Sprouts Farmers Market Inc (NASDAQ:SFM) Offers Affordable Growth with Strong Profitability

Investors looking for growth opportunities at reasonable prices often consider strategies that balance expansion potential with financial stability. The “Affordable Growth” method focuses on companies displaying solid growth paths while keeping good profitability and financial condition, all without high valuation premiums. This process tries to find businesses that can provide lasting returns without the increased risks linked to speculative or expensive assets. One company currently fitting these requirements is Sprouts Farmers Market Inc (NASDAQ:SFM).

Growth Path

Sprouts Farmers Market shows notable growth features that are a main part of its investment attractiveness. The company has displayed solid increases in both revenue and profitability, with recent results notably exceeding industry standards.

- Earnings Per Share grew by a strong 51.88% over the past year, with a five-year average annual growth rate of 24.64%

- Revenue increased by 16.83% in the last year, showing a faster pace compared to its past average

- Analysts forecast ongoing strength with expected EPS growth of 19.18% and revenue growth of 11.53% each year in the future

This steady above-average growth is especially significant in the competitive grocery retail industry, pointing to successful implementation of the company’s plan focused on health-aware customers.

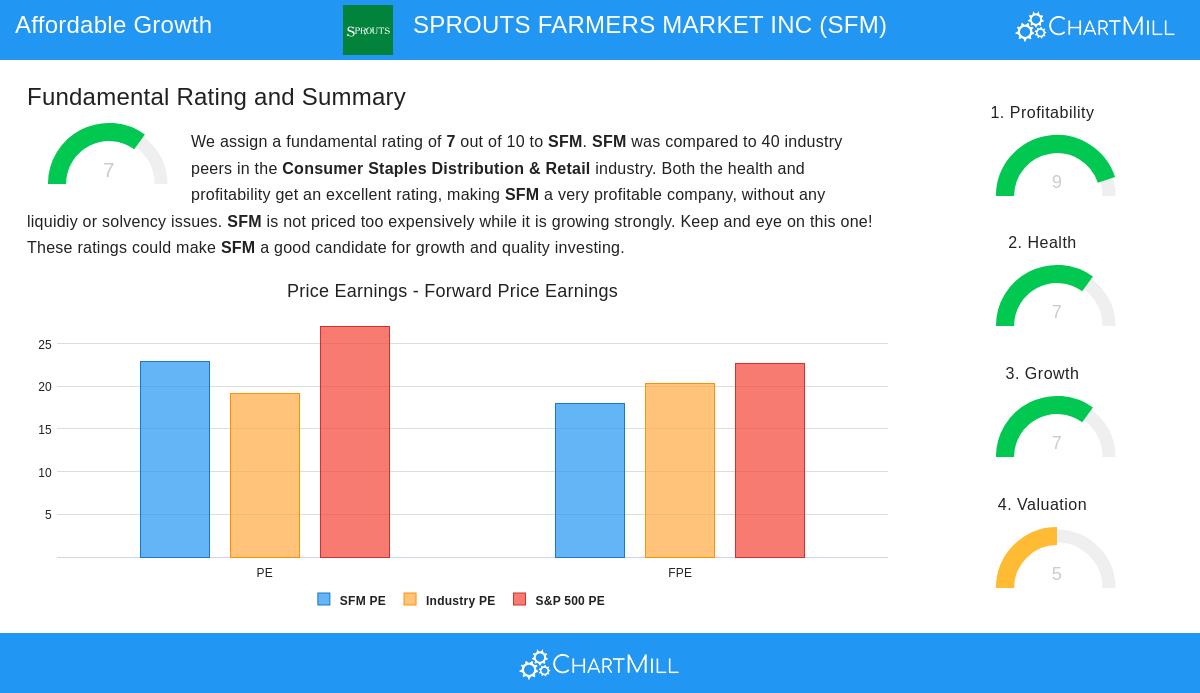

Valuation Review

While growth stocks frequently have high valuations, Sprouts keeps sensible pricing relative to its future. The company’s valuation measurements show a varied but generally acceptable view when weighing its growth speed and quality basics.

- Current P/E ratio of 22.91 is close to industry averages and lower than the S&P 500’s 27.06

- Forward P/E of 18.01 seems more appealing, trading below both market and sector comparisons

- The PEG ratio, which includes growth forecasts, indicates the stock could be sensibly priced considering its expansion possibility

The valuation situation supports the “affordable” part of the screening conditions, as investors are not required to pay high multiples for above-average growth.

Profitability Condition

Sprouts’ capability to turn revenue into profits is distinct within the competitive grocery field. The company reaches margins that are some of the highest in its industry, offering a firm base for continued growth investment.

- Profit margin of 5.77% does better than 90% of industry competitors, with steady improvement in recent years

- Return on Equity of 35.75% and Return on Invested Capital of 15.85% both are in the top ten percent of the sector

- Operating margin of 7.69% shows effective operations and pricing ability within its specialty

These outstanding profitability measurements give important support for the growth narrative, indicating that expansion is being reached efficiently instead of through margin-reducing price cuts.

Financial Condition

The company maintains a mostly firm balance sheet, although with some details in its liquidity situation that deserve notice next to its overall good position.

- Outstanding solvency measurements with very little debt and a high Altman-Z score of 5.67

- Debt-to-equity ratio of 0.00 and debt-to-free-cash-flow of 0.02 show very few leverage issues

- Current and quick ratios below industry averages indicate a focus on working capital effectiveness, although this is lessened by strong cash production

The general financial condition supports the sustainable growth story, as the company has the ability to fund expansion without high leverage.

Sprouts Farmers Market offers a notable case for investors looking for growth at sensible prices. The mix of solid historical and forecasted growth, industry-high profitability, and workable valuation multiples matches well with affordable growth conditions. While the wider market displays positive directions in both near and long-term views, company-specific basics stay the main force for this kind of investment method.

For investors wanting to examine similar opportunities, other stocks meeting these conditions can be located using our Affordable Growth screening tool. A more detailed fundamental analysis of Sprouts Farmers Market is accessible in our detailed report.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with financial advisors before making investment decisions.