WIPRO LTD-ADR (NYSE:WIT) Stands Out in Caviar Cruise Quality Screening

The Caviar Cruise stock screening method is a structured way to find good investment options. This approach concentrates on businesses with steady revenue and profit increases, good returns on invested capital, solid cash flow production, and acceptable debt amounts. It is different from value investing that looks for low prices; this method looks for companies with lasting competitive strengths that can provide reliable returns over many years. The method uses both simple and rigorous filters to find businesses showing strong fundamentals.

WIPRO LTD-ADR (NYSE:WIT) appears as a noteworthy option when viewed with this quality-based perspective. The Indian information technology services company displays a number of traits that match the Caviar Cruise method’s focus on lasting business quality.

Financial Performance and Growth Measures

The company presents a varied yet mostly good growth picture when evaluated against the Caviar Cruise standards:

- EBIT growth of 8.27% over five years is better than the method’s 5% minimum, showing increasing operational profit

- Revenue growth of 3.31% over the same time is a little under the screen’s 5% target

- The situation where EBIT growth is higher than revenue growth points to better operational effectiveness and possible pricing strength

This difference between EBIT and revenue growth is especially significant in this type of investing because it can indicate scale benefits or competitive strengths that let a business turn more revenue into profit at a faster pace.

Profitability and Capital Use

Wipro shows very good results in several important profitability measures key to the Caviar Cruise method:

- Return on Invested Capital (without cash, goodwill, and intangibles) is 52.69%, much higher than the 15% minimum

- Five-year average profit quality of 112.5% shows the company changes accounting profits into real cash flow efficiently

- Operating margin of 16.99% is in the top group of IT services companies

The ROIC measure is particularly important for these investors as it shows how well management uses capital to create returns. Wipro’s very high number indicates the company has important competitive strengths in its main operations.

Financial Condition and Steadiness

The company’s balance sheet quality fits well with the careful style of this investing:

- Debt-to-free cash flow ratio of 1.02 means the company could pay off all debt in about one year

- Current ratio of 2.40 and quick ratio of 2.39 show good short-term liquidity

- Altman-Z score of 5.78 points to very little risk of bankruptcy

The debt-to-FCF ratio is a main filter in the Caviar Cruise method because it makes sure companies keep financial options and are not using too much debt, which is necessary for long-term survival.

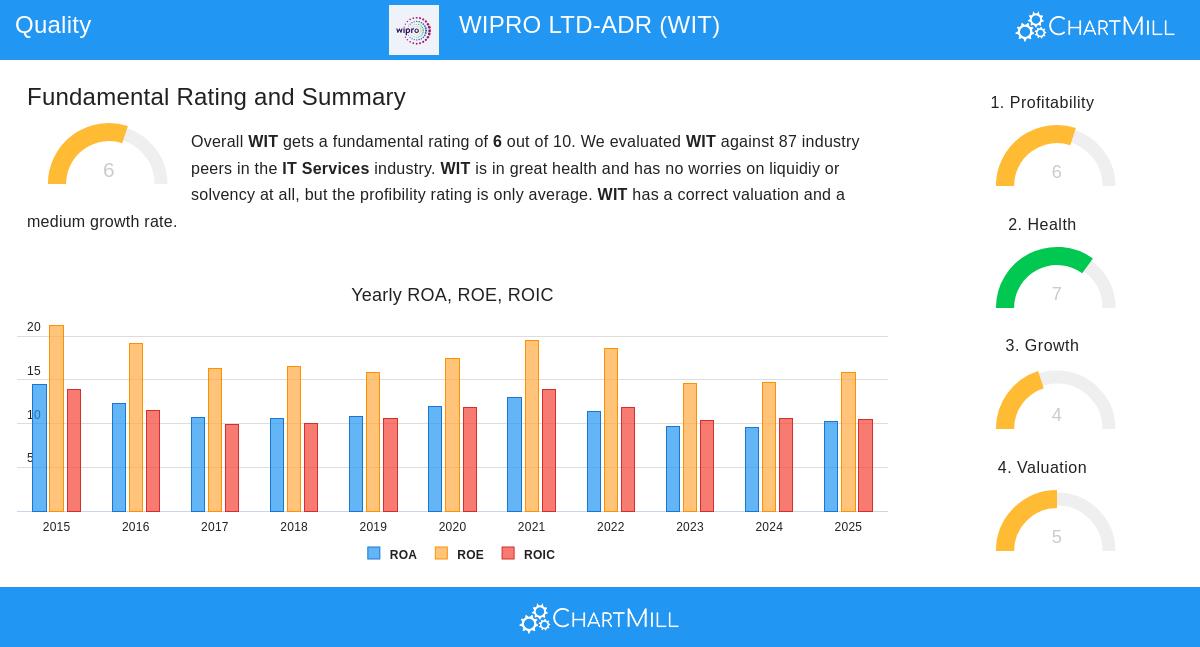

Fundamental Analysis Summary

Based on the detailed fundamental analysis, Wipro gets a total rating of 6 out of 10. The company shows specific strength in financial condition with a score of 7, helped by very good solvency and liquidity measures. Profitability gets a 6, with excellent profit and operating margins balancing lower-than-industry gross margins. Valuation receives a neutral 5 rating, indicating the stock is fairly valued compared to similar companies. Growth measures score 4, showing steady but modest expansion prospects.

The analysis points out Wipro’s history of steady profitability, with positive earnings and operating cash flow in every one of the last five years. Although short-term growth prospects are humble, the company keeps a strong competitive place in the IT services sector.

Investment Points

Investors using this method usually put business longevity ahead of fast growth, and Wipro’s worldwide IT services platform fits this idea. The company’s broad geographic reach, varied services, and long history provide steadiness. Still, investors should be aware of the company’s recent revenue growth difficulties and modest future growth estimates when thinking about investment size.

The Caviar Cruise method acts as an initial step for finding quality businesses, but complete research is still necessary. Wipro’s review through this system points out several positive attributes while also showing parts that need more examination.

For investors wanting to look at other businesses that satisfy the Caviar Cruise standards, the complete screening results offer more investment ideas that deserve additional study.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with a financial advisor before making investment decisions.