SOL Futures Surge as ETP Flows Hit $500M

Key takeaways:

-

CME open interest for SOL hit a record $2.16 billion, signaling strong institutional activity.

-

Retail traders remain cautious after $307 million in liquidations, keeping leverage muted.

-

Solana ETPs surpassed $500 million AUM, reinforcing institutional accumulation trends.

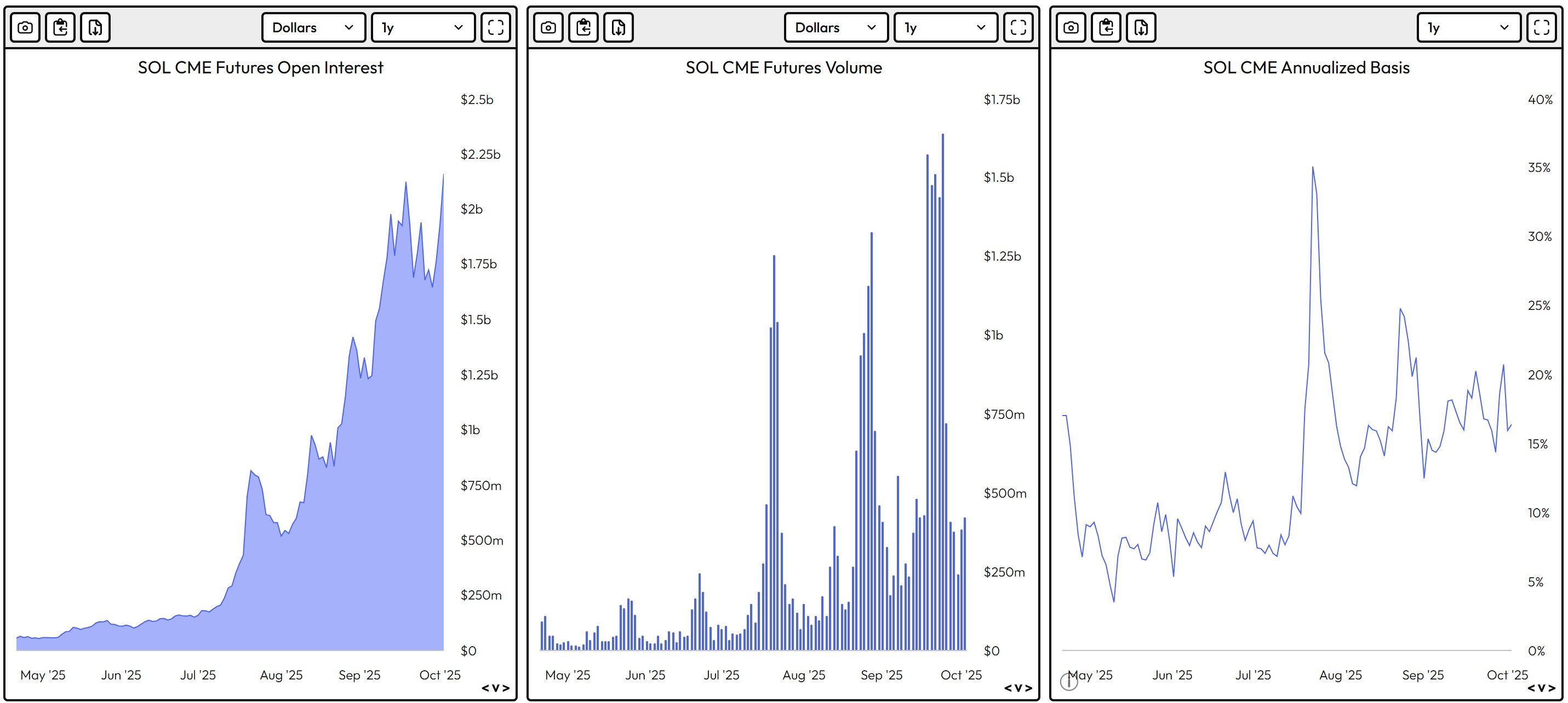

Solana (SOL) futures have entered a pivotal phase, with the Chicago Mercantile Exchange (CME) open interest (OI) reaching an all-time high of $2.16 billion as SOL price rebounded 23% to $235, from a local bottom at $195 on Friday. The timing was notable as institutional volumes surged on CME after SOL established its bottom, demonstrating how market participants are positioning ahead of the SEC’s Oct. 10 SOL ETF decision.

The CME annualized basis sat at 16.37%, well below its 35% July peak, reflecting optimism but not overheated sentiment. By contrast, retail-driven OI on centralized exchanges has stayed relatively flat during the rally, while funding rates hover near neutral.

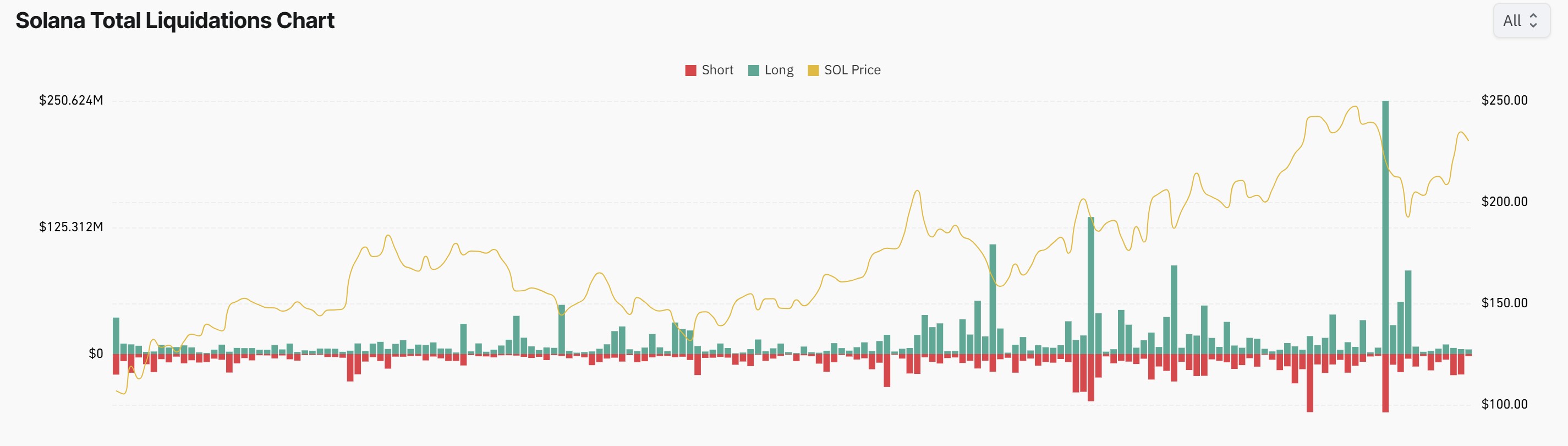

This divergence suggested that while institutions are positioning aggressively, retail remains cautious, likely cautioned by the $307 million in liquidations on Sept. 22, where $250 million longs were wiped out. Traders appear reluctant to chase momentum, leaving the market less prone to over-leveraged volatility.

From a structural standpoint, this creates a balanced but bullish setup. Institutions are layering into positions with conviction, while retail hesitation helps prevent froth from building up. With CME volumes surging at the point of SOL’s local bottom, the data implies that accumulation by stronger hands is occurring rather than speculative blow-off positioning.

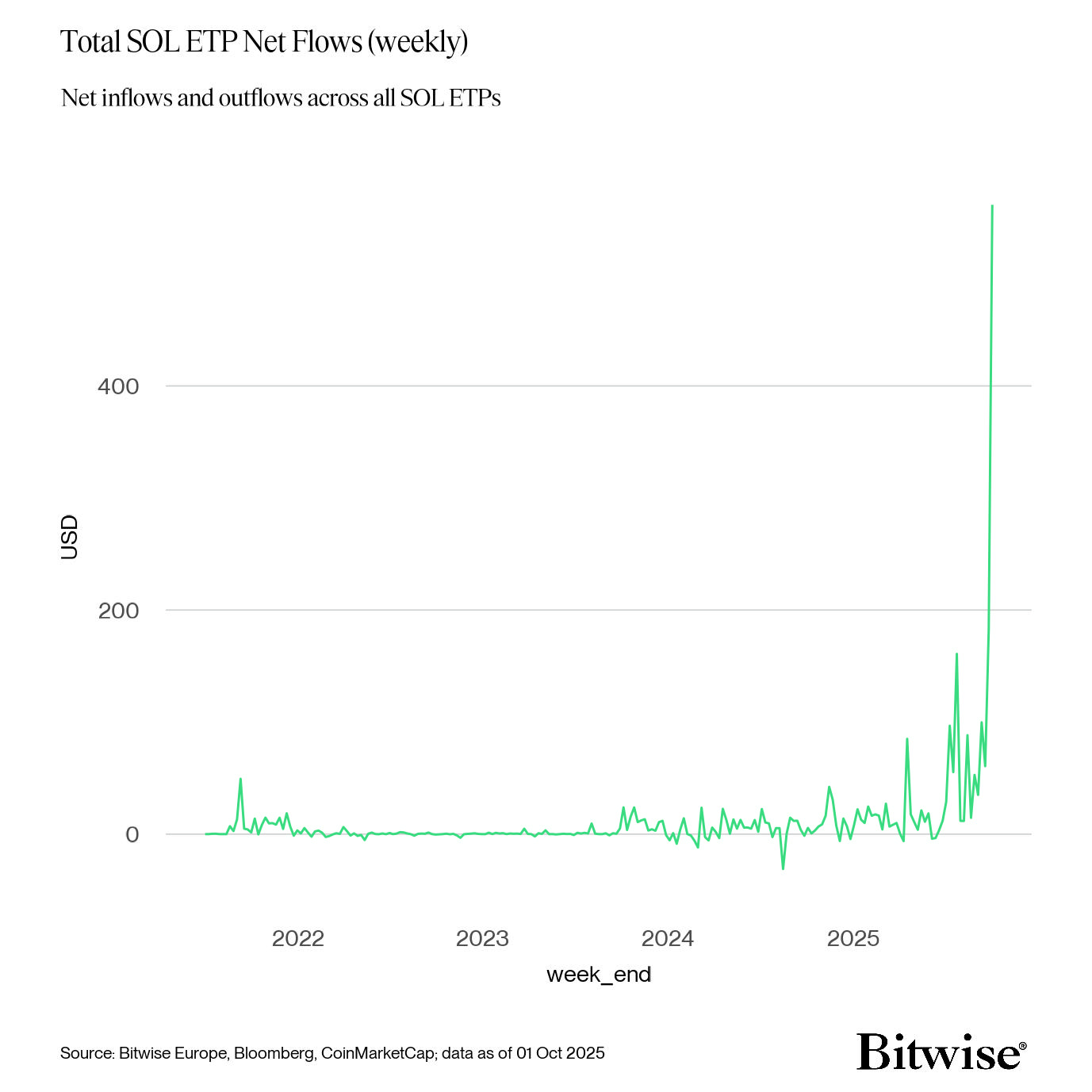

At the same time, inflows into Solana exchange-traded products (ETPs) have reinforced institutional appetite. Total Solana ETP net flows crossed $500 million in assets under management this week, led by the Solana Staking ETF (SSK) from REXShares, surpassing $400 million, while the Bitwise Solana Staking ETP (BSOL) broke above $100 million AUM. This milestone underscored both the rapid growth of BSOL and SSK since launch and the accelerating adoption of regulated vehicles for Solana exposure.

Related: Can BNB, Solana, and Dogecoin rise further in October?

Short-term SOL price scenarios: Rally or dip?

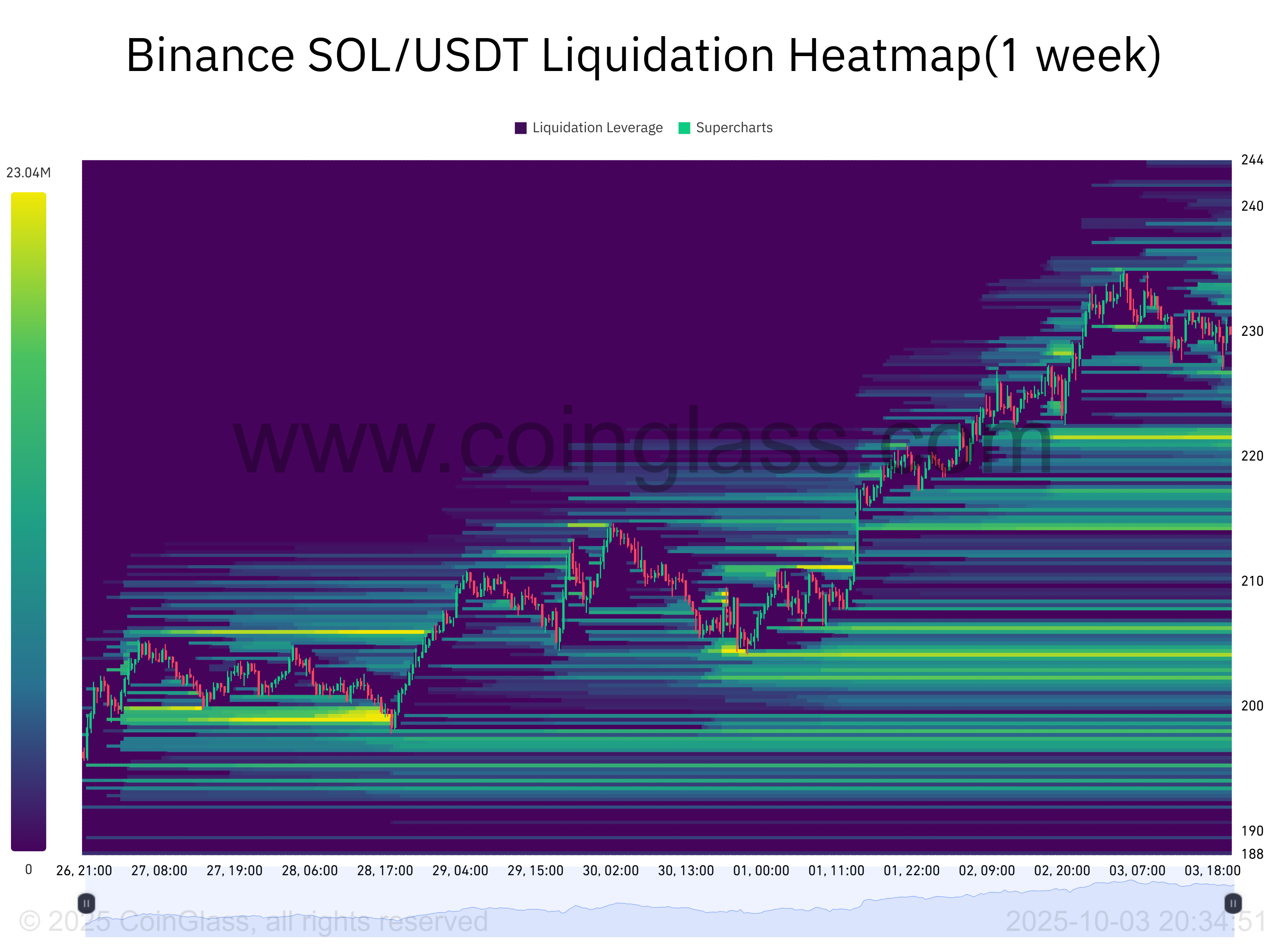

The short-term path for SOL hinges on whether retail confidence returns. On the downside, a retracement toward $218 to $210 would not undermine the broader bullish structure, as it would retest a fair value gap (FVG) on the four-hour chart and retest the 200-period exponential moving average (EMA).

The liquidation heatmap also outlined that a dense liquidity cluster of over $200 million sat between $220-$200, which could act as a price magnet. A correction into this zone could act as a healthy higher low, maintaining bullish market structure while flushing out late entrants.

On the upside, a decisive push above $245 to $250 would signal strength, potentially driving SOL toward its all-time highs near $290. Given institutional flows, this scenario gains weight if ETF speculation remained a dominant narrative.

In both cases, the lack of aggressive retail leverage works in SOL’s favor, reducing downside risk from cascading liquidations. The more institutions continue to anchor CME OI growth, the more likely any correction is shallow rather than trend-breaking.

For now, SOL futures painted the picture of a market transitioning from fear into cautious accumulation, with institutions leading the charge.

Related: Altcoin ETFs face decisive October as SEC adopts new listing standards

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.