Is Rivian Stock a Buy Now?

Rivian’s stock is trading way down from its high, but well off its lows. Whether it is worth buying depends on your risk profile.

Rivian (RIVN -1.84%) stock got caught up in a bit of Wall Street hysteria when it went public. In fact, that hysteria is likely why the vehicle maker went public, so it could cash in on the hype around electric vehicles (EVs) at the time. When the excitement wore off, Rivian’s share price plunged.

Is the story starting to, very slowly, change for the better again?

Image source: Getty Images.

Wall Street likes a hot story

It wasn’t too long ago that Wall Street believed that electric cars were going to change the world. Tesla, after a long period of building its business, had finally proven that making EVs could be a sustainably profitable business. And, importantly, that the traditional automakers had to start taking EVs seriously. The excitement around Tesla led the stock to rise dramatically.

Wall Street jumped into action, as it usually does in such situations. A slew of electric car companies rushed to go public, attempting to catch Tesla’s “lightning in a bottle.” Many of those companies were too early in their development to justify going public, but you have to strike while the iron’s hot in finance if you want to collect the initial public offering (IPO) cash, and the lush investment banking fees that go along with that cash.

That may seem a bit cynical. The truth is probably a bit more complicated, since you could also argue that Wall Street was simply giving investors what they wanted. Regardless, a lot of electric car companies have flamed out, and there is still a material risk that more will do the same. And despite all of this investment drama, Rivian continues to make important progress as a business. So much so that its stock has risen materially off its post-bubble lows.

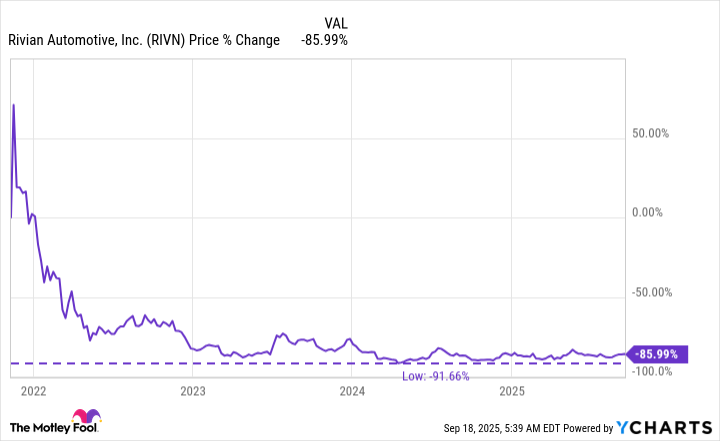

Data by YCharts

What’s got investors interested in Rivian again?

As the chart above highlights, Rivian’s stock is around 85% below its all-time high. But that’s an improvement from the 91% nadir, hit in 2024. Since hitting that low, Rivian’s shares have risen from $8.40 per share to their current value of around $14, an increase in value of roughly 66%! What’s going on?

Simply put, Rivian is slowly building its business, at least partly thanks to the cash it raised when Wall Street was more enthusiastic about the idea that pure-play electric car makers would disrupt the businesses of the traditional automakers. To be fair, Rivian is dealing with far more competition than Tesla was when it broke into the auto industry. In fact, all of the major auto companies are now making their own EVs. But Rivian has continued to make important progress as a business.

For example, the company has twice generated a gross profit. That simply means that it generated enough revenue from selling cars to cover the cost of making those cars. There are other expenses further down the income statement, like research and development and SG&A costs, that will keep Rivian in the red for years to come. But a gross profit is an important first step.

It also counts large and important companies as partners. The list includes Amazon, which has long been a material customer, helping Rivian develop a delivery truck that Rivian now sells to other customers. And the other big one is traditional automaker Volkswagen, which continues to provide cash to Rivian as the upstart reaches new development milestones. The expectation is that Volkswagen will use Rivian technology in its vehicles, thus providing Rivian with another important customer.

Another vital step has been the company’s ability to reach production scale. That was actually what allowed it to shift gears to focus on profitability as it fine-tuned its manufacturing efforts. It will use what it has learned to take the next big step, which should happen in 2026, of introducing a new lower-cost vehicle, the R2, for the mass market. That, not incidentally, is the same approach Tesla took, starting at the high end and then bringing out lower-priced vehicles.

Will Rivian make it?

When asking if Rivian is worth buying, the underlying question is really “Will Rivian make it?” The answer to that is uncertain, so only the most aggressive investors will probably want to look at Rivian today, even as the stock rises off its lows.

However, if you are an aggressive growth investor, it increasingly looks like Rivian may have what it takes to reach sustainable profitability. And if it does, the current low price could signal a good time to buy. That said, Rivian is still a developing business, so the ride could still be a little rough and, as noted, there’s always the risk that Rivian falls short of its ultimate goal.