Vesting NFTs Surge on BNB Chain as Token Lockups Become Tradable

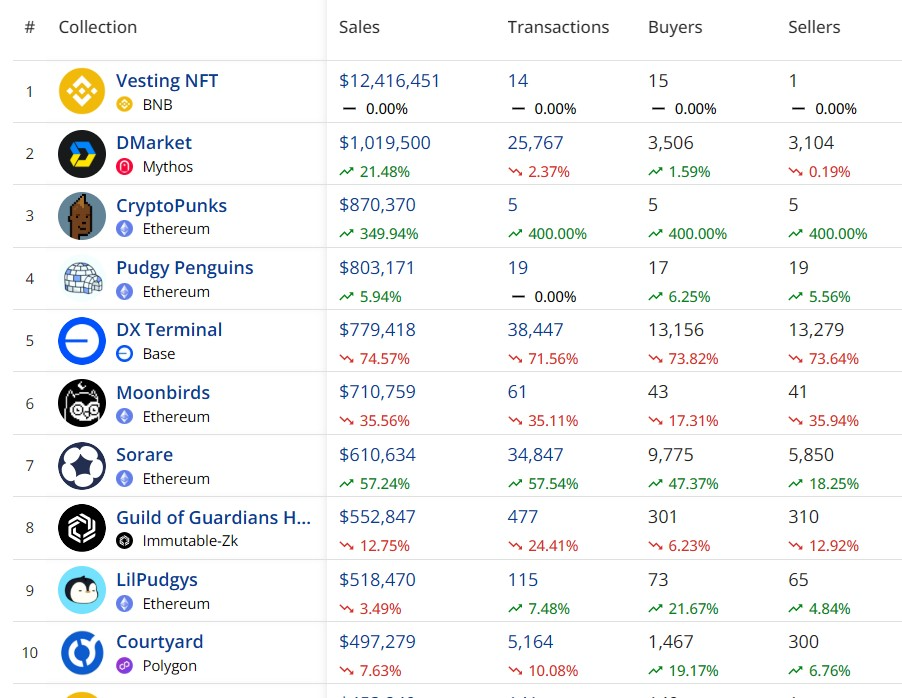

Vesting NFTs surged to the top of data aggregator CryptoSlam’s daily sales volume rankings on Friday, generating over $12.4 million on BNB Chain.

The sharp spike placed the niche non-fungible tokens (NFTs) product ahead of legacy digital art collections like CryptoPunks and Pudgy Penguins, signaling that investors are showing interest in new forms of liquidity for vested tokens.

The activity surge also pushed BNB Chain to become the number one network for daily NFT sales with about $14 million, nearly doubling Ethereum’s $7 million for the day.

CryptoSlam data showed that UNCX Network, a decentralized service provider, operates the Vesting NFTs that surged on BNB Chain. The project allows users to wrap vested tokens and mint a tradable NFT voucher.

Vesting NFTs could have a billion-dollar use case

Vesting is commonly used to deter early investors and team members from hastily selling their tokens for a profit and then leaving the business early. Projects lock the tokens, essentially barring holders from selling them.

However, vesting NFTs has the potential to allow holders of vested tokens to access liquidity by selling their NFTs.

Vesting NFTs wrap token lockups into tradable NFTs that act as a voucher. Owning the NFT grants the holder rights to claim the vested tokens according to their programmed timeline.

This allows users with locked tokens to trade and have liquidity without breaking their original vesting agreements.

While the volume for Vesting NFTs is only in the millions, crypto vesting is a deeply integrated mechanism within the crypto ecosystem.

Tokenomist data showed that in September, the crypto market released about $15 billion in vested tokens into the market. The platform also showed that a combined figure of $10 billion will be unlocked in the next two months.

Related: Ronin Treasury to start buying back millions of RON starting next week

Utility-based NFTs top sales charts

Apart from Vesting NFTs, other utility-based NFTs ranked in the top 10 of CryptoSlam’s 24-hour chart. Real-world asset (RWA) tokenization platform Courtyard, which allows users to use NFTs as vouchers for physical collectibles, was ranked tenth for the day, with nearly $500,000 in sales.

In April, Courtyard’s sales surged, pushing Polygon to the top of the weekly NFT sales chart. At the time, Courtyard NFTs reached a volume of $22.3 million in just seven days.

DMarket, a platform that allows the selling of interoperable gaming NFTs, also ranked among the top projects in NFT sales. The project lets gamers use NFTs as a unique digital certificate of ownership of gaming cosmetics, character outfits and weapon looks.

Magazine: ‘Help! My robot vac is stealing my Bitcoin’: When smart devices attack