TD Cowen Downgrades Lithium Americas Stock After 96% Rally On Potential US Stake

A record 289 million Lithium Americas shares traded hands on Wednesday, compared with its 200-day average trading volume of little over 7 million shares.

Lithium Americas (LAC) stock was in focus on Thursday as TD Cowen downgraded the stock after its meteoric rise in the earlier session.

On Wednesday, the stock rallied nearly 96% in a stellar day of trading, marking its best session ever. A record 289 million shares traded hands, compared with its 200-day average trading volume of little over 7 million shares, according to Koyfin data.

The astonishing surge in stock came after a report stated that the company was in talks with the U.S. government and General Motors to renegotiate the terms of a $2.26 billion loan from the Department of Energy for the Thacker Pass project, which could result in the U.S. government holding a 10% stake in the company.

According to The Fly, TD Cowen analysts downgraded the stock to ‘Hold’ from ‘Buy’ and kept the price target unchanged at $5, which implied a 16.8% downside compared to the stock’s closing price on Wednesday.

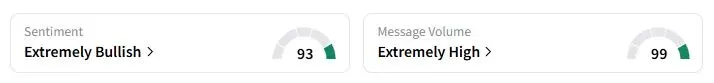

Retail sentiment on Stocktwits about Lithium Americas was still in the ‘extremely bullish’ territory at the time of writing.

TD Cowen analysts reportedly saw “little rationale for a significantly enhanced economic model” with the company’s current anchor tenant, General Motors, providing an undisclosed price floor. The firm noted that Lithium Americas’ current valuation is full.

The brokerage echoed the sentiment of JPMorgan analysts who flagged that the rally on the potential U.S. deal was overblown.

“I would be very uncomfortable holding a short position on this, the way it held up after the news. I would bet on another pump tomorrow,” one user noted on Stocktwits.

The Thacker Pass project is expected to become the largest source of lithium in the Western Hemisphere upon its commencement in 2028. The project was approved by Trump during his first term and secured the federal loan during Joe Biden’s tenure as President.

Including Wednesday’s gains, U.S.-listed shares of Lithium Americas have doubled this year.

Also See: Upstart Stock Eyes Recovery After 5-Day Losing Streak — Retail Wonders If A Short Squeeze Is Due

For updates and corrections, email newsroom[at]stocktwits[dot]com.

For serious investors with a serious sense of humor.