As Alibaba, Baidu Stock Rally Picks Up Steam, Cathie Wood’s Ark Loads Up Shares

Alibaba and Baidu shares, already at multi-year highs, rose by more than 5% in Hong Kong.

Alibaba and Baidu stocks rose by more than 5% on the Hong Kong Stock Exchange on Thursday afternoon (local time) amid a sharp, weeks-long rally in Chinese tech stocks and bullish analyst signals.

Among other buyers, Ark Investment Management, led by noted investor Cathie Wood, is doubling on Alibaba and Baidu. Ark bought Alibaba stock for the first time in four years last week and started a position in Baidu earlier this year. It increased its holdings over multiple transactions this week, including the purchase of $5.4 million worth of Alibaba shares and $2.9 million worth of Baidu shares on Wednesday.

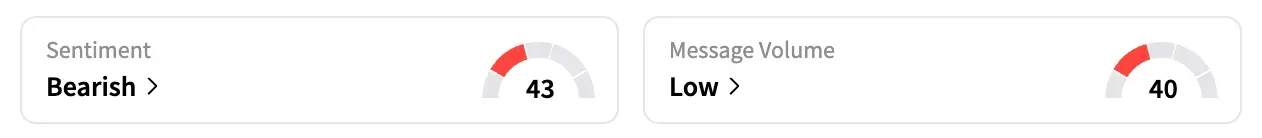

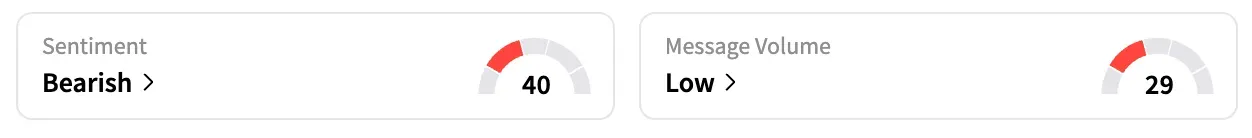

Although the retail sentiment for both tickers was ‘bearish’ on Stocktwits, the rally in Hong Kong would likely have a bearing on the companies’ U.S.-listed shares as trading begins on Thursday.

BABA stock has risen 120% year-to-date, heading for its best year on record. Investors have become more optimistic about Alibaba, citing its impressive progress in AI development and the recent commitment to increase its investment in the area.

At the company’s cloud event last week, CEO Eddie Wu said that Alibaba would invest more than its previously committed 380 billion yuan ($53 billion) on AI models and infrastructure development, “vigorously advancing” its AI plans.

Baidu stock gained momentum only after its recent earnings reports, with shares rising approximately 60% since Aug. 20. Analysts are cheering positive signals from its AI and cloud businesses, its emerging chip unit, and a planned 4.4 billion yuan ($56.2 million) offshore bond sale.

Meanwhile, the KraneShares CSI China Internet ETF (KWEB), which tracks Chinese tech stocks, has advanced over 47% year-to-date. In contrast, the U.S.’s benchmark S&P 500 index has risen 14%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.