GigaCloud Technology Inc – A (NASDAQ:GCT) Demonstrates Quality Investing Metrics in Caviar Cruise Analysis

The Caviar Cruise investment strategy represents a systematic approach to quality investing, focusing on companies demonstrating exceptional operational excellence, financial health, and sustainable competitive advantages. This methodology, inspired by Belgian author Luc Kroeze’s work, uses quantitative filters to identify businesses with strong revenue and profit growth, high returns on invested capital, manageable debt levels, and consistent cash flow generation. The strategy emphasizes long-term ownership of superior companies rather than short-term trading opportunities.

Financial Performance Metrics

GigaCloud Technology Inc – A (NASDAQ:GCT) demonstrates strong financial characteristics that align with quality investing principles. The company’s operational metrics reveal a business model capable of generating substantial returns while maintaining financial discipline.

- EBIT Growth (5Y CAGR): 93.68%, significantly exceeds the 5% minimum threshold

- ROIC excluding cash and goodwill: 23.30%, well above the 15% quality benchmark

- Debt-to-Free Cash Flow: 0.005, indicating minimal debt burden relative to cash generation

- Profit Quality (5-year average): 181.85%, substantially exceeds the 75% requirement

Operational Excellence

The company’s exceptional EBIT growth of 93.68% over five years far surpasses the strategy’s 5% minimum requirement, indicating solid operational expansion and potential economies of scale. This metric is particularly important in quality investing as it reflects core business performance without distortion from financial engineering or tax considerations. Similarly, the return on invested capital of 23.30% demonstrates efficient capital allocation and strong competitive positioning within the large-parcel e-commerce sector.

GigaCloud’s business model as a B2B e-commerce platform for large parcel merchandise appears to benefit from structural advantages in global trade logistics. The platform’s integrated approach from manufacturer discovery to final delivery creates operational efficiencies that likely contribute to these outstanding financial metrics.

Financial Health and Stability

The company’s balance sheet strength is evident in its minimal debt levels, with a debt-to-free cash flow ratio of merely 0.005. This indicates the company could theoretically repay all outstanding debt in a fraction of a year using current cash flows, providing significant financial flexibility and risk mitigation. This characteristic aligns perfectly with quality investing’s emphasis on durable business models capable of weathering economic cycles.

Profit quality, measured at 181.85% over five years, significantly exceeds the strategy’s 75% threshold. This metric indicates the company converts accounting profits into actual cash flow at an impressive rate, suggesting strong operational execution and minimal reliance on non-cash items or aggressive accounting practices.

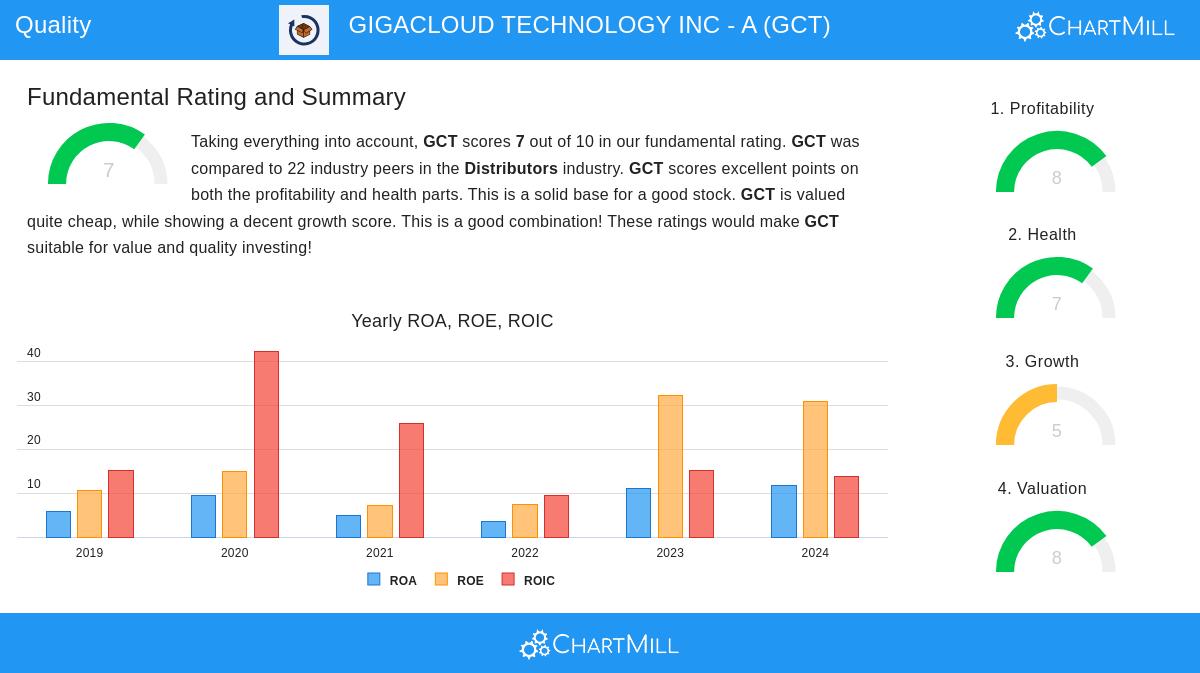

Fundamental Analysis Overview

According to the detailed fundamental analysis report, GigaCloud Technology receives an overall rating of 7 out of 10, with particular strength in profitability and financial health. The report highlights several key strengths:

- Profitability score of 8/10 with industry-leading margins

- Health score of 7/10 demonstrating solid financial foundation

- Valuation score of 8/10 suggesting reasonable pricing relative to fundamentals

- Outstanding return on equity of 30.91% outperforming 86% of industry peers

- Strong current ratio of 2.11 indicating healthy liquidity position

The analysis notes the company’s profit margin of 11.17% ranks in the top tier of its industry, while operating margin improvements in recent years suggest ongoing operational optimization.

Growth Trajectory and Market Position

While historical growth metrics are exceptional, investors should note that analyst projections suggest moderated future growth expectations. The company’s positioning in the global B2B e-commerce space for large parcels represents a specialized niche with potential for continued expansion, particularly as global trade digitization progresses. The integrated platform model addressing discovery, payment, and logistics challenges provides a complete solution that may create sustainable competitive advantages.

Investment Considerations

For investors utilizing the Caviar Cruise methodology, GigaCloud Technology presents an interesting case study in modern e-commerce quality. The company’s financial metrics comfortably exceed the strategy’s quantitative thresholds across multiple dimensions, particularly in profitability, capital efficiency, and financial health. The reasonable valuation multiples relative to both industry peers and broader market indices may provide an additional margin of safety for quality-focused investors.

Interested investors can explore additional quality investment candidates identified through the Caviar Cruise screening methodology to compare GigaCloud Technology against other quality companies meeting similar rigorous criteria.

This article presents factual information for educational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance does not guarantee future results, and all investments carry risk including potential loss of principal.