Hashdex Crypto Index ETF Now Includes Altcoin Exposure

Asset manager Hashdex expanded its Crypto Index US exchange-traded fund (ETF) to include XRP (XRP), SOL (SOL) and Stellar (XLM) following the generic listing rule change from the Securities and Exchange Commission (SEC).

The Nasdaq stock exchange-listed ETF now includes five cryptocurrencies held 1:1 by the fund, including Bitcoin (BTC) and Ether (ETH), and is trading under the ticker symbol NCIQ, according to Thursday’s announcement.

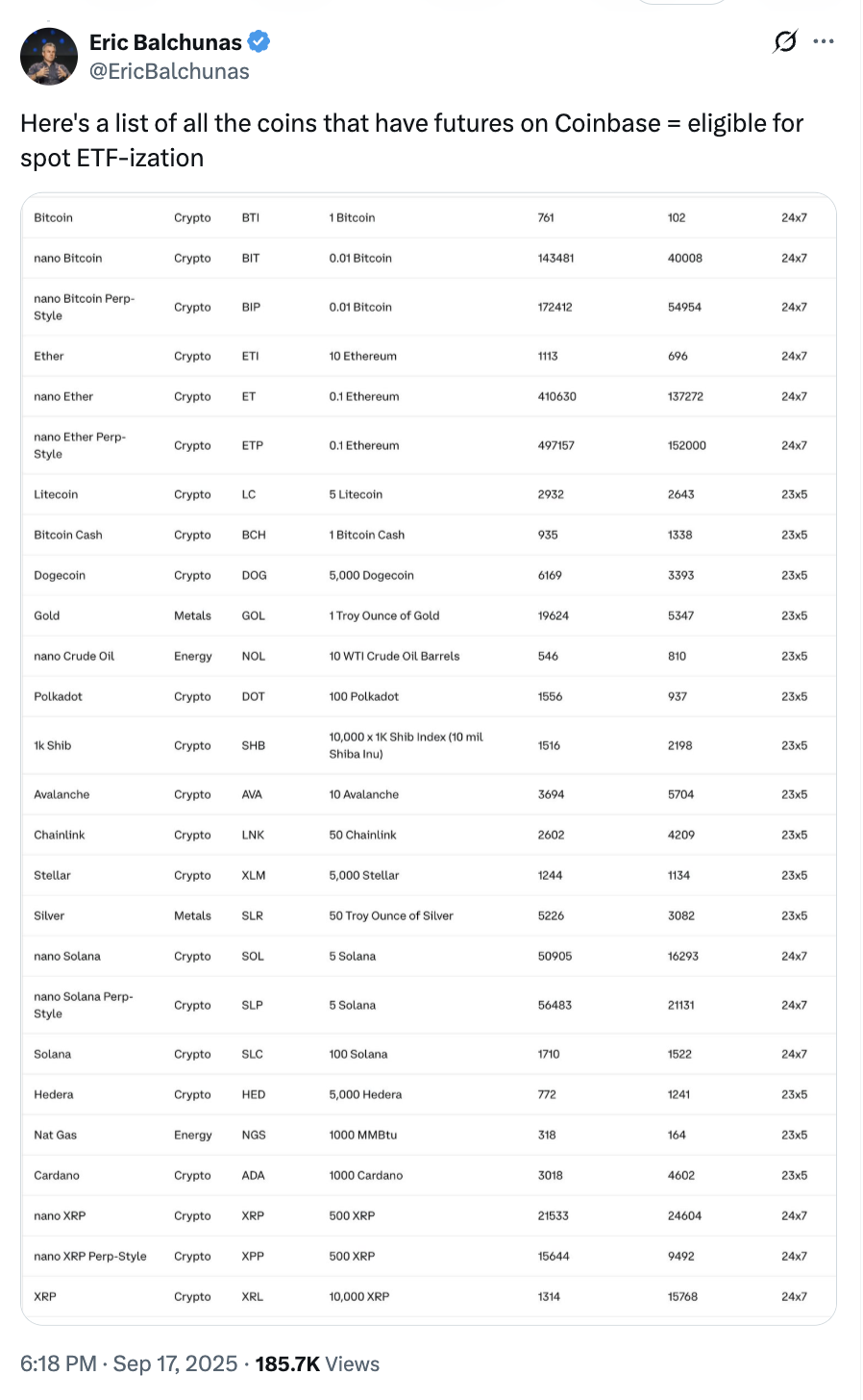

The SEC approved generic listing standards for ETFs in September, paving the way for a faster ETF approval process for eligible cryptocurrencies.

To qualify for generic listing eligibility, a cryptocurrency must be classified as a commodity or feature futures contracts listed on reputable exchanges. Additionally, eligible cryptos must be subject to financial surveillance under the US Intermarket Surveillance Group.

Market analysts and industry executives anticipate a torrent of new crypto ETF filings due to the new standards, which will give stock market participants access to the crypto markets and blur the line between traditional financial instruments and digital assets.

Related: SEC listing rules to boost crypto ETFs, but no guarantee of inflows: Bitwise

US SEC begins approving multi-asset crypto ETFs to hasten innovation

The SEC approved the Grayscale Digital Large Cap Fund, the first US multi-asset crypto ETF, on Sept. 17. Grayscale’s fund includes BTC, ETH, XRP, SOL and Cardano (ADA).

SEC Chair Paul Atkins is spearheading efforts to streamline the ETF approval process for cryptocurrencies as part of a broader initiative to modernize the financial system for digital finance.

Atkins recently proposed an “innovation exemption” for crypto companies, a regulatory sandbox that would allow crypto projects to experiment with new technologies without fear of regulatory reprisal from government agencies.

The SEC, at the behest of US President Donald Trump’s administration, has issued a series of statements and policy proposals in 2025 designed to reduce the regulatory burden on crypto companies — a stark departure from the SEC under former Chair Gary Gensler’s leadership.

These policies include ending regulation by enforcement or filing lawsuits against projects without due notice, crafting comprehensive market structure rules for digital assets and classifying most cryptocurrencies as commodities.

Magazine: SEC’s U-turn on crypto leaves key questions unanswered