All It Takes Is $28,000 Invested in These 2 High-Yield Dividend Stocks and 1 ETF to Help Generate Over $1,000 in Passive Income Per Year

Generating dividend income from stocks is a great way to stay invested in the market while boosting your passive income stream.

Dividend stocks and exchange-traded funds (ETFs) with high yields are excellent ways to generate passive income. But even a high-yield passive income stream doesn’t look all that impressive when the S&P 500 (^GSPC 0.59%) is notching big-time returns.

Therefore, the best way to approach investing in dividend stocks and dividend-paying ETFs isn’t to try to beat the market in a given year, but rather to achieve a financial goal, such as a certain amount of passive income or supplementing retirement income. Investors interested in ways to generate income from stocks, no matter what the market is doing, have come to the right place.

Investing $28,000 into equal parts of ExxonMobil (XOM 1.35%), Whirlpool (WHR -0.07%), and the Vanguard Utilities ETF (VPU 1.42%) should help you generate at least $1,000 in annual dividend income. Here’s what makes these two high-yield dividend stocks and one low-cost ETF top buys in October.

Image source: Getty Images.

ExxonMobil has grown its dividend for decades, and it doesn’t plan on stopping anytime soon

Scott Levine (ExxonMobil): High-yield dividend stocks are a great way to put you on the path to growing your personal wealth. High-yield dividend stocks that are also backed by management teams committed to continue rewarding shareholders for years to come is a winning combination that’s hard to beat. For investors whose interests are piqued with the prospect of such an opportunity, ExxonMobil stock — along with its 3.4% forward-yielding dividend — will seem particularly alluring.

For 42 consecutive years, ExxonMobil has raised its payout to shareholders. That’s no small accomplishment, considering the fact that the energy sector stalwart also must ensure that it remains in solid financial health amid the cyclical nature of energy prices. Over the past four decades, management has navigated this dynamic extremely well, and it remains committed to continue doing so in the years to come. During an investor presentation in May, management stated explicitly, “We know how important the dividend is, especially to our retail shareholders. We’re committed to maintaining a sustainable, competitive, and growing dividend long into the future.”

Experienced investors know the perils of blindly taking a company’s words at face value and not digging deeper. Skeptics, therefore, will find reassurance from the fact that the company has averaged a conservative 68% payout ratio over the past five years.

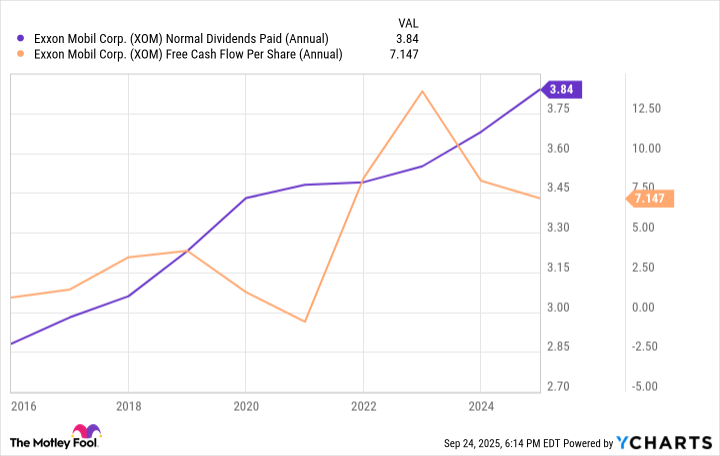

XOM Normal Dividends Paid (Annual) data by YCharts.

Plus, the company consistently generates ample free cash flow from which it can source its dividend.

Investors motivated to ramp up their income streams will surely find ExxonMobil, a leading oil dividend stock, to be a keen way to grease the wheels of their passive-income machines.

The recent sell-off is a buying opportunity

Lee Samaha (Whirlpool): The Federal Reserve cut rates recently, and the market promptly sold off Whirlpool stock. While the logic may seem perplexing, after all, Whirlpool is an interest rate-sensitive stock that will do better in a lower rate environment; it reflects how many investors invest on the basis of “buy on the rumor, sell on the news.” In this case, the “rumor,” which later became the “news,” is the rate cut.

All of which is perfectly fair in love and war, and investing, too, for that matter. Still, investors may regret rushing to sell out of Whirlpool as the case for the stock doesn’t just rest on a lower-rate environment stimulating housing sales and, in turn, discretionary purchases of major domestic appliances by homeowners preparing for a sale or new buyers moving in.

Lower rates will help, but the key to the investment case lies in the positive change in its competitive positioning when the full effect of the tariffs imposed on its Asian competitors takes hold in the future. As a reminder, its rivals have been merrily preloading the market in 2025, first ahead of the Trump presidency launching “Liberation Day” tariffs in early April, and second after the 90-day pause (which ended on Aug. 1 for many countries) was imposed.

That has created a fiercely competitive pricing environment, and Whirlpool has had to lower its earnings expectations for 2025. That said, the tariff landscape now strongly favors domestic producers like Whirlpool, and the company should start to see the benefit of it when its competitors’ inventory is sold off through 2025 and into 2026. Throw in a 4.7% dividend yield, and the stock is attractive to both income-seeking and speculative investors.

AI’s demand for power benefits the utilities sector

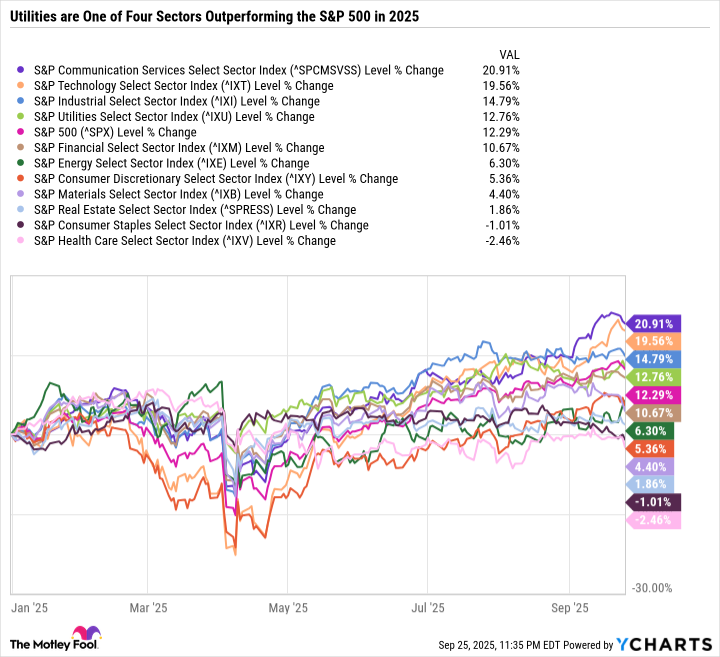

Daniel Foelber (Vanguard Utilities ETF): The stock market sectors that typically benefit the most from bull markets accelerate their earnings growth from innovation, favorable business conditions, tax policy, etc. The usual suspects are technology, communications, industrials, and financials. You’ll find all of those sectors up over 10% year to date. But the utility sector is hovering around all-time highs and even outperforming the S&P 500.

Utilities tend to be a safe and stodgy sector that underperforms during bull markets and outperforms during bear markets or when investor risk appetite is muted. The sector is dominated by electric utilities, especially regulated electric utilities. These companies work with government agencies to set fair prices for customers. In exchange, they benefit from steady cash flow and the need for more power.

Artificial intelligence (AI) has fundamentally changed the investment for utilities. The grid is simply too constrained to handle the power demands of AI. Which is why investors are excited about companies with solutions that function off-grid, like small modular nuclear reactors by NuScale Power and Oklo.

Hyperscalers are spending a fortune on compute through capital expenditures toward data centers and infrastructure build-out. Power is an integral part of the equation. For example, Oracle (NYSE: ORCL) is bringing over 70 data centers online in just a few years. Nvidia (NASDAQ: NVDA) just landed a $100 billion strategic partnership with OpenAI to build a staggering 10 gigawatts of compute power that would feature 4 million to 5 million graphics processing units.

The hyperscalers and chipmakers get a lot of attention in headline AI news. But it would be a mistake to overlook the immense opportunity this creates for the utility sector. However, due to the regulated nature of many top electric utilities, there is limited upside potential from AI compared to AI stocks like Oracle, Broadcom, or Nvidia. Still, the utility sector provides a catch-all way to bet on increased power demand from commercial, industrial, and residential customers.

The Vanguard Utilities ETF is one of the simplest ways to invest in the sector. With a dirt-cheap expense ratio of 0.09%, the ETF’s fees are just 9 cents for every $100 invested. Many utilities have regional focuses. So an ETF provides a way to invest in the general demand for more power in the U.S. rather than just betting big on one region. And with a 2.8% yield, the sector also provides a solid source of passive income. Whereas many AI growth stocks have low yields or don’t pay dividends at all.