JACK HENRY & ASSOCIATES INC (NASDAQ:JKHY): A Sustainable Dividend Stock for Reliable Income

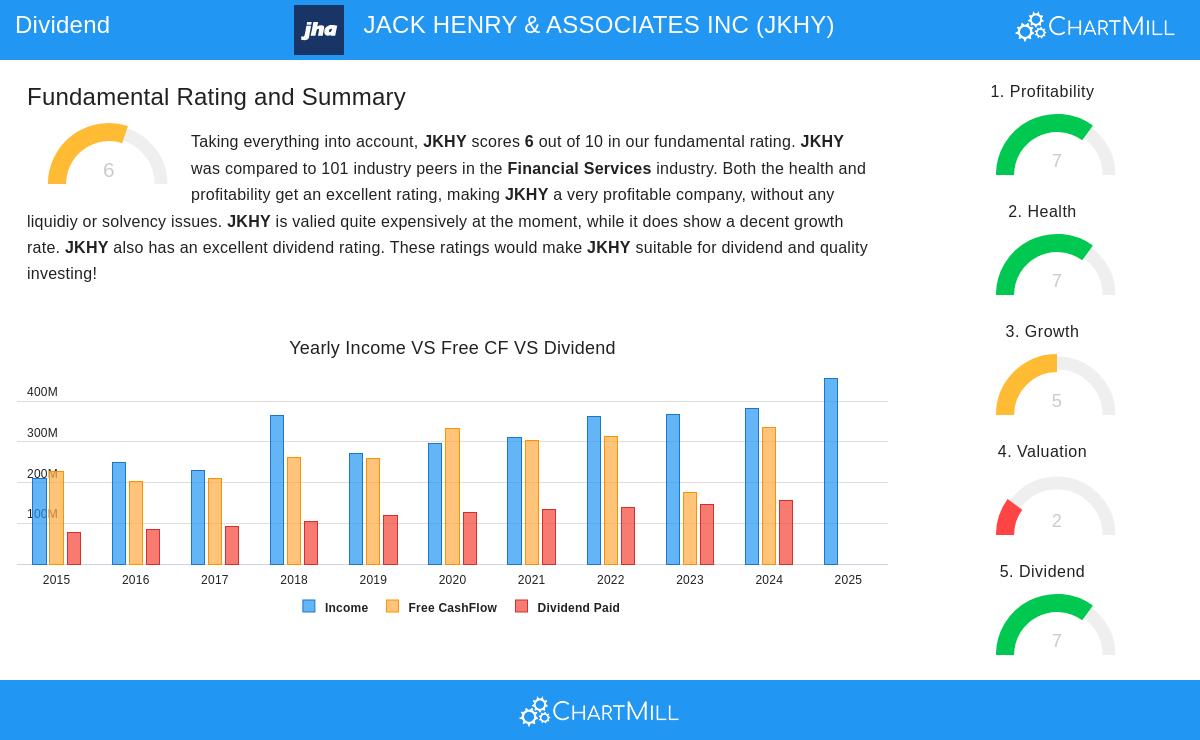

For investors looking for reliable income streams, a disciplined screening method can help find companies that not only pay dividends but have the financial capacity to maintain and increase those payments over time. One useful tactic involves selecting for stocks with good dividend ratings while also having acceptable profitability and financial condition scores. This method emphasizes sustainable income by looking past simple yield numbers to evaluate the fundamental business quality and payout reliability. JACK HENRY & ASSOCIATES INC (NASDAQ:JKHY) appears as a candidate for more detailed review using this structure.

Dividend Sustainability and Track Record

The foundation of any dividend investment idea rests on the sustainability and dependability of the payments. Jack Henry & Associates shows a positive track record here, which is an important point for income-oriented investors who value consistency over potentially high but uncertain yields. A long payment history suggests a company culture focused on giving capital back to shareholders.

- Reliable Dividend History: JKHY has paid a dividend for at least 10 straight years without a decrease. This consistent history offers a degree of assurance about the company’s dedication to its shareholders.

- Consistent Dividend Growth: The dividend has increased at an appealing annual rate of about 6.79% over the last five years. This growth assists investors in having their income match inflation, a key point for long-term investment.

- Sustainable Payout Ratio: The company pays out around 37.87% of its earnings as dividends. This is a cautious ratio, showing that the dividend is easily supported by profits and allows significant capacity for business reinvestment or future dividend raises, even if the economy weakens.

A sustainable payout ratio is a fundamental part of the screening method since it directly relates to the chance of a dividend reduction. A low ratio, like JKHY’s, means the company is not straining its finances to pay dividends, which is necessary for the “decent health” part of the method.

Fundamental Profitability Strength

A company’s capacity to produce profits is what supplies dividend payments. Jack Henry & Associates displays good profitability measures, which supports its place in a screen that demands acceptable profitability. Good profitability confirms that dividends are paid from real business performance, not from borrowing or selling assets.

- High Returns on Capital: The company has a Return on Invested Capital (ROIC) of 16.66% and a Return on Equity (ROE) of 21.08%, both numbers placing it in the high end of its financial services industry group.

- Good Margins: JKHY maintains a solid Profit Margin of 18.50% and an Operating Margin of 23.22%, which have been consistent or getting better in recent periods.

These strong profitability ratings are important for the dividend method because they indicate a good-quality business with a lasting competitive position. A very profitable company is much more able to have the financial freedom to sustain and raise its dividend through different market conditions.

Financial Health and Balance Sheet

A solid balance sheet offers a buffer in times of economic instability, making sure a company can keep operating, and paying dividends, even if profits decline temporarily. JKHY’s financial condition is a main reason it satisfies the initial screen.

- Very Low Debt: The company has an extremely small Debt-to-Equity ratio of 0.04 and a Debt-to-Free-Cash-Flow ratio of 0.56, showing it could eliminate its debts rapidly. This minimal borrowing is a major positive.

- High Solvency: JKHY’s Altman-Z score of 10.43 shows a very small likelihood of financial trouble, performing better than most of its industry rivals.

The need for a decent health rating in the screening method is intended to steer clear of companies that could be pressured to reduce dividends because of balance sheet problems. JKHY’s nearly nonexistent debt and high solvency score make its dividend payments seem very safe.

Valuation and Growth Considerations

While the main emphasis is on income, valuation and growth potential give useful background. JKHY is presently valued at a higher level compared to some industry peers, with a Price-to-Earnings (P/E) ratio of 24.27. This valuation shows the market’s positive view of its good-quality, steady business operation. Growth is consistent, with revenue and earnings per share showing mid-to-high single-digit growth in the past, which is projected to persist. For dividend investors, this steady growth backs the possibility of ongoing dividend raises.

A Detailed View of the Fundamentals

The review above is backed by the detailed Fundamental Analysis Report for JKHY, which gives a full breakdown of all rating parts. Investors are advised to examine this report for a more detailed look at the measures.

For investors wanting to research other companies that fit similar requirements for sustainable dividend investing, the fully set up Best Dividend Stocks screen is a good beginning point for more investigation.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The opinions expressed are based on current data and may change. All investments involve risk, including the possible loss of principal. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.