Should You Buy Domino’s Pizza Stock Before Oct. 14?

The pizza company reports earnings in a few weeks.

Domino’s Pizza (DPZ 3.14%) is an iconic pizza chain with a presence in dozens of countries throughout the world. And in the U.S. alone, it has more than 7,000 locations. It’s an attractive go-to fast food option for people looking for a quick and easy meal. It is a well-known brand and it has even attracted the interest of billionaire investor Warren Buffett. His company, Berkshire Hathaway, invested in the pizza maker last year.

Over the past five years, however, Domino’s has been an underwhelming investment to own, rising by around 1% during that stretch (returns as of Sept. 25). Could it be due for a much bigger rally, and could its third-quarter earnings report, which comes out on Oct. 14, be the catalyst that sends the stock higher? Let’s take a closer look at the stock and how it has performed in the past.

Image source: Getty Images.

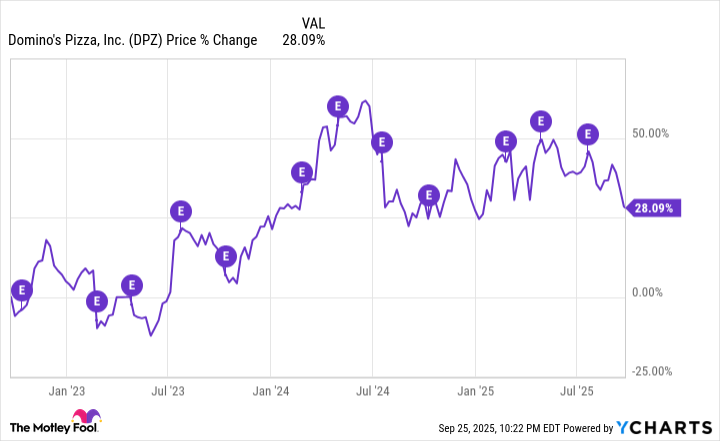

How Domino’s has performed after previous earnings reports

The last time that Domino’s reported earnings was back in July. At the time, the company posted solid numbers as its same-store sales in the U.S. came in at 3.4%, which was better than analyst estimates of 2%. Unfortunately, its bottom line was less than stellar, with its diluted earnings per share coming in at $3.81, which was lower than what Wall Street was looking for — $3.95.But despite the fairly decent showing, Domino’s stock would proceed to fall shortly after the earnings numbers came out.

In the past three earnings reports, Domino’s stock has ended up falling in value afterward. And from the chart above, it’s clear that while there have been some positive increases in the share price following the release of earnings, oftentimes there’s been a decline. After all, Domino’s isn’t in a high-growth sector like technology and so the likelihood of it generating a lot of excitement on its earnings numbers is unlikely.

The more pressing concerns may be about what lies ahead for the business. And with tariffs and considerable macroeconomic uncertainty, investors may not be overly optimistic. It also doesn’t help that Domino’s isn’t a cheap stock.

Domino’s trades at a high multiple given its growth

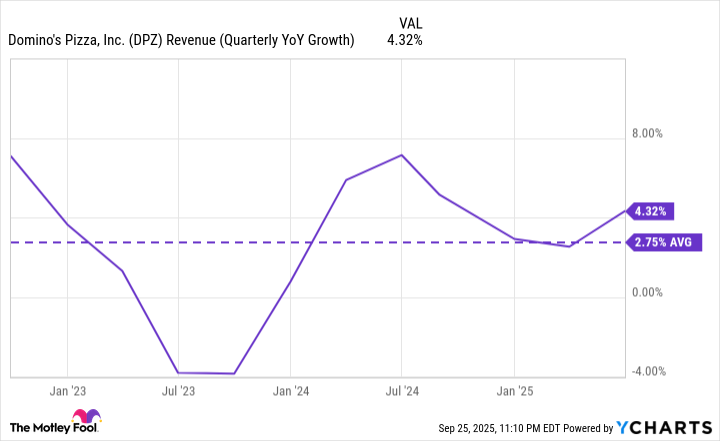

Although Domino’s hasn’t been doing badly, the stock is trading at a not-so-modest valuation. Currently, its price-to-earnings (P/E) multiple sits at around 25. That’s in line with the S&P 500 average, but it’s still a bit pricey for a business that’s growing in the single digits. This is not the type of growth chart I would expect to see from a stock that trades at 25 times its earnings.

DPZ Revenue (Quarterly YoY Growth) data by YCharts

With modest growth at a time when consumers may be cutting back on discretionary spending and perhaps eating at home more often, my concern is that the company’s already-underwhelming growth rate may come down even further in future quarters. Even though Domino’s may have a strong and profitable business, its valuation may be what’s hurting the stock from rising a whole lot higher right now.

I wouldn’t rush to buy Domino’s stock

A positive earnings report can often boost a stock’s value in both the short and long term, but unless Domino’s has a completely unexpected blowout quarter, I wouldn’t expect that to happen when it reports earnings in a few weeks. At best, I can see the stock rising a few percentage points if it continues to show good same-store comps. But at worst, I could see a sizable decline given its valuation. There looks to be more downside risk than there is upside potential based on where it trades today.

The stock has been flat this year and there’s little reason to expect that to change after it posts its upcoming earnings. There is no rush to buy, and waiting until after the company reports its latest numbers before making a decision on the stock may be a sound option for investors.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Domino’s Pizza. The Motley Fool has a disclosure policy.