Opendoor Stock Rebounds After Jane Street Discloses Stake: Retail Confidence Climbs

The prominent quantitative and algorithmic trading firm holds a 5.9% stake in the real estate services company, it disclosed on Wednesday.

Opendoor Technologies shares rebounded on Wednesday after Jane Street Capital, a large U.S. investment firm known for algorithmic trading, disclosed a sizable stake in the online real estate platform.

Jane Street owns a 5.9% stake through 44,031,310 Opendoor shares, the investor said in its 13G filing to the Securities and Exchange Commission on Wednesday.

The new position by a prominent investor lifted Opendoor’s stock over 16%, after a sharp 30% decline in the preceding four sessions. The rally continued into extended trading, with the shares rising another 10.3%.

That’s a shot in the arm for the newly minted “meme stocks,” whose momentum appeared to be waning.

The runaway rally since July, sparked by bullish commentary from hedge fund manager Eric Jackson, has made Opendoor one of the most closely watched stocks in the market.

Earlier this month, the company appointed a new chief executive, overhauled its board, and discussed product improvements and expansion.

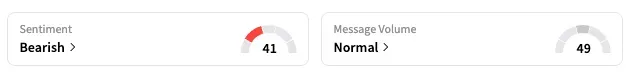

On Stocktwits, the retail sentiment remained ‘bearish’ as of late Wednesday, although the score was higher than from a day ago.

“Jane Street taking a 5% stake is MASSIVE. Moves like this trigger a flood of other institutional investors to pile in. A tsunami of smart money is on its way,” said one user.

Another user noticed a rare “seahorse” pattern in the stock chart and forecast that shares could eventually hit $82, the hyper-optimistic level Jackson had predicted back in July when the stock was under $1.

Opendoor stock is up 414.4% year-to-date.

Last month, CoreWeave’s stock also received a boost after a regulatory filing revealed that Jane Street had raised its stake in the data center infrastructure firm.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Get the daily email that keeps you tuned in and makes markets fun again.