CREDO TECHNOLOGY GROUP HOLDING LTD (NASDAQ:CRDO) Emerges as a Top High-Growth Momentum Stock

The method used in finding promising growth stocks joins Mark Minervini’s Trend Template with a concentration on high-growth momentum. Minervini’s method highlights stocks showing strong technical condition, characterized by upward-trending moving averages, nearness to 52-week highs, and solid relative strength, while the high-growth momentum filter makes certain these firms also show accelerating fundamentals, like surging earnings and revenue growth. This two-part screening tries to capture leaders with both price momentum and foundational business health, matching the idea that the top performers frequently display high quality in both price action and fundamental growth.

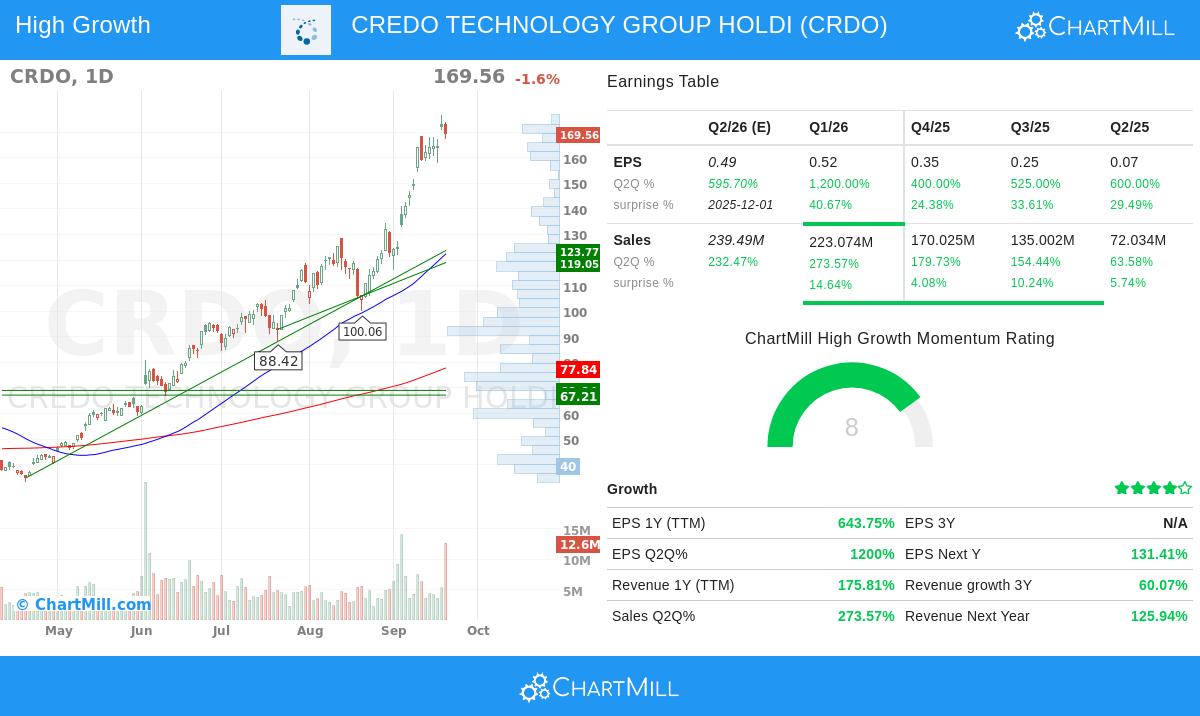

CREDO TECHNOLOGY GROUP HOLDING LTD (NASDAQ:CRDO) has appeared as a clear candidate through this joined screening process. The company, which creates high-speed connectivity solutions for data infrastructure, works in the growing market for bandwidth and efficient data transmission, a sector set up for continued growth with rising data demands.

Technical Strength and Trend Template Alignment

From a technical view, CRDO meets all main conditions of Minervini’s Trend Template, which is made to find stocks in confirmed uptrends with lower volatility risk. The template needs stocks to trade above important moving averages with those averages themselves in upward trends, a signal of maintained momentum. CRDO’s current price of $169.56 sits well above its rising 50-day ($122.48), 150-day ($79.95), and 200-day ($77.84) moving averages. Each of these averages is trending upward, confirming both short and long-term strength.

Additional trend template points are also met:

- The stock is trading within 25% of its 52-week high of $176.70, showing strong momentum.

- It has advanced greatly from its 52-week low of $28.75, reflecting strong recovery and growth potential.

- Its relative strength ranking of 98.93 shows it is doing better than nearly 99% of all stocks, an important sign of leadership.

These technical features are important within Minervini’s plan because they help remove unstable or fading stocks, concentrating instead on issues with confirmed momentum and a greater chance of continued progress.

Fundamental Momentum and Growth Qualities

On the fundamental side, CRDO shows the kind of explosive growth that high-growth momentum investors search for. The company has delivered notable quarterly and annual improvements across key financial measures:

- Earnings per share (EPS) growth has been exceptional, with a 1-year TTM growth of 643.75% and recent quarterly growth above 1000% in some periods.

- Revenue growth is equally strong, with a TTM increase of 175.8% and the most recent quarter showing a 273.6% rise year-over-year.

- Profit margins have grown significantly, reaching 28.4% in the last quarter, up from 21.5% the prior quarter, showing better efficiency and pricing power.

- The company has beaten analyst EPS estimates in each of the last four quarters, with an average surprise of 32%, reflecting steady outperformance.

These measures are important because high-growth investing looks for companies that are not only growing quickly but also getting better in profitability and exceeding expectations, factors that frequently draw institutional interest and push further price gains.

Technical and Setup Assessment

According to the technical analysis report, CRDO holds a perfect rating of 10 out of 10, reflecting high technical condition. The long and short-term trends are positive, and the stock is trading near its 52-week high with strong relative strength against both the market and its industry peers. However, the setup rating is currently moderate, suggesting that while the stock is technically sound, its recent price movement has been volatile, and investors may gain from waiting for a more settled entry point.

Review the full technical report for CRDO here.

Conclusion

CRDO represents a strong case of a stock that matches both Minervini’s trend-following ideas and the conditions for high-growth momentum investing. Its solid technical profile, joined with outstanding fundamental growth, places it as a leader in its sector. Investors using these strategies often search for such two-part strength to increase the chance of maintained performance.

It is worth noting that while the technical and growth measures are solid, the current volatility may need careful entry timing. As with any plan, joining systematic screening with disciplined risk management stays essential.

For those interested in finding similar high-growth, technically solid candidates, our predefined screen, High Growth Momentum + Trend Template, offers a selected list of stocks meeting these strict conditions.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice. All investment decisions carry risk, and individuals should conduct their own research or consult a qualified financial advisor before making investment decisions.