Carvana Co (NYSE:CVNA) Exemplifies Louis Navellier’s Growth Stock Criteria

Louis Navellier’s “The Little Book That Makes You Rich” describes a disciplined method for finding high-quality growth stocks using eight specific fundamental rules. This approach looks for companies with strong earnings momentum, increasing sales, growing profitability, and sound financial condition. By using these rules in a structured way, investors try to find stocks set for notable growth. One company that recently appeared from this screening process is Carvana Co (NYSE:CVNA).

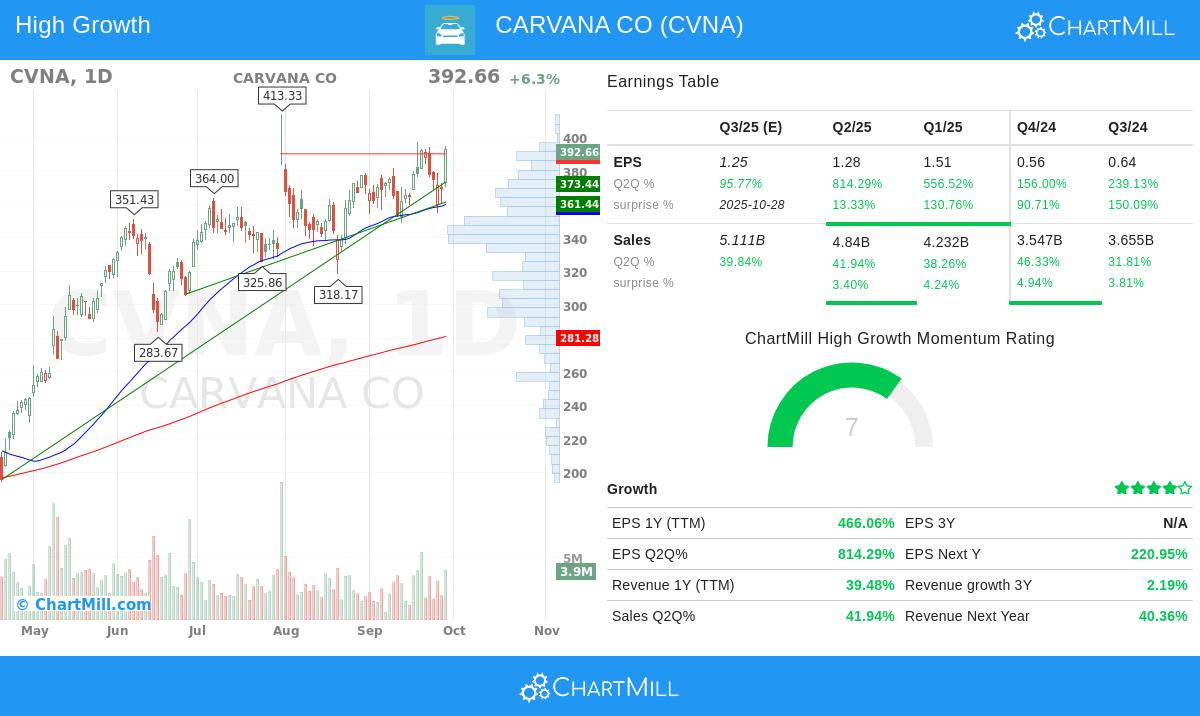

Earnings Revisions and Surprises

A key part of Navellier’s method is how Wall Street analysts adjust their views on a company’s future. Positive earnings revisions mean analysts are becoming more confident because of new data, while regular earnings surprises show a company’s habit of doing better than predicted.

- Positive Earnings Revisions: The average EPS estimate for Carvana’s next quarter has gone up by 9.10% in the last three months.

- Positive Earnings Surprises: The company has exceeded EPS estimates in each of the last four quarters, with an average surprise of 96.22%.

These numbers are important because they frequently come before further increases in future earnings estimates, which can be a strong force for stock price gains.

Sales and Earnings Growth

For a growth stock to support its price, it must show large, and often quickening, increases in both revenue and earnings. Navellier’s method demands solid, measurable growth.

- Sales Growth: Carvana reported year-over-year revenue growth of 39.48% and a very high quarter-over-quarter sales growth of 41.94%.

- Earnings Growth: The company’s earnings growth is even more notable, with a 466.06% year-over-year EPS increase and an 814.29% rise in the latest quarter-over-quarter comparison.

This fast growth in both sales and profits is a main feature the method looks for, pointing to solid market demand and good operational management.

Profitability and Cash Flow Expansion

Beyond just growth, the quality of that growth is very important. Growing operating margins show that a company is increasing sales without a matching rise in costs, which means it is getting more efficient. Good cash flow generation gives the company the financial ability to pay for future expansion without needing too much outside money.

- Expanding Operating Margins: Carvana’s operating margin has grown by 168.55% over the past year.

- Strong Cash Flow: The company’s free cash flow increased by 203.36% in the last twelve months.

These numbers indicate Carvana is not only getting bigger, but also becoming more profitable and financially sound as it grows, fitting well with the method’s focus on high-standard growth.

Earnings Momentum and Return on Equity

The method searches for companies with positive earnings momentum, where growth rates are speeding up, and a high return on equity (ROE), which calculates how well a company creates profits from money shareholders have invested.

- Positive Earnings Momentum: The current quarterly EPS growth of 814.29% is much higher than the growth rate from the same quarter a year ago (125.46%), confirming solid positive momentum.

- High Return on Equity: Carvana’s ROE is 32.54%, above the method’s required minimum and showing good use of equity capital.

Fundamental Rating Overview

A look at Carvana’s detailed fundamental analysis shows a varied but encouraging picture. The company gets a medium total fundamental rating, with its financial health and profitability scores being typical for its industry. However, its most noticeable trait is a high growth rating, fueled by the strong numbers described above. The main warning for investors is its valuation; the stock seems costly on standard measures like P/E ratio, though this might be acceptable given its exceptional growth path for those using a growth investing style.

Finding Similar Investment Candidates

Carvana Co is a good example of the kind of company the Little Book method tries to find. For investors wanting to find other stocks that meet these strict growth rules, the screen used for this review is open to the public. You can examine and adjust the screen here to locate more possible options.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The information presented should not be used as the sole basis for any investment decision. Past performance is not indicative of future results. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.