Ether Price Eyes 145% Gains to $10K as ETF Inflows Return

Key takeaways:

-

An ETH price bull flag is in play on the weekly chart, targeting $10,000.

-

Ether ETFs recorded inflows for two straight days totaling $674 million.

-

Strategic Ether reserves and ETF holdings have jumped by 250% since April 1.

Ether’s (ETH) price printed a bull flag pattern on the weekly chart, a technical chart formation associated with strong bullish momentum following an upward breakout.

Could this technical setup, coupled with the return of institutional demand, signal the start of a rally to new all-time highs?

Ether’s price bull flag targets $10,500

ETH price technicals show it could gain momentum if it breaks out of a bull flag pattern on the weekly candle chart.

A bull flag pattern is a bullish setup that forms after the price consolidates inside a down-sloping range following a sharp price rise.

Related: ETH falls as crypto, stocks correct, but $547M spot ETF inflows show TradFi positioning

Bull flags typically resolve after the price breaks above the upper trendline and rises by as much as the previous uptrend’s height. This puts the upper target for Ether’s price at $10,533, or a 145% increase from current prices.

The daily RSI is moving above the midline at 61, suggesting that the macro setup still favors the upside.

To ensure a sustained recovery, the ETH/USD pair must first overcome the resistance at $4,500, the upper boundary of the flag.

Several analysts argue that Ether’s growth to $10,000 is in the cards, citing increasing network flows, persistent spot ETF flows, and bullish onchain metrics.

“The Ethereum season is inevitable,” said pseudonymous technical analyst Ethernasyonal in a Wednesday post on X, adding:

$ETH has entered its 3rd major market cycle while maintaining its historical cyclical structure on the road to $10K.”

A recent X analysis by trader Jelle suggested that strong fundamentals and Ether breaking out of its multimonth megaphone put it on a path to $10,000.

Spot Ethereum ETF inflows return

A possible continuation of ETH’s bull run is supported by the sustained capital flows into US-based spot Ethereum exchange-traded funds (ETFs) since they turned positive on Monday.

These investment products have attracted a total of $674 million in net inflows over the last two days, following a straight week of outflows.

This signals resurgent institutional demand, which has previously driven price increases.

“Ethereum ETFs brought in $127,500,000 the past 24 hours. A 2nd day back of positive inflows into ETH ETFs,” said analyst Crypto Gucci in an X post, adding:

“The smart money keeps stacking ETH.”

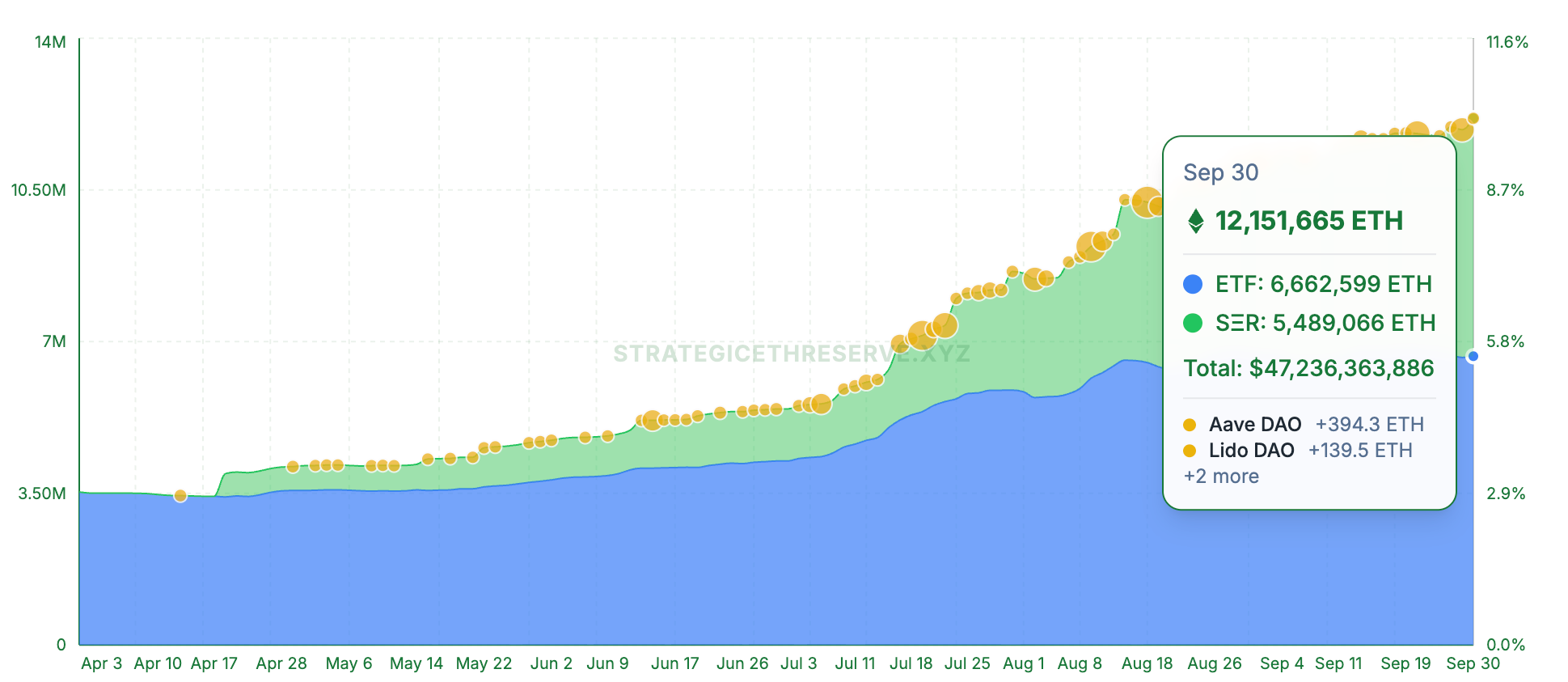

Data from StrategicETHreserve.xyz indicates that collective holdings of strategic reserves and ETFs have surged 250% since April 1, reaching 12.15 million ETH as of Tuesday.

The increase highlights a steady consolidation of Ether supply into the hands of major institutional and corporate players.

As Cointelegraph reported, ETH has gained traction as a strategic reserve asset due to its ability to generate income through staking, offer practical utility and support a growing ecosystem of tokenized assets.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.