CareTrust REIT Inc (NYSE:CTRE) Shows Strong Growth Momentum and Technical Breakout Setup

CareTrust REIT Inc (NYSE:CTRE) has appeared as an interesting option for investors using a high growth momentum plan joined with technical breakout review. This process finds companies displaying both solid fundamental growth traits and positive technical placement. The system searches for securities with three main scores: a High Growth Momentum Rating over 4, showing good earnings and sales movement; a Technical Rating over 7, verifying a sound and confirmed uptrend; and a Setup Rating over 7, pointing to a consolidation shape that might come before a possible price breakout. This layered filter tries to find stocks with quickening business basics that are also technically set for their next step up.

High Growth Momentum Basics

CareTrust REIT shows a solid fundamental growth story, which is key to the high growth momentum plan. This plan favors companies displaying notable and often quickening earnings and sales growth, positive analyst changes, and growing profit margins, all of which are clear in CTRE’s recent results.

The company’s earnings and sales growth has been especially strong, a main part of the High Growth Momentum Rating:

- EPS Growth (TTM): 108.47% against the prior year.

- Revenue Growth (TTM): 50.83% against the prior year.

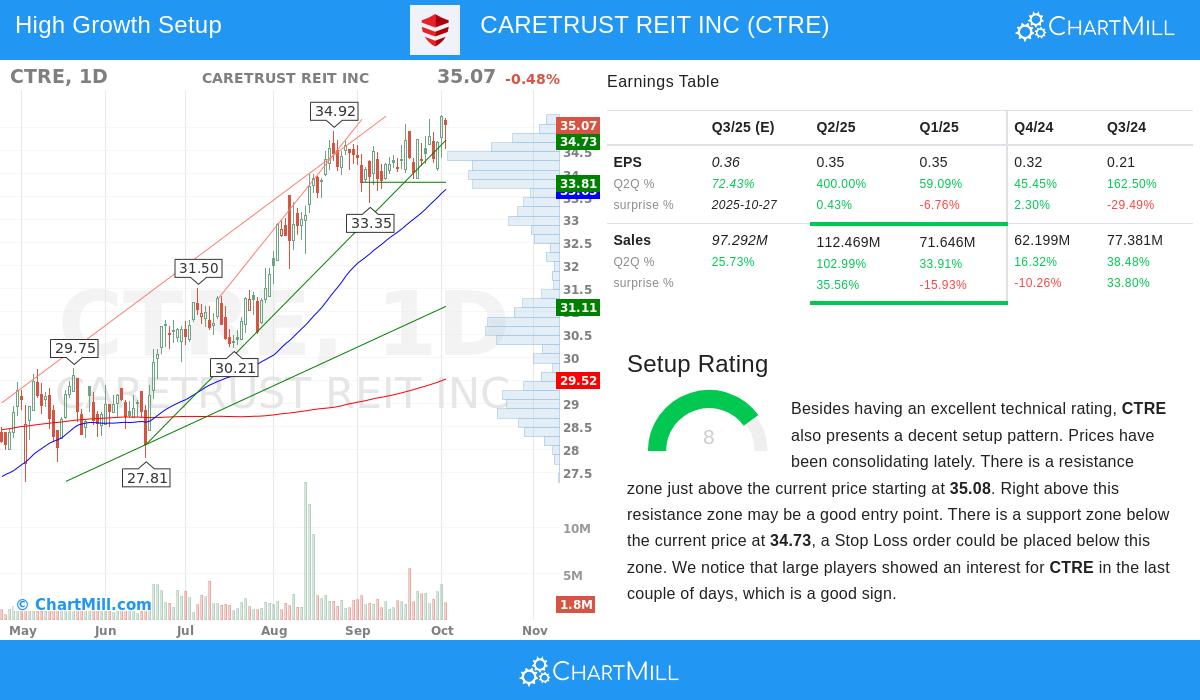

- Recent Quarterly EPS Growth: The newest quarter displayed a large 400% year-over-year rise in EPS.

- Sales Quickening: Quarterly sales growth has been quickening, with the last quarter posting 102.99% growth against 53.20%, 45.55%, and 38.48% in the earlier quarters.

Beyond top-line growth, the company’s profitability is growing notably, another important part checked by the momentum rating. The profit margin in the last reported quarter was 60.78%, a large rise from 43.09% posted three quarters before. This margin growth is a strong force for earnings growth and is highly regarded by momentum investors. Also, analyst opinion has become positive, with the average EPS guess for the next year changed upward by 0.48% over the past three months, showing increasing belief in the company’s future outlook.

Technical Health and Setup Grade

From a technical view, CareTrust REIT shows an equally interesting image. The stock has been given a high Technical Rating of 9 out of 10, reflecting its solid and continued uptrend. According to the detailed technical report, both the short-term and long-term trends are positive, and the stock is doing better than 89% of its group in the Diversified REITs industry. It is now trading near its 52-week high, confirming the health of its upward movement.

Maybe more important for timing an entry, the stock has a Setup Rating of 8. This shows that after its solid run, the price has moved into a consolidation stage, trading in a close range over the past month. Such times of pause often come before a restart of the earlier trend. The technical review finds a clear resistance area just above the present price, beginning at $35.08. A clear move above this point could indicate the start of a new upward step. The report also notes big institutional buying interest in recent days, giving more weight to the setup.

Investment Points

For investors following this plan, the mix of strong fundamental movement and a helpful technical setup makes CTRE a stock worth more review. The high growth numbers meet the central idea of looking for companies with quickening business results, while the technical scores help find a possible lower-risk entry point inside a confirmed uptrend.

The search that found CareTrust REIT is refreshed each day and can find other possible chances that meet these strict needs. You can find more high-growth momentum stocks with positive technical breakout setups by checking the High Growth Momentum Breakout Setups Screen.

Disclaimer: This article is for information only and does not make a suggestion to buy or sell any security. It is not investment guidance. Investors should do their own study and think about their personal money situation before making any investment choices.