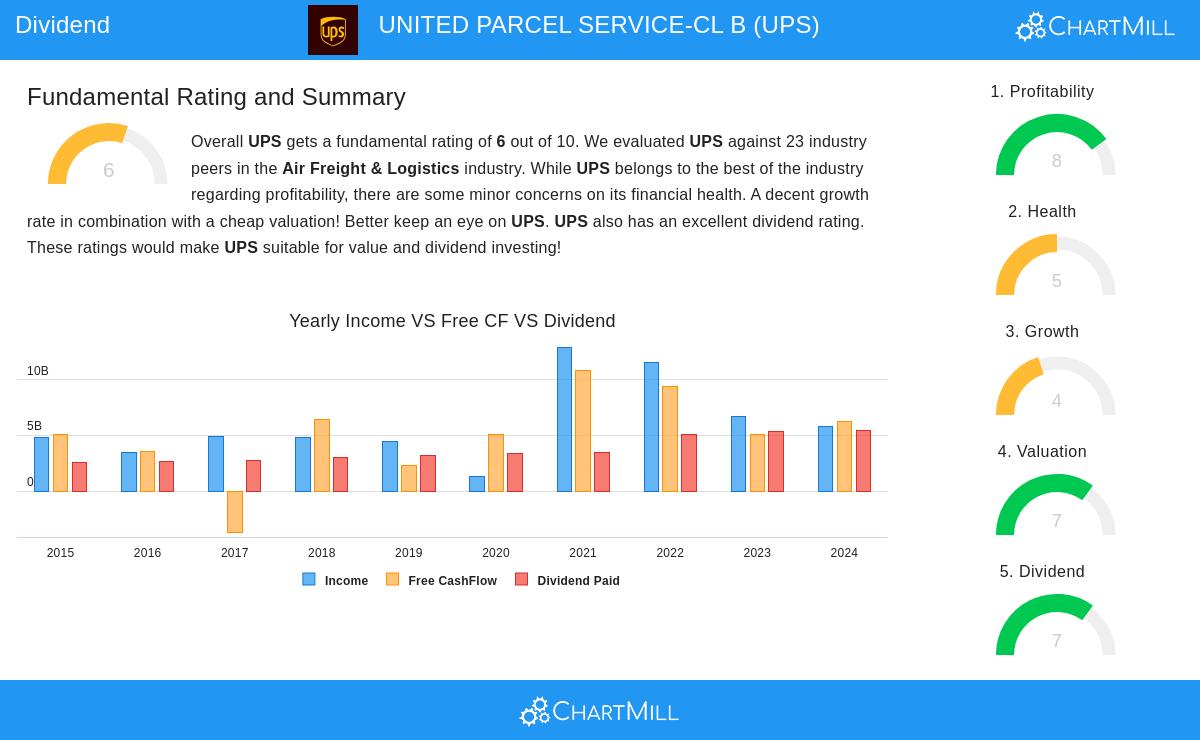

United Parcel Service-CL B (NYSE:UPS) Emerges as a Top Dividend Stock with Strong Profitability

Using a methodical system for dividend investing can help investors find companies that provide reliable income streams along with sound financial condition. The “Best Dividend Stocks” screen uses particular filters to find companies with good dividend traits while keeping sufficient profitability and financial soundness. This approach concentrates on stocks with a ChartMill Dividend Rating of 7 or more, confirming high-grade dividend quality, and also demands minimum scores of 5 for both profitability and health ratings to exclude companies with basic shortcomings. Volume and price filters further improve the selection to more settled, easily traded securities.

United Parcel Service-CL B (NYSE:UPS) appears as a notable candidate from this screening process, displaying several features that dividend investors usually look for. The global logistics company functions through its U.S. Domestic Package and International Package segments, offering wide-ranging supply chain solutions across the world.

Dividend Strength and Sustainability

UPS shows very good dividend features that match income-oriented investment plans. The company’s present dividend yield is 7.82%, greatly surpassing both the industry average of 3.79% and the S&P500 average of 2.41%. This large yield places UPS in the top 5% of dividend payers in its industry.

Important dividend measures include:

- Dividend Growth: A notable 11.17% yearly growth rate over recent years

- Payment History: Steady dividend payments for more than ten years without cuts

- Track Record: Dependable dividend rises kept for at least 10 years

These elements help UPS reach a ChartMill Dividend Rating of 7, signaling good dividend quality compared to the wider market.

Profitability Foundation

The durability of dividend payments depends significantly on a company’s capacity to produce steady profits. UPS performs well here with a ChartMill Profitability Rating of 8, indicating solid operational effectiveness and earning capacity.

Profitability points of interest:

- Return Metrics: ROA of 8.08% and ROE of 36.38% both place in the top quartile in the industry

- Margin Strength: Profit margin of 6.34% and operating margin of 9.41% do better than 87% of industry competitors

- Historical Consistency: Positive earnings and operating cash flow sustained over the last five years

These solid profitability metrics supply the necessary earnings base to maintain continuing dividend payments, speaking to a main worry for dividend investors about payment durability.

Financial Health Considerations

While UPS displays some points to watch, it keeps sufficient financial health with a ChartMill Health Rating of 5. The company shows value creation through ROIC above its cost of capital and has bettered its debt-to-assets ratio compared to the prior year.

Health evaluation elements:

- Solvency: Debt-to-equity ratio of 1.51 shows higher leverage, although debt-to-FCF ratio of 6.97 does better than 65% of industry competitors

- Liquidity: Current and quick ratios of 1.32 give enough short-term obligation coverage

- Share Management: Lowered share count over five years shows capital allocation discipline

Valuation Appeal

UPS offers a pleasing valuation profile that might interest value-aware dividend investors. The stock trades at a P/E ratio of 11.49, showing a major discount to both the S&P500 average of 27.86 and the industry average of 14.61. Forward P/E of 11.86 keeps this pleasing valuation position.

Growth Outlook

The company displays steady, though limited, growth features with a ChartMill Growth Rating of 4. Revenue has increased at a 4.21% average yearly rate over recent years, while EPS is forecast to speed up to 6.93% yearly growth in the future. This moderate growth profile backs the possibility for maintained dividend rises without stressing the company’s financial means.

For investors looking to research similar dividend possibilities, the Best Dividend Stocks screen gives more candidates that fit these methodical standards. The full fundamental analysis for UPS is accessible via the detailed fundamental report.

This article offers impartial analysis founded on publicly accessible data and is not meant as investment guidance. Investors should perform their own investigation and think about their personal financial situations before making investment choices. Past results do not assure future outcomes, and dividend payments are subject to company judgment and market situations.