Can Aster Price Rise Again in October?

Key takeaways:

-

ASTER defends hot support at $1.60–$1.80 for a potential 35% rebound next month.

-

October’s $325 million token unlock looms, but ASTER’s $1 billion daily volume suggests the market can absorb the supply.

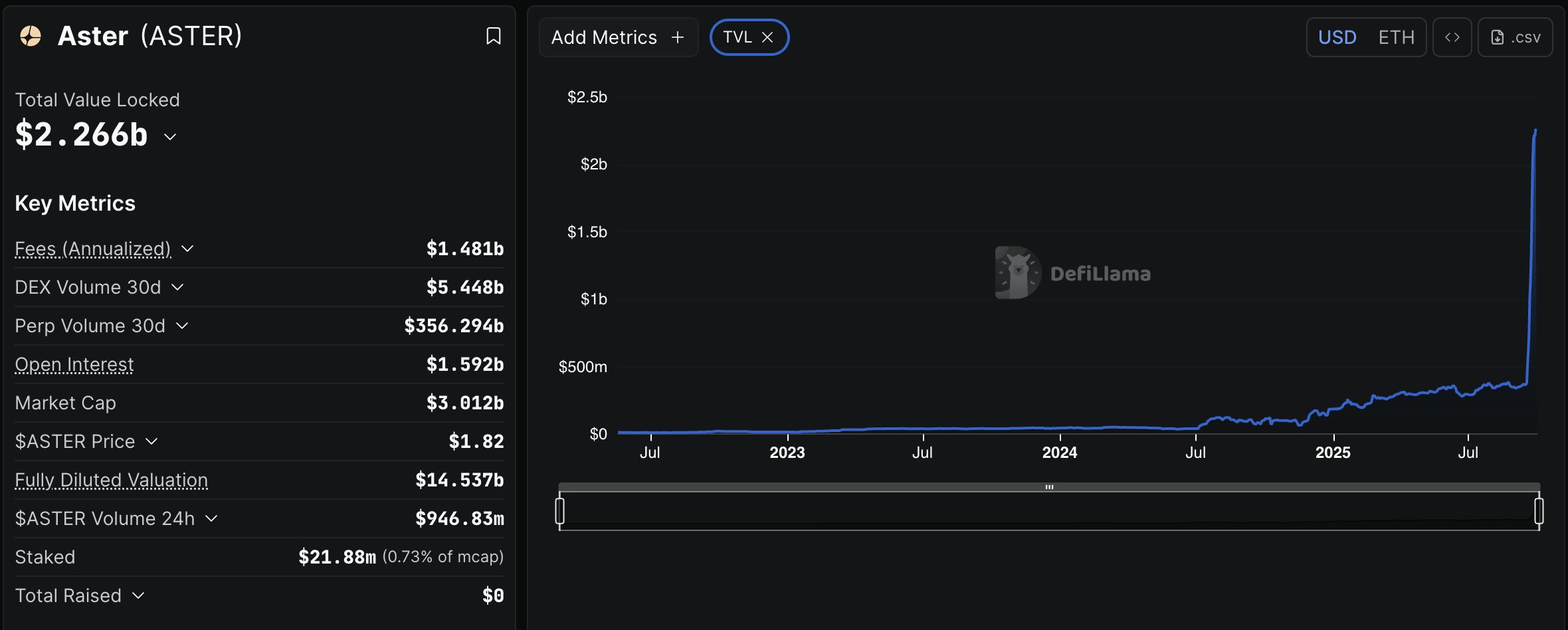

Aster (ASTER) has corrected by more than 25% a week after hitting a record high at around $2.43, and was trading for $1.80 as of Sept. 30. Can this Binance-linked DEX token recover in October?

Hot support makes case for 35% ASTER price rebound

ASTER’s correction has pulled it into a “hot support” zone at $1.60–$1.80, which, as analyst Michaël van de Poppe notes, has preceded 15–35% rebounds.

Thus, he anticipates a similar bounce in the coming days, noting that “a break through $2” may send ASTER to a new record high above $2.43.

Related: Aster can flip HYPE by market cap and rally another 480%: Analyst

This bullish outlook aligns with ASTER’s prevailing falling wedge pattern, a technical setup often associated with trend reversals to the upside.

The breakout projects a measured move toward $2.22–$2.45 in October if confirmed, amounting to a 35%-plus rally.

Trader BitcoinHabebe predicts Aster price will hit $3 in October if it bounces decisively from the $1.60-$1.80 area, saying that the range is “for accumulation.”

What could change this bullish Aster outlook?

The bullish case could flip if ASTER falls below $1.60–$1.80, Van de Poppe warns, opening the door for a drop toward $1.25, which lies near the support zone from Sept. 21–22.

This bearish outlook is based on a descending triangle pattern, a setup that traders often view as a warning sign.

In this formation, the price makes lower highs, showing that buyers are losing strength, while a flat support line holds the floor. If that support eventually breaks, it usually signals that sellers have taken control, often leading to a sharper drop.

In ASTER’s case, the descending triangle’s measured move points to a decline toward $1.26, just around Van de Poppe’s downside target for October.

ASTER token unlock looms over October

Technicals aside, Aster faces a major token unlock on Oct. 17, when 183.13 million ASTER, worth approximately $325 million—or 11% of the market cap—will enter circulation, according to data resource DropStab.com.

ASTER appears to be better positioned than most tokens to handle its upcoming unlock, however.

The project processes nearly $1 billion in daily trading volume and holds over $2.26 billion in total value locked (TVL), signaling deep liquidity across its ecosystem.

That kind of activity suggests the market can likely absorb the new supply. It may even act as a springboard for ASTER’s rally to a new record high, if traders see the unlock as a chance to “buy the dip.”

But not all analysts agree. Trader Gordon, who claims to have made $1.40 million in profits by shorting ASTER, argues that buyers may hesitate at current levels.

He points to the project’s tokenomics, noting that roughly $700 million worth of ASTER is set to unlock by year’s end, warning the token may “keep bleeding” as new supply hits the market.

Aster is already considering a vesting schedule for airdrop recipients to limit such downside risks.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.