X Financial-ADR (NYSE:XYF): A Peter Lynch GARP Investment Case

The investment philosophy created by Peter Lynch, detailed in his important work One Up on Wall Street, focuses on finding companies that show strong, sustainable growth while trading at sensible prices. This method, often grouped as Growth at a Reasonable Price (GARP), steers clear of the extremes of speculative growth chasing and deep-value contrarianism. Instead, it looks for businesses with good fundamentals, healthy profitability, manageable debt, and a clear growth path, that are often missed by the wider market. A key principle is the PEG ratio, which connects a stock’s price-to-earnings (P/E) ratio to its earnings growth rate, trying to find companies where the market has not yet completely priced in their future possibility.

X Financial-ADR (NYSE:XYF) appears from a screen built on Lynch’s criteria, presenting a noteworthy case for investors following this structured strategy. The Chinese online personal finance company runs a technology platform for personal loans and wealth management services, a field with considerable long-term growth possibilities as financial services become digital.

Meeting the Lynch Criteria

A central part of Lynch’s strategy is finding companies with earnings growth that is solid but not extreme, indicating sustainability. The valuation must then be sensible relative to that growth, which is exactly where XYF is notable based on the given metrics.

-

Sustainable Growth and Notable Valuation: The company’s earnings per share have grown at an average yearly rate of about 16.75% over the past five years. This fits directly into Lynch’s chosen range of 15% to 30%, showing a sound growth speed that is not too fast to be unsustainable. Importantly, this growth is combined with a very low PEG ratio of 0.18. A PEG ratio under 1.0 is a Lynch characteristic, suggesting that the stock may be undervalued considering its growth rate. With a P/E ratio of only 2.93, XYF seems notably undervalued next to both its industry competitors and the wider S&P 500.

-

Financial Health and Profitability: Lynch stressed investing in companies with good balance sheets to handle economic slowdowns. XYF shows this with a Debt-to-Equity ratio of 0.34, which is not only much lower than the screen’s limit of 0.6 but also matches Lynch’s stricter liking for ratios under 0.25. This points to little dependence on debt financing. Also, the company’s Current Ratio of 1.50 shows it has enough short-term assets to meet its immediate liabilities, confirming its financial steadiness. From a profitability view, a Return on Equity (ROE) of 21.99% is much higher than the 15% minimum needed by the screen, emphasizing management’s effectiveness in creating profits from shareholder equity.

Fundamental Analysis Overview

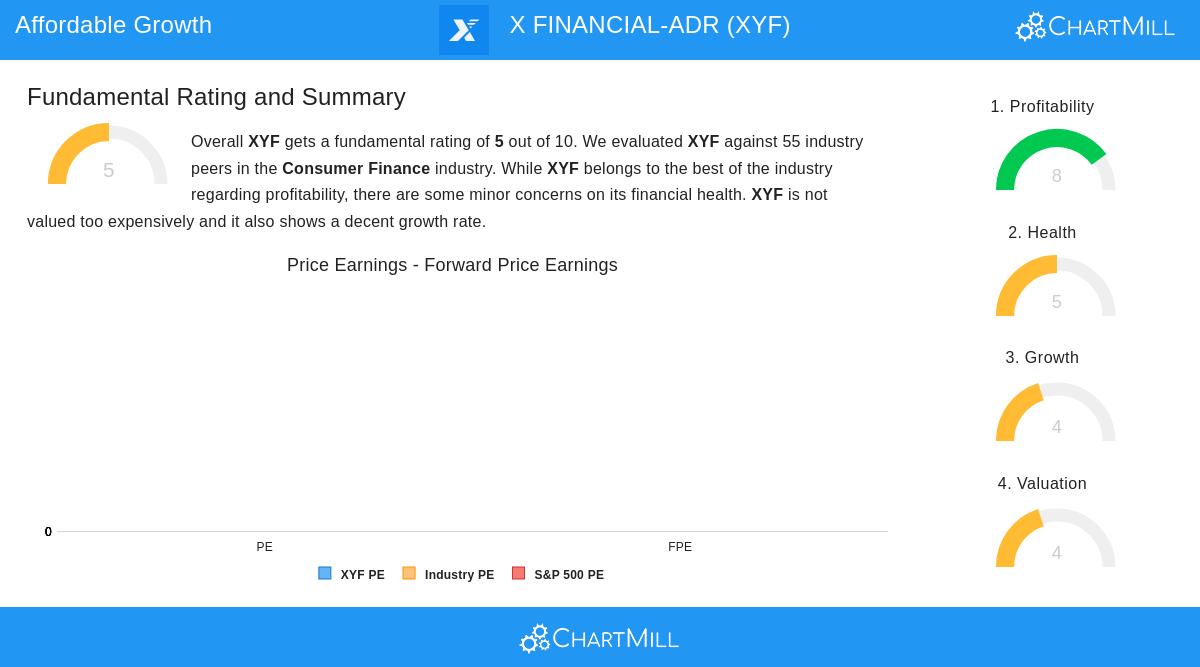

A closer look into the company’s fundamentals, as described in the full fundamental analysis report, supports the findings from the Lynch screen. The report gives XYF an overall score of 5 out of 10, stating that while it is part of the best in its industry for profitability, there are small issues about its financial health. The analysis verifies notable strengths:

- Outstanding Profitability: XYF’s operating margin of 62.29% puts it at the top of the consumer finance industry, doing better than 100% of its competitors. Its return on invested capital (ROIC) of 32.59% is also very high.

- Good Growth Path: Recent performance has been good, with revenue increasing 31.56% and EPS increasing 34.50% over the past year.

- Valuation Issues Addressed: The report clearly says that XYF’s valuation can be called “very cheap” and that its profitability might support a higher P/E ratio.

The main warnings mentioned involve the absence of available analyst estimates for future growth, which makes forward-looking study more difficult, and an Altman-Z score that, while superior to most competitors, puts the company in a “grey zone” related to bankruptcy risk, though with little immediate worry.

Investment Considerations for the Long Term

For a GARP investor, XYF represents a possible chance to invest in a profitable, growing company at a large discount to its intrinsic value. The Lynch-based screen effectively found a stock that mixes the wanted features of growth, value, and financial health. However, investors must think about the specific risks related to the company, including its status as an ADR for a China-based firm, which brings in geopolitical and regulatory factors not found in domestic investments. The small analyst coverage, while occasionally a good sign for Lynch-style investors looking for undiscovered opportunities, also requires more independent research.

This study of X Financial was produced from a stock screen made to find companies matching the Peter Lynch investment philosophy. For investors curious about finding other companies that meet these criteria, you can view the full list of results from the Peter Lynch strategy screen here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The information presented should not be used as the only basis for making any investment decision. Investors should do their own research and talk with a qualified financial advisor before making any investment.