Visa Pilot Lets Banks Use Stablecoins for Global Payouts

Visa has launched a pilot allowing banks and financial institutions to pre-fund cross-border payments using stablecoins.

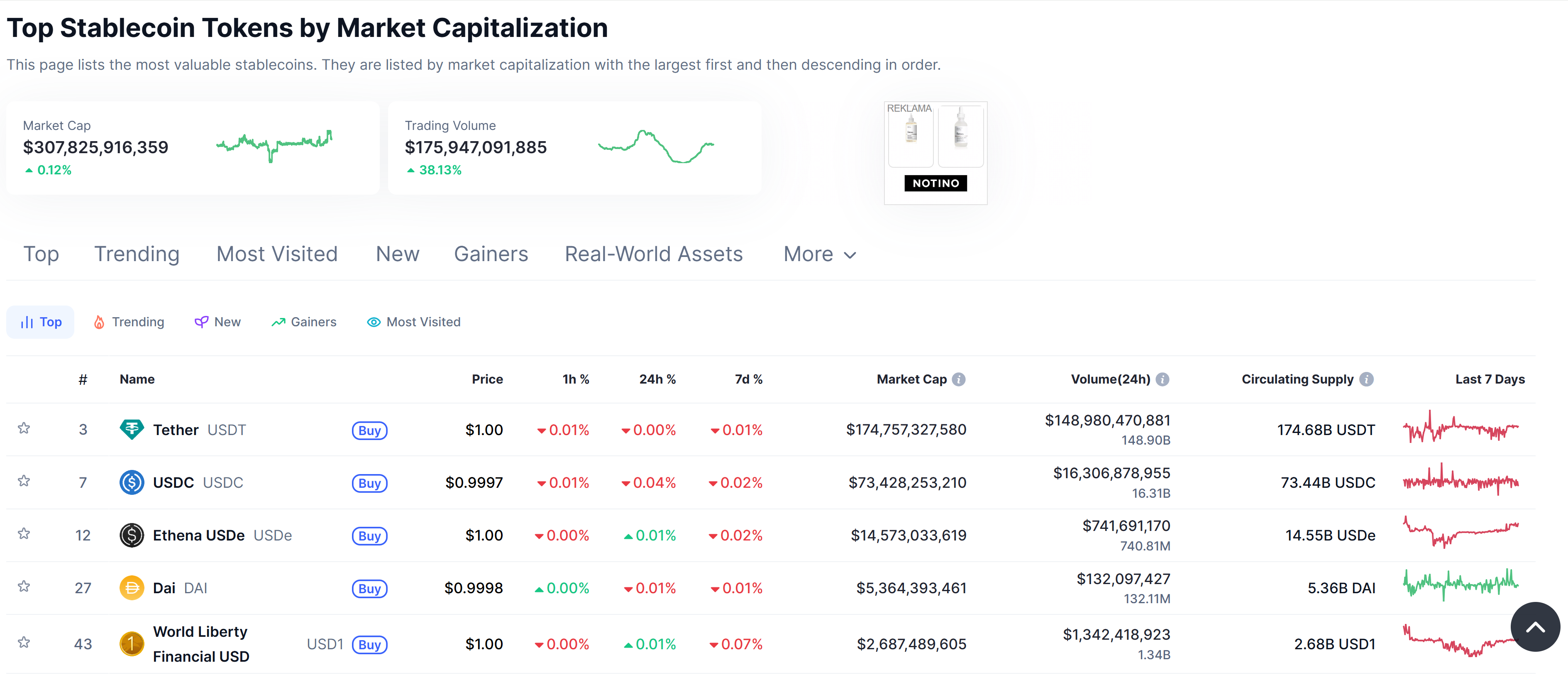

Announced at SIBOS 2025, the Visa Direct stablecoin pilot enables select partners to use Circle’s USDC (USDC) and EURC (EURC) as pre-funded assets to facilitate near-instant payouts, according to a Tuesday announcement.

“Cross-border payments have been stuck in outdated systems for far too long,” said Chris Newkirk, president of commercial and money movement solutions at Visa.

The goal is to reduce the need for capital to be parked in advance and modernize treasury operations. “Visa Direct’s new stablecoins integration lays the groundwork for money to move instantly across the world, giving businesses more choice in how they pay,” Newkirk added.

Related: Colombians can soon save in stablecoins with new MoneyGram app

Visa pilot lets banks use stablecoins for global payouts

The pilot is designed for banks, remittance services and financial institutions seeking to optimize liquidity. Instead of tying up fiat currencies across multiple corridors, participants can fund Visa Direct with stablecoins, which Visa treats as cash equivalents for the purpose of initiating payouts.

Stablecoin pre-funding is expected to unlock working capital, reduce exposure to currency volatility and improve predictability in treasury flows, especially during off-hours or weekends when traditional systems are inactive.

Visa says it has settled over $225 million in stablecoin volume to date, though that remains a small fraction of its $16 trillion in annual payments. The pilot is currently limited to partners that meet Visa’s internal criteria, with plans for a broader rollout in 2026.

Cointelegraph reached out to Visa for comment, but had not received a response by publication.

Related: SWIFT declares second sandbox connector tests a success for CBDC and more

Swift to build blockchain for cross-border settlements

Visa’s move to use stablecoins for cross-border payments came a day after Swift announced it was collaborating with Ethereum developer Consensys and over 30 financial institutions to build a blockchain-based settlement platform aimed at enabling 24/7 real-time cross-border payments.

Crypto payment firms have also seen growing attraction. Last week, stablecoin payments startup RedotPay reached unicorn status after raising $47 million in a strategic round led by Coinbase Ventures, with support from Galaxy Ventures and Vertex Ventures.

During the same week, stablecoin infrastructure startup Bastion raised $14.6 million in a round led by Coinbase Ventures, with backing from Sony, Samsung Next, Andreessen Horowitz and Hashed.

Magazine: Bitcoin mining industry ‘going to be dead in 2 years’ — Bit Digital CEO