Sprott Physical Gold Trust (NYSEARCA:PHYS) Passes Key Peter Lynch Investment Filters

Investors looking for long-term growth at reasonable prices often consider methods developed by well-known investors. The Peter Lynch investment strategy, described in his book One Up on Wall Street, centers on finding companies with lasting earnings growth, good financial condition, and prices that do not exaggerate their future potential. This method, frequently grouped as GARP (Growth at a Reasonable Price), steers clear of speculative investments, choosing instead businesses that are profitable, easy to comprehend, and available at a logical price compared to their growth path. A stock filter based on Lynch’s ideas can assist in finding such chances, and one entity that recently appeared from this filter is Sprott Physical Gold Trust (NYSEARCA:PHYS).

Meeting the Lynch Criteria

Sprott Physical Gold Trust makes a strong argument when evaluated with important filters from the Peter Lynch screen. The strategy focuses on lasting growth, financial soundness, and good price, and PHYS shows positive attributes in these categories.

- Lasting Earnings Growth: Lynch liked companies with earnings per share (EPS) growth between 15% and 30% per year, as this rate is seen as maintainable. PHYS reports a five-year EPS growth rate of about 18.5%, putting it directly within this preferred band and showing a steady, non-speculative increase in earnings.

- Sensible Price via PEG Ratio: A fundamental part of the Lynch method is the PEG ratio (Price/Earnings to Growth), which should be less than or equal to 1 to indicate a good price. PHYS has a PEG ratio of only 0.21, well below this level. This implies the market might be pricing the trust’s shares low compared to its past earnings growth.

- Outstanding Financial Condition: Lynch gave priority to companies with solid balance sheets. PHYS is very good in this area, showing outstanding liquidity and solvency measurements.

- Debt/Equity Ratio: The trust has a Debt/Equity ratio of 0.0, meaning it functions with no debt. Lynch strongly favored companies that were financed by equity instead of debt, lowering financial risk.

- Current Ratio: PHYS reports a very high Current Ratio of over 39,000, showing it has more than enough short-term assets to meet any immediate liabilities, a significant sign of financial soundness.

- Good Profitability: A Return on Equity (ROE) above 15% is needed to confirm the company is effectively producing profits from shareholder equity. PHYS satisfies this requirement with an ROE of 26.7%.

Fundamental Analysis Overview

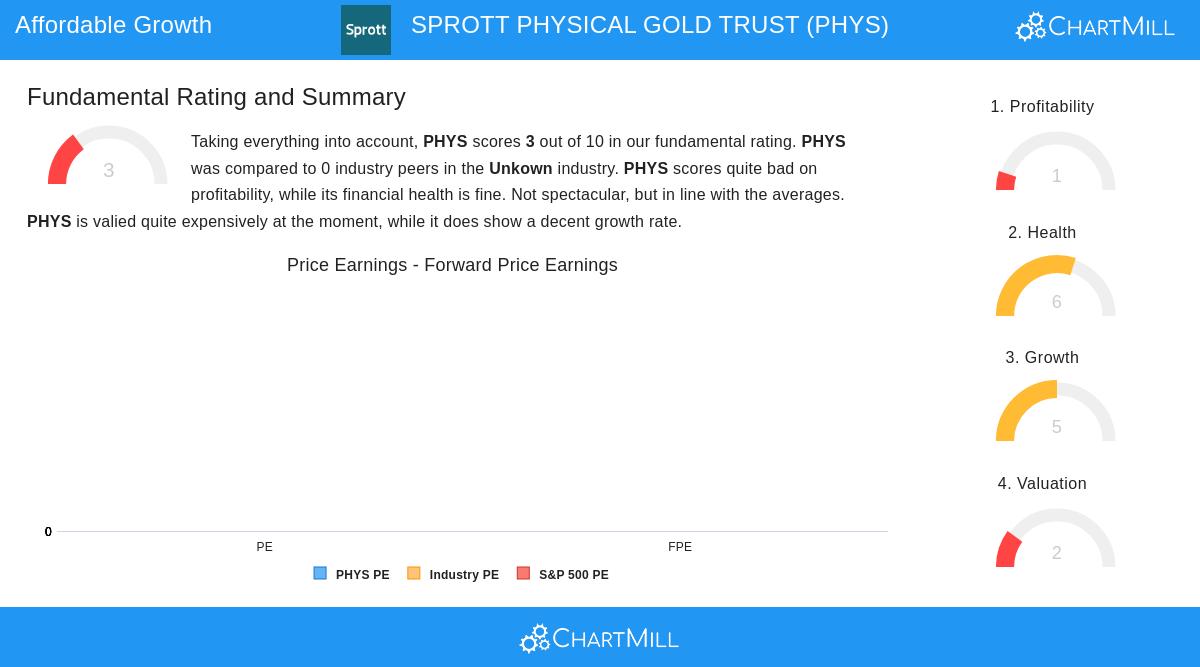

A more detailed examination of the fundamental analysis report for PHYS gives a varied but mostly favorable summary. The trust gets an overall fundamental score of 3 out of 10. Its biggest asset is its financial condition, which is scored a 6, supported by the total lack of debt and high liquidity ratios. The growth score is a 5, backed by the good past performance in both EPS and revenue.

However, the report points out areas needing attention. Profitability is scored a 1, mainly because of a record of negative operating cash flow, although it has reported positive earnings in the last year. The price score is a 2; while the P/E ratio of 3.82 seems inexpensive next to the wider S&P 500, the report mentions there are questions about its total costs. It is necessary for investors to consider these less strong profitability numbers against the trust’s good performance on the specific Lynch filters.

A Distinct Investment Profile

Sprott Physical Gold Trust provides a unique profile. Different from a standard operating company, it is a closed-end trust that contains physical gold bullion, giving investors a direct, safe, and simple way to gain exposure to the price of gold. This setup matches Lynch’s idea of investing in what you comprehend—a simple asset-backed entity. The trust’s results are directly connected to the gold market, which can act as a protection against inflation and market instability, possibly introducing a diversifying component to a long-term portfolio.

Finding Similar Options

The Peter Lynch screen is a useful beginning point for investors constructing a long-term portfolio. Sprott Physical Gold Trust is one of a number of companies that currently satisfy these strict filters. For investors wanting to examine other possible choices that fit this strategy, the full Peter Lynch Stock Screener is accessible for more study.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy, sell, or hold any security, or an endorsement of any investment strategy. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.