Microsoft Corp (NASDAQ:MSFT) Shows Bullish Consolidation Pattern Ahead of Potential Breakout

For investors using technical analysis, finding stocks with good underlying momentum that are also making consolidation patterns can be a good strategy. The objective is to locate market leaders that are taking a break after a rise, presenting a possible entry point before a next breakout. This method frequently uses custom ratings that measure a stock’s technical condition and the standard of its present chart formation. MICROSOFT CORP (NASDAQ:MSFT) has recently been identified by such a scan, indicating it might be ready for a notable move.

Technical Strength Evaluation

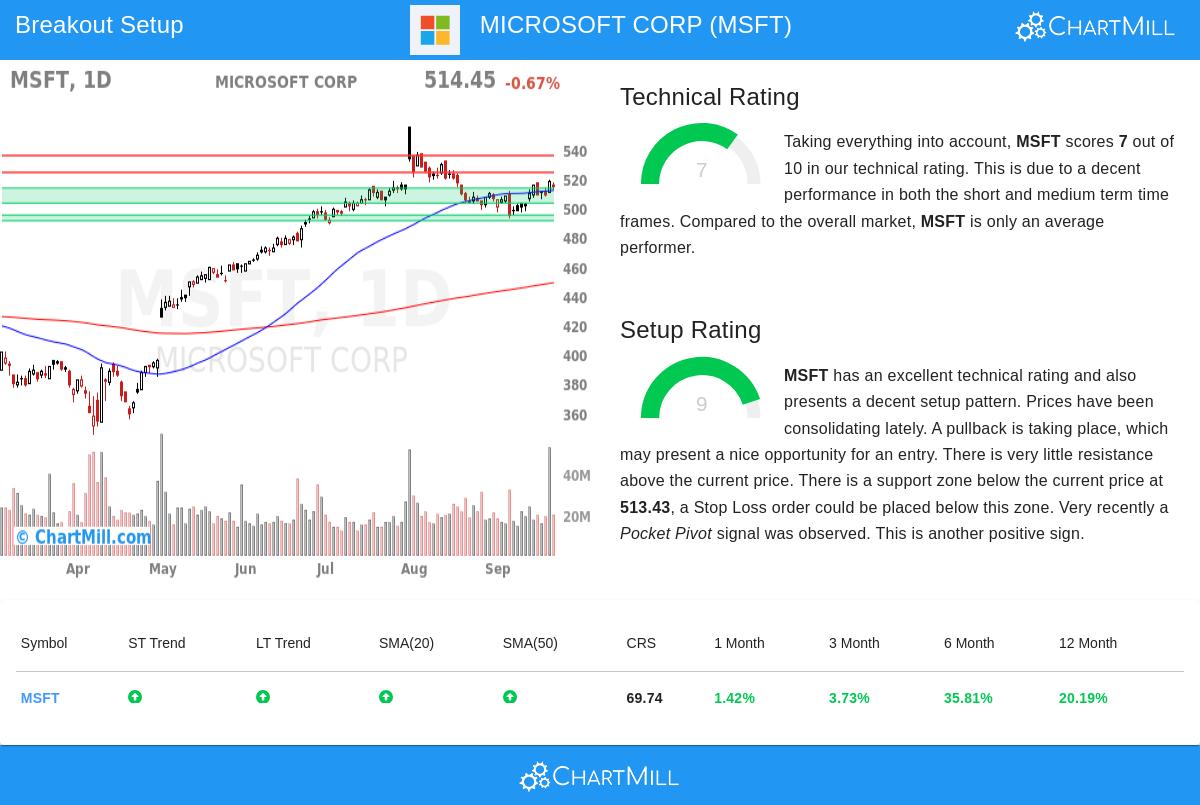

A basic part of this strategy is a stock’s general technical condition, which shows the force and course of its trend. Microsoft receives a good Technical Rating of 7 out of 10, indicating a favorable trend structure. This score is important because it assists in selecting for stocks that are already in confirmed uptrends, raising the chance that a breakout will result in more gains instead of falling short.

Important elements adding to this rating are:

- Positive Trend Alignment: Both the short-term and long-term trends for MSFT are defined as positive, a very good sign for momentum investors.

- Supportive Moving Averages: The stock is priced above its main moving averages (20, 50, 100, and 200-day), and all of these averages are themselves in upward arrangements, verifying the bullish trend.

- Respectable Relative Strength: While not a top-level market leader currently, Microsoft’s results over the last year still beat 69% of all stocks, showing it is doing in line with or a bit better than the wider market.

The full technical report for MSFT gives a more detailed look into these measures. This underlying technical condition offers a positive setting for a possible breakout play.

Setup Standard and Consolidation Pattern

While a solid trend is essential, a favorable entry point is described by a high-standard setup. This is where Microsoft really distinguishes itself, having a very good Setup Rating of 9 out of 10. This high score is vital as it spots times of price consolidation, where a stock trades in a narrow band after a rise, forming a base for its next step upward.

The present chart of MSFT shows a number of traits of a hopeful setup:

- Tight Trading Range: Over the last month, the stock has been consolidating between about $492 and $519, showing a balance between buyers and sellers and a reduction in volatility.

- Clear Support and Resistance: The analysis finds a solid support area between $503 and $513, made by a combination of trendlines and moving averages. This gives a sensible point for setting a protective stop-loss order. Resistance is seen close to $524.

- Positive Volume Signal: A recent “Pocket Pivot” signal has been observed, which is a price/volume formation indicating buying by institutional investors, frequently a sign of a bullish move.

Trading Consequences and Market Situation

The mix of a favorable technical trend and a high-standard consolidation pattern makes Microsoft an interesting option for technical investors. The suggested automated setup proposes an entry point on a breakout above the $524 resistance level, with a stop-loss set below the main support area. It is essential to recognize that this is an explanatory example; investors must always decide their own entry, exit, and position size according to their personal risk tolerance.

This evaluation happens within a situation of a favorable trend for the S&P 500 in both the short and long term, which usually offers a supportive setting for breakout strategies.

For investors wanting to find other stocks that fit similar technical and setup conditions, the Technical Breakout Setups screen is refreshed each day with new possible opportunities.

Disclaimer: This article is for informational purposes only and does not constitute investment advice, a recommendation, or an offer or solicitation to buy or sell any securities. The analysis presented is based on technical indicators and should not be the sole basis for making an investment decision. All investments involve risk, including the possible loss of principal. Always conduct your own research and consider your individual financial circumstances before trading.