ONTO INNOVATION INC (NYSE:ONTO) Emerges as a Top Affordable Growth Stock

The search for growth stocks at reasonable prices represents a cornerstone of disciplined investing, aiming to capture the upside potential of expanding companies without overpaying for that future prosperity. This strategy, often referred to as Growth at a Reasonable Price (GARP) or affordable growth, seeks to identify companies demonstrating strong growth trajectories while maintaining sound profitability and financial health, all at a valuation that does not appear excessive. By applying a systematic screen for stocks with high growth, profitability, and health ratings alongside a reasonable valuation score, investors can filter for opportunities that balance ambition with prudence. One such company emerging from this methodology is ONTO INNOVATION INC (NYSE:ONTO).

Growth Trajectory

A core tenet of the affordable growth strategy is identifying companies with a demonstrably strong and sustainable expansion path. ONTO Innovation’s growth profile is a key reason it passes the initial screen, evidenced by its solid ChartMill Growth Rating of 8 out of 10. The company is not only growing but doing so at an impressive pace.

- Earnings Per Share (EPS) has grown by 24.12% over the past year, with a notable 3-year average annual growth rate of 36.96%.

- Revenue has increased by 15.51% in the last year, supported by a strong 3-year average annual growth rate of 26.41%.

- Looking forward, analysts project continued strong growth, with expected annual EPS growth of 15.71% and Revenue growth of 13.58%.

This combination of strong historical performance and solid future expectations provides a positive growth narrative, which is essential for a stock to be considered in this category. While the projected growth rates are slightly below the explosive historical pace, they remain well above average, suggesting a maturation of growth into a still-impressive and potentially more sustainable trajectory.

Valuation Context

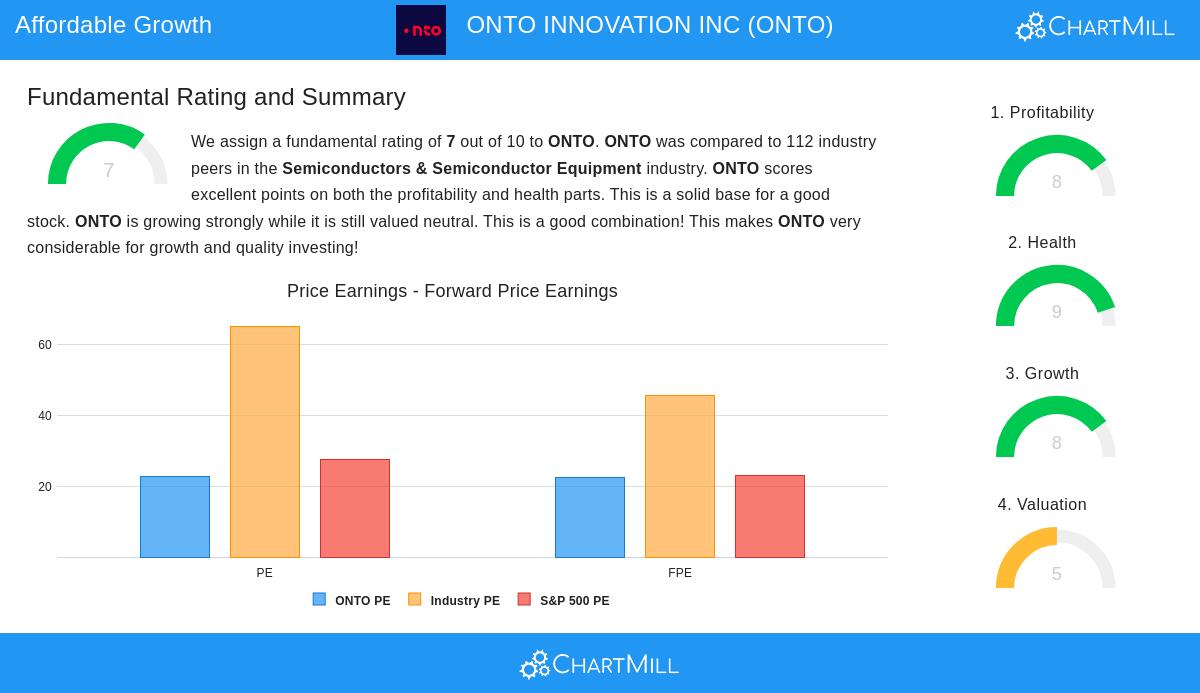

The “affordable” or “reasonable” aspect of this strategy is critical, as overpaying for growth can lead to disappointing returns even if the underlying business performs well. ONTO Innovation’s ChartMill Valuation Rating of 5 positions it in a neutral territory, indicating it is not egregiously overvalued despite its strong growth. This balance is what makes it an interesting candidate.

- The company’s Price/Earnings (P/E) ratio of 22.74 is valued cheaper than nearly 80% of its industry peers, whose average P/E sits above 65.

- Similarly, its Forward P/E of 22.30 and Enterprise Value/EBITDA ratios are more attractive than the vast majority of its semiconductor equipment competitors.

- When compared to the broader S&P 500 index, ONTO’s P/E and Forward P/E ratios are roughly in line with the market average, suggesting investors are not paying a significant premium for its above-average growth profile.

This valuation backdrop is precisely what the affordable growth screen seeks: a company whose growth prospects are not fully reflected in an inflated stock price, offering a potential margin of safety.

Profitability and Financial Health

Sustainable growth is supported by a profitable business model and a sturdy balance sheet, which are necessary to fund future expansion without excessive risk. ONTO Innovation performs well in these areas, earning a high ChartMill Profitability Rating of 8 and an even more impressive Health Rating of 9. These strengths validate the quality of its growth.

The company’s profitability is broad-based, featuring a Profit Margin of 19.29% and an Operating Margin of 22.40%, both of which outperform over 80% of industry peers. Its returns on assets and invested capital are also solid, indicating efficient use of capital. From a health perspective, the balance sheet is exceptionally strong. ONTO operates with no debt and has a Current Ratio of 9.59 and a Quick Ratio of 7.86, providing immense liquidity and financial flexibility. This fortress-like balance sheet significantly reduces financial risk and provides the company with ample resources to handle economic cycles and invest in future growth initiatives.

Conclusion

ONTO Innovation presents a strong case study for the affordable growth investment approach. It possesses a notable combination of strong historical and projected growth, a reasonable valuation relative to both its industry and the broader market, and is backed by excellent profitability and a pristine balance sheet. This alignment with the core principles of the GARP strategy—seeking quality growth without overpaying—makes it a stock worthy of further investigation for investors seeking such opportunities.

For investors interested in discovering other companies that fit this profile, more results can be found using the Affordable Growth stock screen. A detailed breakdown of ONTO Innovation’s fundamentals is available in its full fundamental analysis report.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. All investments involve risk, including the possible loss of principal. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.