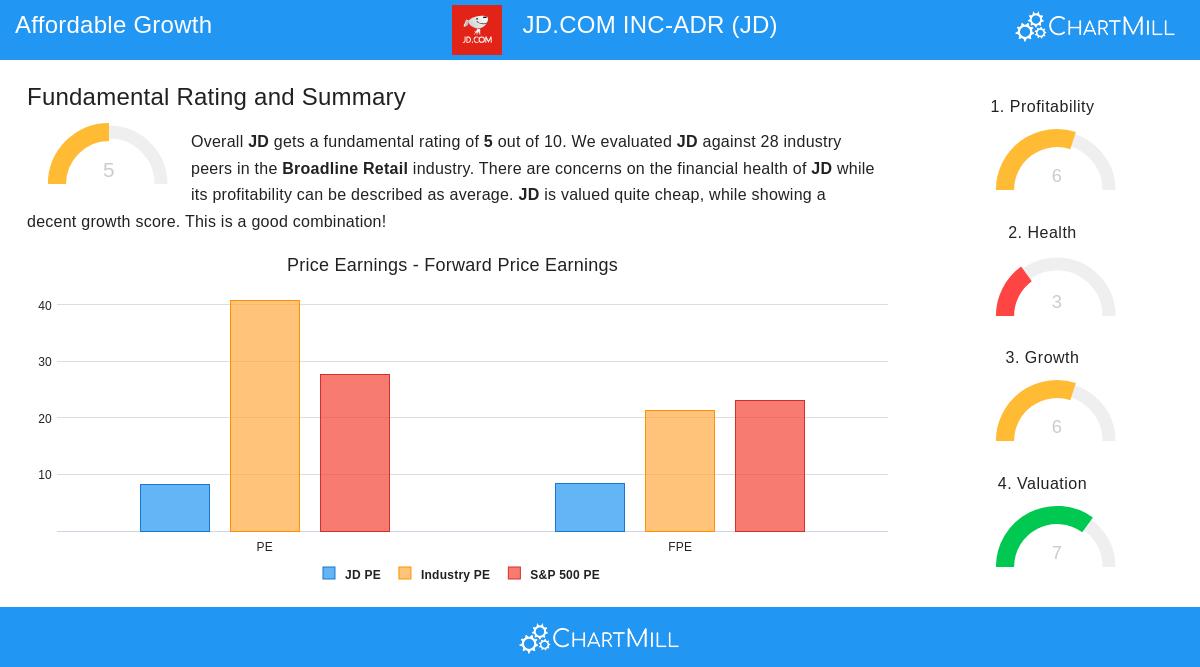

A wider fundamental analysis of JD.com supports the results from the Lynch screen. The analysis gives the company an overall score of 5 out of 10, pointing out both positive aspects and areas to watch. On the good side, the valuation is a clear positive, with very good Price-to-Earnings and Price-to-Forward-Earnings ratios compared to both the industry and the wider S&P 500. Profitability is also scored as acceptable, backed by a good ROE and getting better margins.

The main worries are in the company’s financial health, which gets a lower score. While the solvency numbers related to long-term debt are good, liquidity measures like the Quick Ratio are noted as possible weak points. The growth view is average, with solid expected EPS growth balanced by a predicted decrease in revenue growth.

A Candidate for the Long-Term Investor

For investors following the ideas of Peter Lynch, JD.com presents a strong case. It fits the GARP model by showing a past of significant earnings growth that is being valued very cautiously by the market. Its good ROE and low debt levels meet the strategy’s needs for profitability and financial health. While the fundamental analysis indicates some worries about liquidity, the main Lynch criteria—maintainable growth, a low PEG ratio, and a sound balance sheet—are satisfied. This mix makes it a stock worth more study for those putting together a varied, long-term portfolio.

For investors wanting to find other companies that fit this proven strategy, you can view the complete Peter Lynch screen results here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. All investments involve risk, including the possible loss of principal. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.