Stablecoins, ETPs and Legislation Key Themes for Crypto Returns in Q4

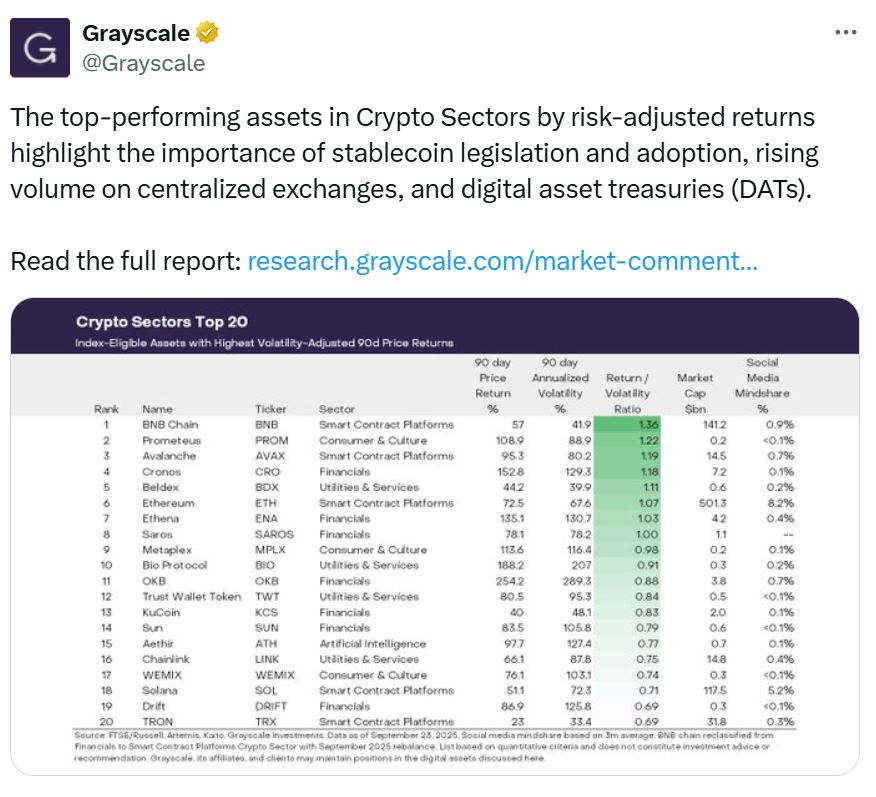

Crypto prices will likely be spurred by crypto market structure legislation, stablecoins and a flood of exchange-traded products (ETP) in the fourth quarter, analysts told Cointelegraph, after assets tied to digital treasuries dominated over the last quarter.

In a report released on Thursday, crypto asset manager Grayscale’s research team said crypto market structure legislation in the US, the CLARITY Act, represents “comprehensive financial services legislation,” and could be “a catalyst for deeper integration with the traditional financial services industry.”

Meanwhile, the Securities and Exchange Commission’s approval of a generic listing standard for commodity-based ETPs could also spark inflows because it increases the “number of crypto assets accessible to US investors.”

The researchers also said “crypto assets should be expected to benefit from Fed rate cuts,” with the Federal Reserve slashing rates for the first time since last year on Sept. 17, with more possibly on the way.

Although JPMorgan CEO Jamie Dimon cast doubt on more rate cuts, and said on Monday he thinks the Fed will have a hard time cutting the interest rate unless inflation drops.

Stablecoin chains could emerge as winners this quarter

Speaking to Cointelegraph, Edward Carroll, head of markets at crypto and blockchain investment firm MHC Digital Group, said he expects stablecoin growth to be a key driver of returns in Q4.

US President Donald Trump signed the GENIUS Act into law in July. It’s aimed at establishing clear rules for payment stablecoins, but is still awaiting final regulations before implementation.

“This should be positive medium- to long-term for any chain being used for stables, Ethereum, SOL, Tron, BNB, Eth layer 2s, but more fundamentally to the companies building and providing the products to market,” Carroll said.

At the same time, he predicts institutional applications of tokenization will start to gain traction, as larger players start to pursue more tokenized money market funds, bank deposits, and exchange-traded funds (ETFs).

Bitcoin and altcoins could have a bumper quarter, too

Pav Hundal, lead analyst at Australian crypto broker Swyftx, told Cointelegraph that more money is flowing into crypto through funds and automated contributions, and a Bitcoin (BTC) rally toward the end of the year will fuel an altcoin surge in Q4.

A report from financial services company River released earlier this month found that ETFs are gobbling up, on average, 1,755 Bitcoin per day in 2025.

“Unless the market is kneecapped by something unexpected, Bitcoin will likely hit new highs before the end of the year, and that will fuel altcoins,” Hundal said.

“It’s been a rotational market for all of 2025, with alt coins performing well after an initial Bitcoin rally. I don’t see any reason for that pattern to change now. The top performers during rotations have been memecoins and DeFi applications like Pump.fun, Hyperliquid and Aster.”

Last quarter, Hundal said the big theme was US-listed companies converting to digital asset treasuries, with Ether (ETH), Solana (SOL) and Hype emerging as the top performers in the last few months.

Related: Crypto treasury share buybacks could signal a ‘credibility race’ is on

DeFi revenue-generating projects could also be a winner

Henrik Andersson, chief investment officer of Apollo Crypto, told Cointelegraph he expects Q4 to include ETF approvals in the US, including for staked assets, and the CLARITY Act to pass.

“On a sector basis, we believe revenue-generating projects in DeFi will continue to perform very well. Stablecoins and RWA will very likely continue to be major themes overall.”

However, he also said “rate cut expectations in the US might disappoint as the economy and labor market seemingly are doing better than the Fed feared when it lowered rates.”

While last quarter, Andersson said Hyperliquid and Pump buybacks made big waves in crypto markets, along with the “proliferation of digital asset treasuries.”

Magazine: How do the world’s major religions view Bitcoin and cryptocurrency?