Artificial intelligence remains a hot investment area in 2026, but it’s also a volatile sector. For example, Wall Street was disappointed in the latest earnings reports from Advanced Micro Devices (AMD 0.87%) and Alphabet (GOOGL 1.46%)(GOOG 1.47%), contributing to a share price drop for both.

This volatility creates opportunities for the astute long-term investor. Now is the time to scoop up shares in AMD and Alphabet. After all, one earnings report does not define how these companies will perform over the long run.

But is one a better long-term investment in AI? To answer that question, let’s dive into where they stand currently.

Image source: Getty Images.

A look into AMD

AMD wrapped up 2025 on a strong note. Revenue in its fiscal fourth quarter, ended Dec. 27, was a record $10.3 billion. Each of its divisions, from data centers to gaming, experienced year-over-year Q4 sales growth.

AMD’s excellent results were thanks to the fast-growing artificial intelligence market. Customers are rushing to buy the company’s products to build the computing power needed for AI.

This demand is expected to continue. AMD forecasted fiscal Q1 revenue of about $9.8 billion, representing 32% growth from the prior year’s $7.4 billion, which was record first quarter revenue at the time.

That prediction was not enough for Wall Street’s sky-high expectations, leading to AMD’s share price drop.

Today’s Change

(-0.87%) $-1.87

Current Price

$214.13

Key Data Points

Market Cap

$352B

Day’s Range

$213.90 – $219.37

52wk Range

$76.48 – $267.08

Volume

717K

Avg Vol

40M

Gross Margin

45.99%

How Alphabet is faring

Alphabet also delivered a strong performance. Its Q4 sales soared 18% year over year to $113.8 billion. This enabled Alphabet’s 2025 revenue to exceed $400 billion for the first time. Its ubiquitous Google search engine was a key contributor here as the division’s Q4 sales reached $63.1 billion, up from 2024’s $54 billion.

Google’s search income is rising because of AI. According to Alphabet CEO Sundar Pichai, “Search saw more usage in Q4 than ever before as AI continues to drive an expansionary moment.”

Its outstanding results didn’t save the stock from dropping due to the company’s massive increase in capital expenditures. In Q4, capex skyrocketed 95% year over year to $27.9 billion, which resulted in Alphabet ending 2025 with over $91 billion in capex costs.

But what spooked Wall Street was the tech titan’s plan to spend more in 2026, with capex estimated between $175 billion and $185 billion. Alphabet sees this expenditure as essential to evolving its AI tech.

Today’s Change

(-1.46%) $-4.72

Current Price

$319.60

Key Data Points

Market Cap

$3.9T

Day’s Range

$314.62 – $321.61

52wk Range

$140.53 – $349.00

Volume

1.3M

Avg Vol

37M

Gross Margin

59.68%

Dividend Yield

0.26%

Deciding between AMD and Alphabet

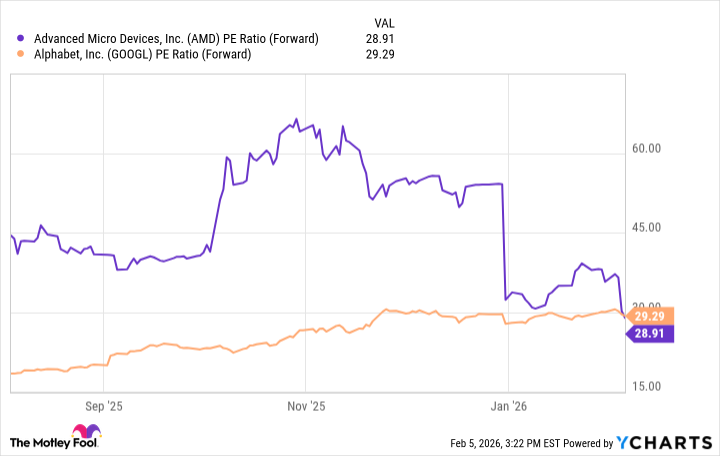

AMD’s share price valuation was elevated before its fiscal Q4 earnings release, as illustrated by its forward price-to-earnings (P/E) ratio. But after its stock price drop, as the chart shows, its forward P/E multiple is now on par with Alphabet’s.

Data by YCharts.

Consequently, is AMD the stock to buy? Actually, a few factors give Alphabet the edge.

For income-oriented investors, Alphabet offers a modest dividend yielding 0.25%. AMD does not pay a dividend.

In addition, Alphabet remains the global leader in search with a 91% market share. As Pichai noted, Google usage is climbing thanks to AI, solidifying its market dominance.

Alphabet’s capex spending may have scared Wall Street, but as its Q4 results demonstrate, the AI investments are driving results. These factors mean the superior AI stock is Alphabet.