Sandur Manganese, Zuari Industries And Blackbuck On SEBI Analyst’s Radar

Analyst flags all three as potential multi-week winners driven by technical breakouts and improving fundamentals.

SEBI-registered analyst Palak Jain has flagged upside potential in three stocks: Sandur Manganese, Zuari Industries and Blackbuck (Zinka Logistics). She believes they are strong buying opportunities driven by their technical strength and improving fundamentals.

Let’s take a look at the rationale behind her stock recommendations:

Sandur Manganese

Sandur Manganese has seen a fresh resistance breakout, accompanied by strong volumes, an ascending channel structure, and positive RSI momentum, confirming a bullish trend. Palak Jain highlighted the improvement in ownership structure and outperforming sector growth rates for Sandur, with a technical scorecard signaling “strong buy” and further re-rating potential.

In the June quarter, Sandur had posted a 15% rise in profits and a 89% surge in revenues, with steady margin expansion on multi-year high manganese and iron ore output. The company also declared a 2:1 bonus issue, aiding liquidity and sentiment.

She recommended buying above ₹171 with a stop loss at ₹153 for target prices of ₹176, ₹181, and ₹190.

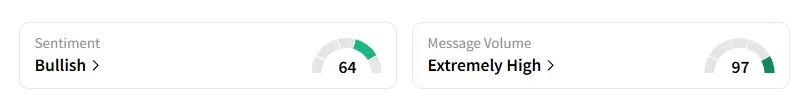

Data on Stocktwits shows that retail sentiment is ‘extremely bullish’ amid high message chatter.

Sandur Manganese shares have risen 21% year-to-date (YTD).

Zuari Industries

Zuari Industries has seen a symmetrical triangle breakout above resistance, backed by a powerful volume spike and strong RSI momentum, signaling a bullish trend reversal.

In Q1 FY26, it posted consolidated revenue of ₹267.6 crore and a standalone income at ₹210.3 crore. Other growth triggers include strategic investments worth ₹4,608 crore, product pipeline, ongoing expansion, and improved segmental performance.

Jain said that with Zuari management targeting capital unlocking, both technicals and fundamentals signal a “strong buy”, offering a profitable risk-reward setup for swing moves.

She recommended buying above ₹377 with a stop loss at ₹338 and target prices of ₹388, ₹398, and ₹421.

Data on Stocktwits shows that retail sentiment is ‘ bullish’ amid high message chatter.

Zuari Industries shares have risen 22% year-to-date (YTD).

Blackbuck (Zinka Logistics)

Blackbuck has seen a W-pattern breakout above downtrend resistance with strong volume, and the bullish DMI shows fresh upside momentum after a multi-week consolidation.

The company’s tech-driven expansion in logistics, solid operating leverage, and improving market share, along with strong growth in order book, and continued investment in digital transformation, are driving Jain’s bullish outlook. She added that technical indicators and fundamentals both support further upside as the stock approaches an all-time high zone.

She recommended buying above ₹626 with a stop loss at ₹563 and target prices of ₹643, ₹662, and ₹700.

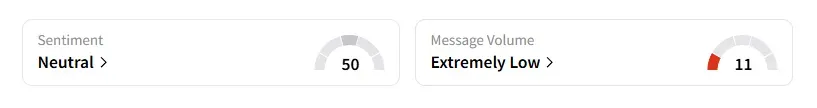

Data on Stocktwits shows that retail sentiment is ‘neutral’ amid low message chatter.

Blackbuck shares have risen 27% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

The most relevant Indian markets intel delivered to you everyday.