Rigel Pharmaceuticals Inc (NASDAQ:RIGL) Identified as a Top Value Stock with Strong Fundamentals

Rigel Pharmaceuticals Inc (NASDAQ:RIGL) has been identified by a screening process made to find companies trading at appealing valuations while keeping good basic business foundations. This method looks for stocks with high valuation scores, typically above 7 on a 10-point scale, along with good ratings for profitability, financial condition, and growth. The thinking for this screen matches basic value investing ideas: looking for securities where the market price seems separated from the company’s real worth, possibly providing a safety buffer for investors.

This method is important because a low valuation by itself can be misleading if the company’s foundations are weakening. By confirming that profitability, condition, and growth are at least acceptable, the screen tries to remove companies that are inexpensive for a valid cause, concentrating on those that could be briefly priced low by the market even with having good operational and financial qualities.

Valuation Metrics

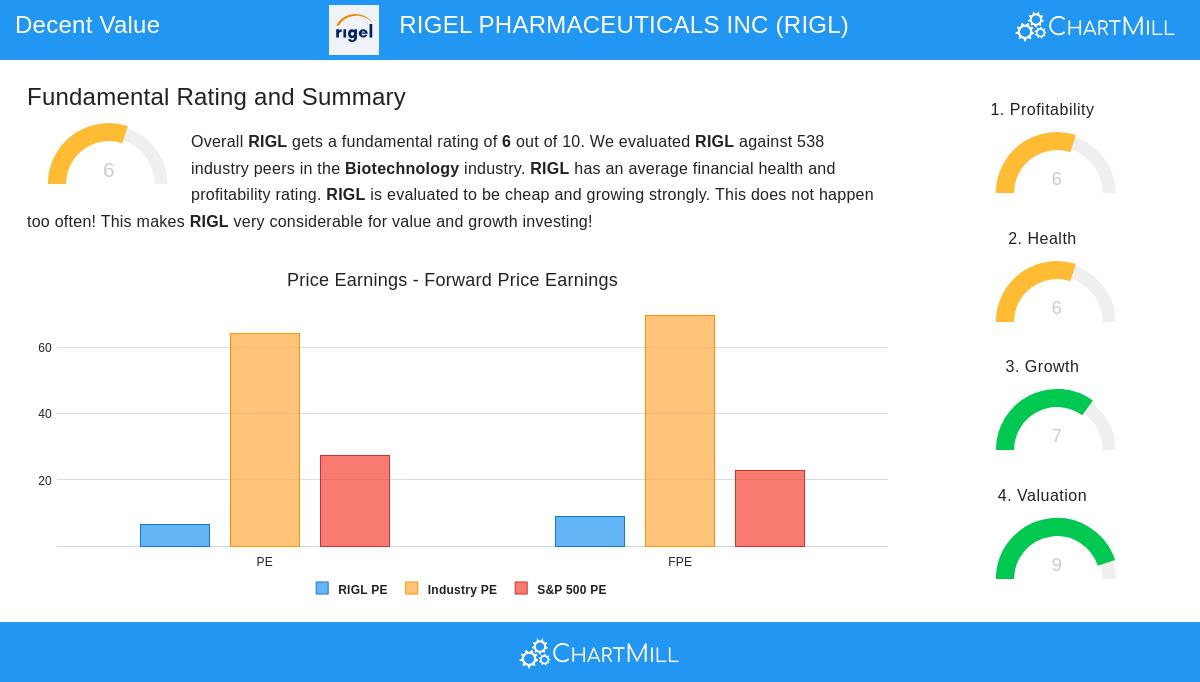

The most notable feature of Rigel Pharmaceuticals is its valuation, which gets a high score of 9 out of 10. The stock seems considerably priced low compared to both its industry and the wider market. Important numbers show this difference:

- Price-to-Earnings (P/E) Ratio: At 6.37, RIGL’s P/E ratio is much lower than the biotechnology industry average of about 64 and the S&P 500’s average of 27.41. This puts it in the best group of its sector, with over 97% of similar companies being more costly on this measure.

- Forward P/E Ratio: The forward P/E of 8.94, using future earnings projections, also indicates a fair valuation, staying much lower than industry and market comparisons.

- Price-to-Free-Cash-Flow and EV/EBITDA: The company also appears good on other valuation measures, with its ratios doing better than over 97% of companies in the biotechnology industry.

For value investors, these numbers are the first sign of a possible chance. A low P/E ratio compared to others hints the market might not be fully recognizing the company’s current earnings ability, a typical indicator of a low price.

Profitability and Growth

An inexpensive stock is only a sound purchase if the company can produce profits and expand. Rigel’s foundations show it is doing this, with a profitability rating of 6 and a growth rating of 7.

The company has shown very high growth over the last year, which is a key point in supporting a higher valuation. Revenue increased by 105.62%, while Earnings Per Share (EPS) went up by a notable 729.07%. For the future, analysts think this good performance will persist, with predicted yearly EPS growth of almost 30% and revenue growth of 14.40%. This mix of high past results and good future outlook is unusual for a stock selling at such a low earnings multiple.

Also, Rigel’s profitability margins are very good within its industry that requires a lot of capital:

- The company has a Profit Margin of 36.51% and an Operating Margin of 39.04%, doing better than most of its biotechnology counterparts.

- Its Return on Equity (119.39%) and Return on Assets (47.32%) are also in the top part of the sector, showing very effective use of investor money and assets.

This high profitability is important for the value investing argument, as it gives assurance that the company’s real worth is backed by its capacity to create actual earnings, not just optimistic forecasts.

Financial Health

While the valuation and growth are prominent features, a review of financial health, which gets a score of 6, gives a more detailed view. The company keeps an acceptable Debt-to-Equity ratio of 0.46, showing it is not too dependent on debt for funding. Its capacity to handle short-term responsibilities is sufficient, with a Current Ratio of 2.02. A very good aspect is its Debt-to-Free-Cash-Flow ratio of 0.91, indicating it could settle its existing debt in under a year with its present cash flow, a situation more favorable than almost 95% of its industry rivals.

Still, investors should be aware of an important point of caution: the Altman-Z score, a gauge of bankruptcy danger, is in the trouble area. While this is frequent for biotech firms in development and is similar to almost half of its industry peers, it points to the natural dangers linked to the sector. This shows the value of the “safety buffer” given by the low valuation, as it provides protection from such industry-specific dangers.

Conclusion

Rigel Pharmaceuticals Inc offers a strong argument for investors using a value-focused approach. The stock sells at a major discount to its industry and the wider market, as shown by its low earnings multiples. Importantly, this low price is not matched with poor foundations; rather, the company displays very high growth, first-rate profitability margins, and a fair, though not risk-free, financial health picture. This mix, which is not common, implies the market might be missing Rigel’s better operational results and future possibilities. The low valuation, when compared with high growth and profitability, sets up the chance for price growth as the market revalues the company’s real worth.

For investors curious about finding similar chances, this Decent Value Stocks screen can be a good beginning. A more thorough basic analysis of RIGL is found here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy, sell, or hold any security, or an endorsement of any investment strategy. All investments involve risk, including the possible loss of principal. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.