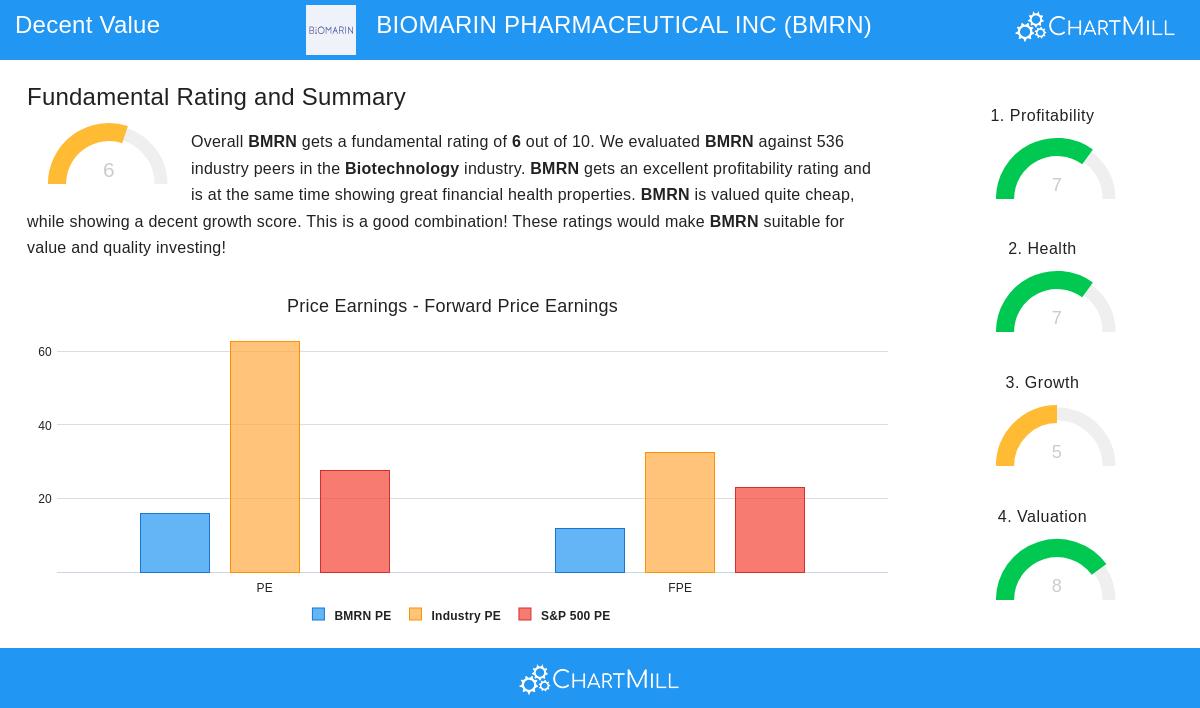

BioMarin Pharmaceutical Inc (NASDAQ:BMRN) Presents a Compelling Value Investment Case

BioMarin Pharmaceutical Inc (NASDAQ:BMRN) has become a possible option for investors using a value-focused method. This method centers on finding companies trading for less than their inherent worth while keeping good fundamental condition. The selection used a “Decent Value” screen that emphasizes stocks with good valuation measures, scoring above 7 out of 10, while also needing acceptable scores in profitability, financial condition, and growth. This even-handed method aims to find companies that are not just inexpensive but fundamentally healthy, possibly providing a safety buffer that value investors such as Benjamin Graham and Warren Buffett have historically supported.

Valuation Metrics

BioMarin’s attraction starts with its notable valuation picture, which scores an 8 out of 10. The company seems notably priced low compared to both its industry and the wider market, an important beginning for any value investment idea.

- The company’s Price/Earnings ratio of 15.98 is much lower than the industry average of 62.83, making it less expensive than 95.52% of its biotechnology counterparts.

- Compared to the S&P 500’s average P/E of 27.54, BioMarin is also valued more appealingly.

- Its Price/Forward Earnings ratio of 11.86 indicates a sensible valuation based on future earnings projections and is less expensive than 96.64% of the industry.

- Other measures like Enterprise Value to EBITDA and Price/Free Cash Flow also point to a low valuation, doing better than over 96% of industry rivals.

For value investors, these numbers are essential. A low valuation compared to earnings and cash flow supplies the “safety buffer” that guards against mistakes in assessment or unexpected market declines, a central principle of the value investing school of thought.

Financial Health

A good balance sheet is essential for value investors, as it shows a company’s capability to endure economic shifts without threatening its activities. BioMarin receives a good Health rating of 7, indicating sound financial steadiness.

- The company displays high solvency, with a Debt to Free Cash Flow ratio of 0.86, meaning it could in theory pay off all its debt in under a year. This ratio is more favorable than almost 95% of its industry.

- An Altman-Z score of 5.66 shows no short-term bankruptcy danger and is better than 77% of counterparts.

- Liquidity is very good, with a Current Ratio of 5.56 and a Quick Ratio of 3.60, showing a good ability to fulfill immediate liabilities.

This financial strength is exactly what value investors search for. A healthy company trading at a discount is less probable to be a “value trap”—a scenario where a stock is inexpensive for a basic reason linked to its weak financial state.

Profitability Strength

Value investing is not only about purchasing low-cost stocks; it is about purchasing good companies at a reduced price. BioMarin’s Profitability rating of 7 verifies it is a profitable business with effective operations.

- The company has notable margins, with a Profit Margin of 21.45% and an Operating Margin of 27.07%, doing better than over 94% and 96% of the industry, in that order.

- Its returns on capital are good, with a Return on Assets of 8.81% and a Return on Invested Capital of 10.27%, both putting it in the leading group of its field.

- BioMarin has been profitable in four of the last five years and has steadily produced positive operating cash flow.

These measures are important because they affirm that the company’s low valuation is not due to bad operational results. A profitable company with high returns on capital is more likely to have its market price move toward its inherent worth as time passes.

Growth Prospects

While pure value stocks can occasionally have little growth, BioMarin offers an interesting combination, with a Growth rating of 5. It shows a good recent history and positive future outlooks, which can work as a stimulus for price increase.

- In the last year, the company displayed fast growth in Earnings Per Share (139.01%) and good Revenue growth (18.36%).

- Looking ahead, EPS is projected to grow by an average of 28.47% per year, a very good estimate.

- Revenue is also predicted to grow at a consistent 7.65% yearly.

For a value investor, this growth element is a major plus. It implies that the company is not inactive and that future earnings growth could be the event that narrows the difference between its present market price and its greater inherent value, resulting in possible investment profits.

Conclusion

BioMarin Pharmaceutical offers an interesting argument for investors looking for low-priced possibilities with good fundamentals. Its appealing valuation, good financial condition, established profitability, and acceptable growth path match well with the ideas of value investing. The stock seems to provide the desired safety buffer while representing an ownership part in a company with a hopeful future in the rare disease treatment market.

For investors curious about locating other companies that match a comparable outline of acceptable valuation paired with good fundamentals, more investigation can be performed using the Decent Value Stocks screen on ChartMill.

,

Disclaimer: This analysis is based on current fundamental data and is intended for informational purposes only. It does not constitute investment advice, a recommendation to buy or sell any security, or a guarantee of future performance. Investors should conduct their own research and consider their individual financial circumstances before making any investment decisions.