IDEX CORP (NYSE:IEX): A Top Dividend Stock with Strong Earnings and Financial Health

For investors looking for dependable income sources, dividend investing stays a key strategy. The method involves finding companies that not only provide regular dividends but also show the financial soundness and earnings capacity to maintain and possibly increase those payments over time. One way to find these chances is through organized filtering, concentrating on measures such as dividend reliability, company earnings capacity, and balance sheet soundness. This process helps remove companies with possibly unreliable yields, frequently a warning sign of deeper business problems, and points out those with strong operational and financial conditions.

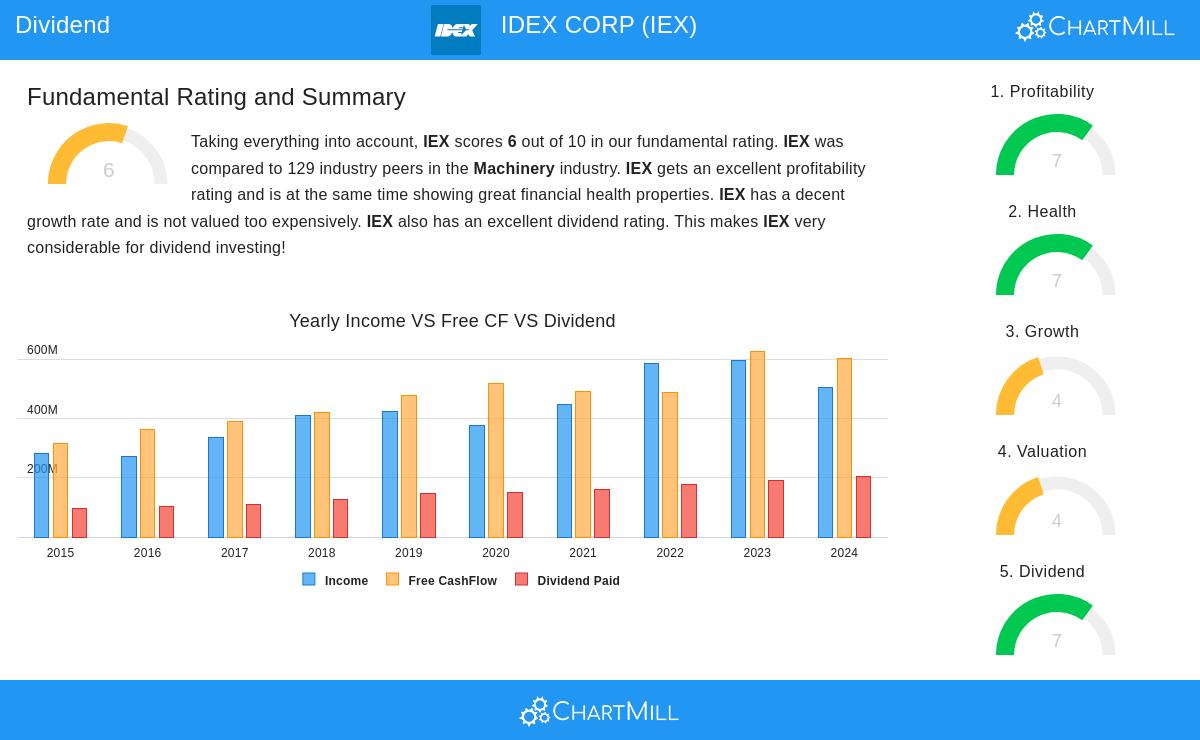

IDEX CORP (NYSE:IEX) appears as a strong candidate from this type of filtering process, made to identify stocks with high dividend scores along with good earnings capacity and financial soundness. The company, which focuses on engineered products and essential components in areas such as fluid handling, health sciences, and fire safety, displays multiple traits that dividend investors usually value.

Dividend Consistency and Increase

A main draw for income-oriented investors is IEX’s history and future-looking dividend reliability. The company has regularly provided and raised its dividend for more than ten years, showing a dedication to giving capital back to shareholders. Its dividend yield of 1.75% is strong within the machinery sector, doing better than 80% of similar companies. Most significantly, the dividend has increased at an average yearly rate of almost 7% over recent years, backed by a payout ratio of 44.84%, a level that shows reliability without pressuring the company’s earnings ability. This mix of yield and increase is important for long-term dividend plans, as it hints at possibility for future raises without risking financial steadiness.

Earnings Capacity Supporting Payments

Dividend reliability is directly connected to a company’s skill to produce earnings, and IEX performs solidly here. With a ChartMill Earnings Capacity Rating of 7, the company shows high operational effectiveness. Important measures include:

- A profit margin of 14.05%, doing better than 86% of sector peers

- An operating margin of 20.87%, placed in the top 7% of the industry

- Return on equity of 11.70% and return on invested capital of 8.64%, both higher than industry averages

These numbers show that IEX is not only profitable but also efficient at turning sales into income, a necessary feature for supporting and raising dividend payments over time.

Financial Soundness Providing Steadiness

A solid balance sheet is needed for enduring economic slumps and continuing dividend payments during hard times. IEX’s ChartMill Soundness Rating of 7 shows good liquidity and solvency:

- A current ratio of 3.05 and quick ratio of 2.13 imply sufficient short-term liquidity

- Debt amounts are controllable, with a debt-to-equity ratio of 0.46 and a sound Altman-Z score of 4.44, showing low failure risk

- Operating cash flow has been positive over the last five years, offering a dependable source for financing dividends

This financial strength lowers the chance of dividend reductions and matches the filtering goals meant to find durable dividend providers.

Valuation and Expansion Background

While the main interest for dividend investors is often income, valuation and expansion possibilities also contribute to total return possibility. IEX trades at a P/E ratio of 20.75, which is fair compared to the industry and wider market. Earnings are predicted to expand at nearly 10% each year over the next few years, indicating possibility for both dividend increase and price growth. This pairing of reasonable valuation and positive expansion view improves its attractiveness further.

For a complete summary of these measures, readers can examine the full fundamental analysis report.

Investigating More Possibilities

IEX stands for just one result of a strict filtering process aiming for high-quality dividend stocks. Investors curious about finding comparable companies that match standards for dividend strength, earnings capacity, and financial soundness can investigate other outcomes using the Best Dividend Stocks screen.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consider their financial situation and risk tolerance before making any investment decisions.