TAYLOR DEVICES INC (NASDAQ:TAYD) Passes the “Caviar Cruise” Quality Investing Screen

For investors looking for companies with lasting competitive strengths and steady financial results, quality investing provides a systematic method for building wealth over time. This approach centers on finding businesses with good revenue increases, high profit margins, solid balance sheets, and the capacity to produce significant cash flows. The “Caviar Cruise” stock screen puts this strategy into practice by using a strict set of quantitative filters meant to identify companies that display these key characteristics. The screen assesses past results, operational effectiveness, and financial condition to produce a list of possible candidates for more investigation.

One company that currently passes this strict screening process is TAYLOR DEVICES INC (NASDAQ:TAYD). The North Tonawanda-based firm focuses on designing and making shock absorption, rate control, and energy storage devices for the aerospace, defense, construction, and industrial markets. A detailed look shows how its financial numbers match the main ideas of quality investing.

Good Historical Growth Path

A basic part of quality investing is a proven record of growth, showing a company’s capacity to increase its market share and grow its operations efficiently. The Caviar Cruise screen asks for at least 5% yearly growth in both revenue and EBIT (Earnings Before Interest and Taxes) over a five-year span.

- Revenue Growth (5Y CAGR): 9.13%

- EBIT Growth (5Y CAGR): 23.88%

Taylor Devices not only reaches these levels but goes well beyond them. Importantly, its EBIT growth is faster than its revenue growth, a sign of better operational efficiency and possible pricing strength. This implies the company is not only increasing sales but is also making more profit from each additional dollar sold, often a marker of economies of scale or a durable competitive advantage.

Outstanding Profitability and Returns

For quality investors, profitability is essential. High returns on invested capital (ROIC) show a company’s skill in using resources to create profits. The screen establishes a high standard with an ROIC requirement above 15%.

- Return on Invested Capital (ex. Cash & Goodwill): 31.31%

Taylor Devices’ ROIC of over 31% is very high, putting it in the leading group of its industry. This shows that management is very good at using capital for projects that produce strong returns for shareholders. This number is important because a persistently high ROIC is a good indicator of a company’s potential to build value over the long run, which is the main goal of quality investing.

Solid Financial Health

A sound balance sheet is essential for quality investments, as it offers stability in economic declines and the freedom to chase opportunities without taking on too much debt. The screen checks this by examining the Debt-to-Free Cash Flow ratio, favoring companies that could pay off all debt in under five years.

- Debt / Free Cash Flow: 0.0

Notably, Taylor Devices has no debt, leading to a Debt/FCF ratio of zero. This very clean balance sheet removes interest cost risk and offers a large safety buffer. It lets the company handle market changes from a secure position and give capital back to shareholders via dividends or buybacks, although it does not currently pay a dividend.

Superior Earnings Quality

Quality investing stresses the value of earnings quality, specifically, the capacity to turn accounting profits into real cash. The screen looks for companies with a five-year average Profit Quality (Free Cash Flow/Net Income) above 75%.

- Profit Quality (5y average): 169.56%

Taylor Devices greatly surpasses this need, with a Profit Quality ratio averaging almost 170% over the last five years. This means the company creates much more free cash flow than its stated net income. Such a high ratio is a strong sign of very good earnings quality and a business that is very effective at producing cash, providing actual liquidity for new investments or shareholder returns.

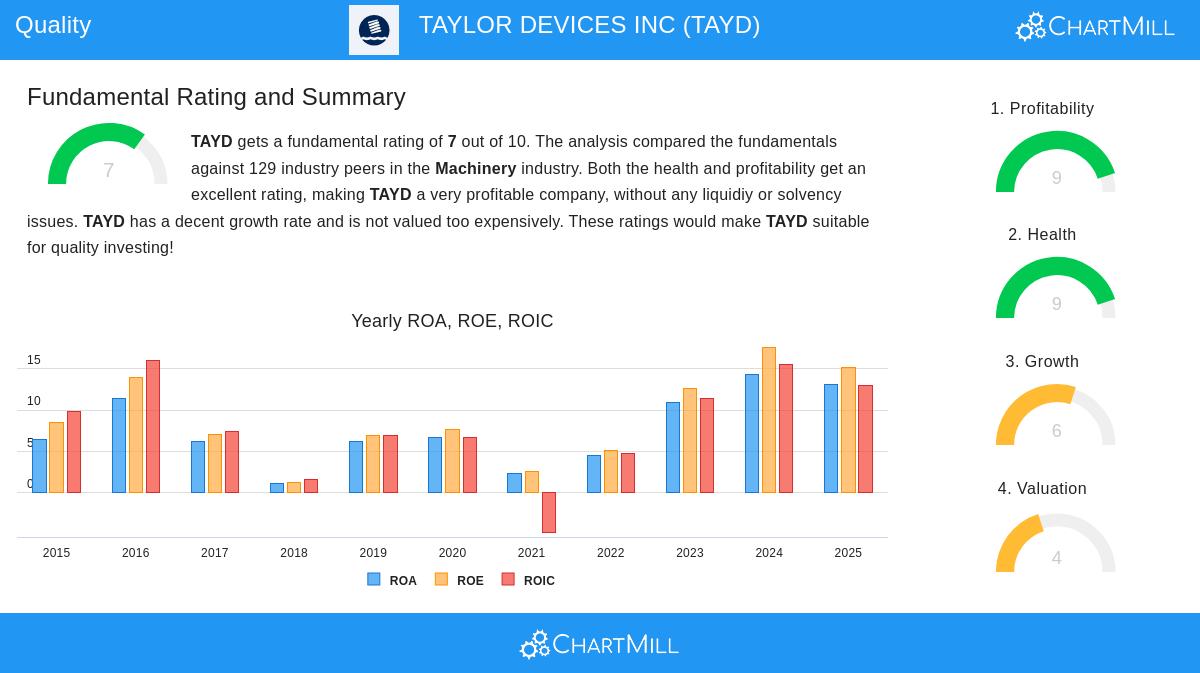

Fundamental Analysis Summary

A detailed fundamental analysis of Taylor Devices supports the results from the screen. The company gets an overall fundamental rating of 7 out of 10, with very high marks for Profitability (9/10) and Financial Health (9/10). Main advantages noted in the report include top-tier profit margins, very good liquidity ratios, and a clear balance sheet. The valuation is seen as reasonable, trading at a Price-to-Earnings ratio that is a bit more appealing than both the industry average and the S&P 500.

Conclusion

Taylor Devices makes a strong argument for investors using a quality-based strategy. Its mix of consistent growth, outstanding profitability, a balance sheet with no debt, and excellent cash flow production fits well with the standards of the Caviar Cruise method. While its specialized market and smaller scale may involve different factors compared to larger, more varied industrial companies, its financial numbers point to a well-managed business with a durable market position.

For investors wanting to find other companies that meet these strict quality measures, the Caviar Cruise stock screen is a useful instrument. You can view the current screen results and adjust the parameters here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer to buy or sell any security. All investments involve risk, including the possible loss of principal. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.